NC OIC 100 2019 free printable template

Show details

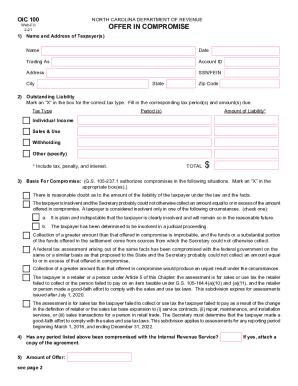

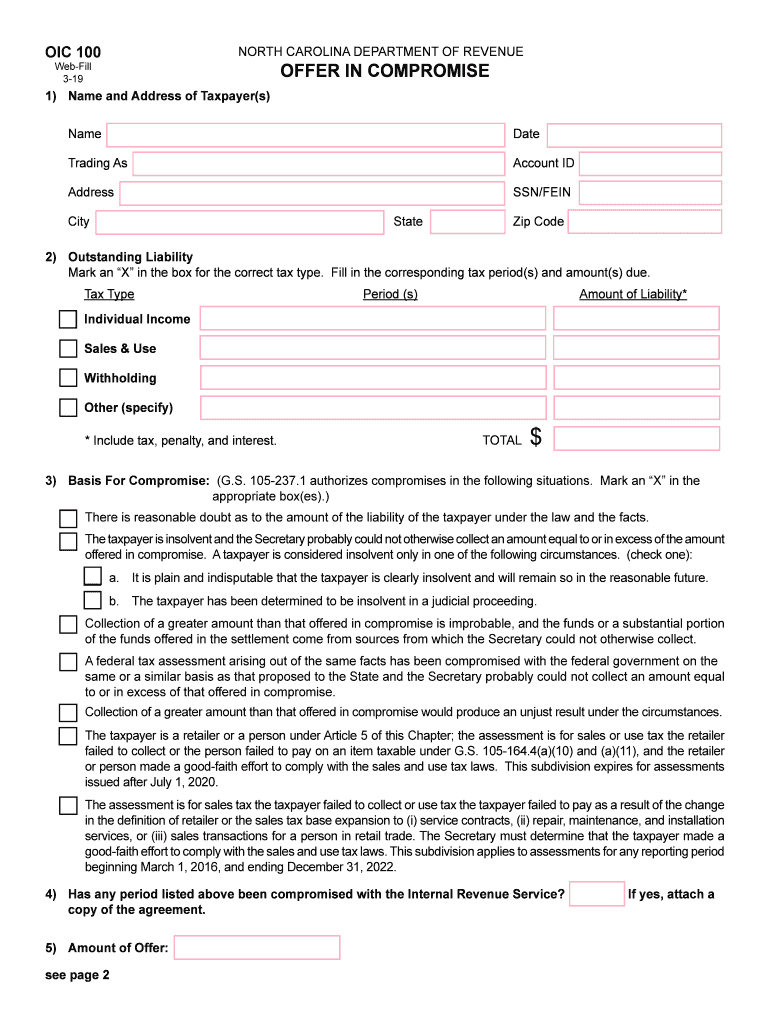

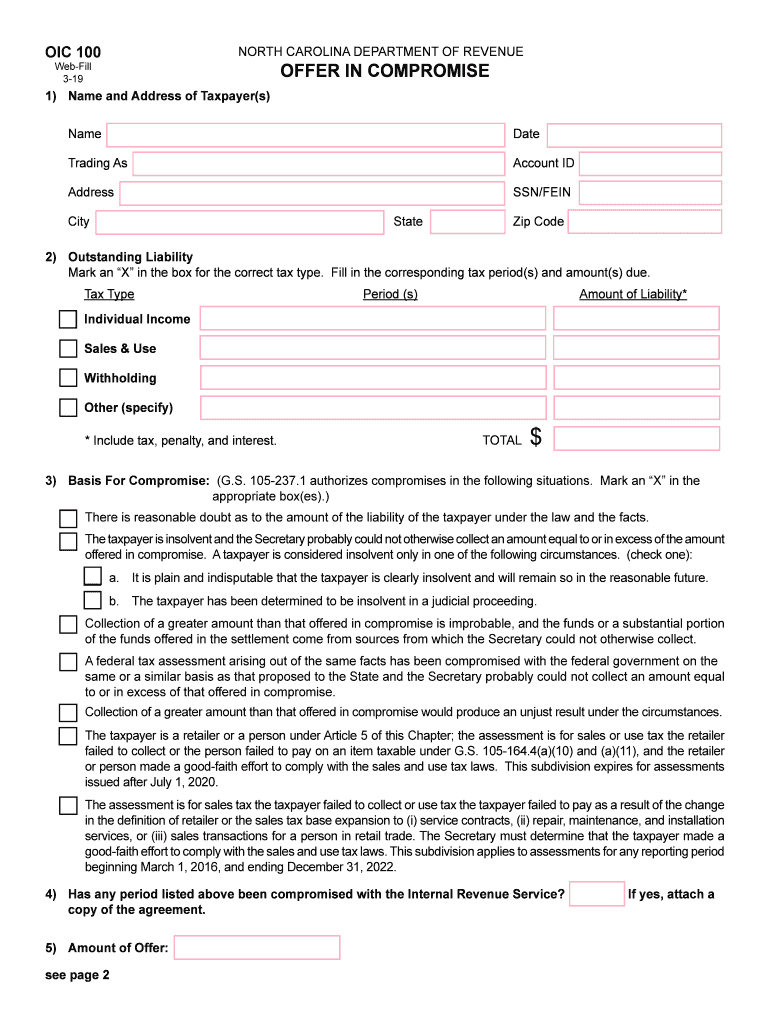

OIC 100NORTH CAROLINA DEPARTMENT OF REVENUEOFFER IN COMPROMISEWebFill 3194PRINTCLEAR1) Name and Address of Taxpayer(s) NameDateTrading Account IDAddressSSN/FEINCityStateZip Code2) Outstanding Liability

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC OIC 100

Edit your NC OIC 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC OIC 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC OIC 100 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NC OIC 100. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC OIC 100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC OIC 100

How to fill out NC OIC 100

01

Obtain the NC OIC 100 form from the appropriate state website or office.

02

Fill out the applicant's name and address in the designated sections.

03

Provide the reason for requesting the OIC (Offer in Compromise) in detail.

04

Complete the financial information section, detailing income, expenses, assets, and liabilities.

05

Review all information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form along with any required documentation and payment to the appropriate agency.

Who needs NC OIC 100?

01

Individuals or businesses who owe tax liabilities to the state of North Carolina and seek to settle their debts for less than the full amount.

02

Taxpayers facing financial difficulties who cannot pay their tax debts in full.

Fill

form

: Try Risk Free

People Also Ask about

Do I qualify for an offer in compromise?

You're eligible to apply for an Offer in Compromise if you: Filed all required tax returns and made all required estimated payments. Aren't in an open bankruptcy proceeding. Have a valid extension for a current year return (if applying for the current year)

How much should I offer in compromise to the IRS?

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

Is an IRS offer in compromise a good idea?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship.

How do you fill out an offer in compromise?

What Are the Specific Steps for an Offer in Compromise? Gather personal and financial information. Fill out all forms: Form 656, Form 433 A, and Form 433 B. Attach all required documents. Pay the application fee.

Does an offer in compromise affect your credit?

An OIC can be as advertised – a fresh start from your IRS debt. No more looking over your shoulder with fear of an IRS seizure of your wages or bank accounts. Improved credit score – after an offer in compromise is complete, the IRS will release all tax liens filed against you.

Does IRS offer in compromise affect credit?

Currently, the offer programs does not affect your credit score. However, if you're considering filing for bankruptcy then it will likely have an adverse effect on your credit score and there are other factors that can also negatively impact a person's number (late payments, loans, etc).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NC OIC 100 online?

With pdfFiller, you may easily complete and sign NC OIC 100 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my NC OIC 100 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NC OIC 100 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the NC OIC 100 form on my smartphone?

Use the pdfFiller mobile app to complete and sign NC OIC 100 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NC OIC 100?

NC OIC 100 is a form used in North Carolina for reporting insurance company filings related to the Office of the Insurance Commissioner (OIC).

Who is required to file NC OIC 100?

Insurance companies operating in North Carolina are required to file NC OIC 100 as part of their regulatory compliance.

How to fill out NC OIC 100?

To fill out NC OIC 100, gather necessary company and policy information as required in the form, complete all sections accurately, and submit it to the NC Department of Insurance.

What is the purpose of NC OIC 100?

The purpose of NC OIC 100 is to ensure that insurance companies comply with state regulations and provide accurate data for oversight and monitoring.

What information must be reported on NC OIC 100?

NC OIC 100 requires reporting on company identification details, policy types, financial data, claims status, and other relevant information as specified in the form.

Fill out your NC OIC 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC OIC 100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.