Get the free merge and combine pdf

Show details

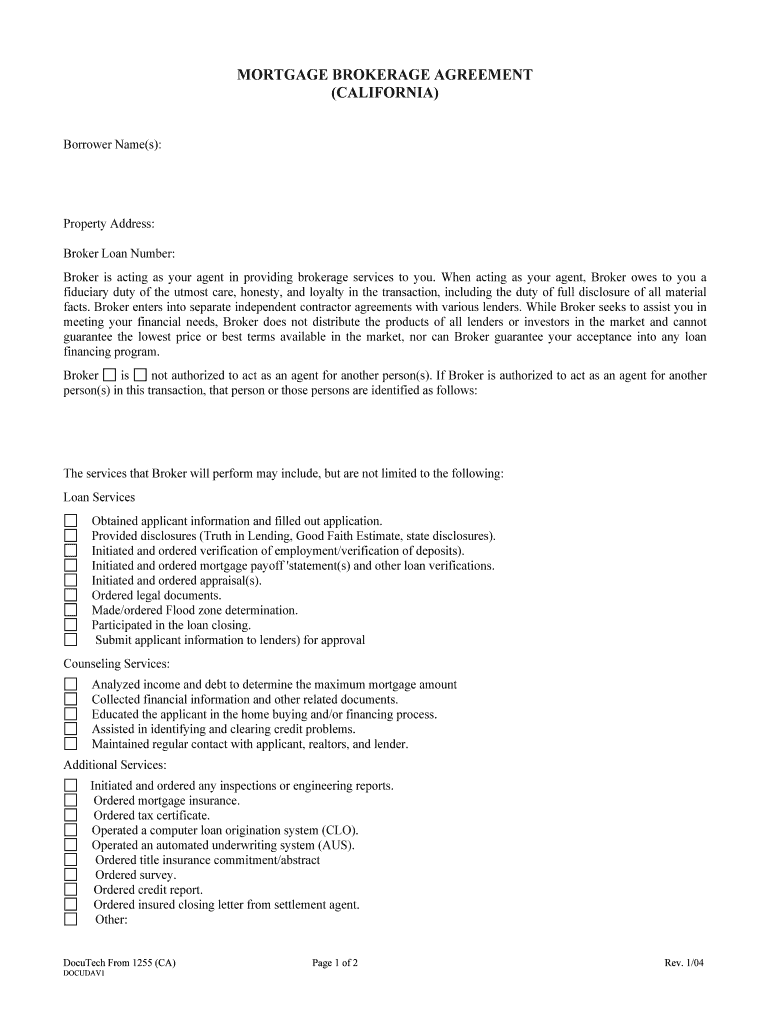

MORTGAGE BROKERAGE AGREEMENT (CALIFORNIA) Borrower Name(s): Property Address: Broker Loan Number: Broker is acting as your agent in providing brokerage services to you. When acting as your agent,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign merge and combine pdf

Edit your merge and combine pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your merge and combine pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit merge and combine pdf online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit merge and combine pdf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out merge and combine pdf

How to Fill Out a Mortgage Brokerage Agreement in California:

01

Begin by obtaining a mortgage brokerage agreement form specific to California. These forms can typically be found online or obtained from your local real estate association or mortgage broker association.

02

Read through the agreement form carefully, making sure you understand all the terms and conditions stated. Pay close attention to the responsibilities and obligations of both parties involved.

03

Fill in your personal information, including your name, address, and contact details, along with the same details for the mortgage broker or brokerage firm you are engaging with.

04

Specify the purpose and scope of the agreement. This may include the type of mortgage loan you are seeking, the specific services you expect from the broker, and any specific requirements or considerations.

05

Clearly outline the compensation structure between you and the mortgage broker. This may include details such as commission rates, payment terms, and any additional fees or charges that may apply.

06

Include any relevant disclosures or disclaimers required by California law. This may include information regarding conflicts of interest, potential risks involved, or any legal disclosures necessary when dealing with mortgage brokerage services.

07

Review the completed agreement thoroughly before signing. Make sure all the information provided is accurate and complete.

08

Sign the agreement, along with the mortgage broker or brokerage firm representative. It is recommended to keep a copy of the signed agreement for your records.

Who needs a Mortgage Brokerage Agreement in California?

A mortgage brokerage agreement in California is typically required when individuals or businesses seek the services of a mortgage broker to assist in obtaining a mortgage loan. This agreement ensures that both parties have a clear understanding of their roles, responsibilities, and compensation structure. It is important for borrowers and mortgage brokers alike to have a written agreement to protect their interests and ensure a fair and transparent relationship throughout the mortgage process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete merge and combine pdf online?

pdfFiller makes it easy to finish and sign merge and combine pdf online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit merge and combine pdf on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing merge and combine pdf.

Can I edit merge and combine pdf on an Android device?

You can make any changes to PDF files, like merge and combine pdf, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mortgage brokerage agreement california?

A mortgage brokerage agreement in California is a contract between a mortgage broker and a borrower outlining the terms of the mortgage transaction.

Who is required to file mortgage brokerage agreement california?

The mortgage broker is required to file the mortgage brokerage agreement in California.

How to fill out mortgage brokerage agreement california?

To fill out a mortgage brokerage agreement in California, the broker and borrower must detail the loan amount, interest rate, repayment terms, and any fees associated with the transaction.

What is the purpose of mortgage brokerage agreement california?

The purpose of a mortgage brokerage agreement in California is to protect the rights and responsibilities of both the mortgage broker and borrower during the mortgage transaction.

What information must be reported on mortgage brokerage agreement california?

The mortgage brokerage agreement in California must include details about the loan amount, interest rate, repayment terms, fees, and any other relevant information about the mortgage transaction.

Fill out your merge and combine pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Merge And Combine Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.