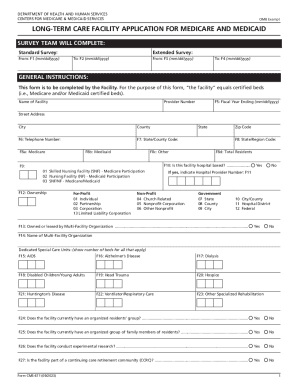

OK 538-S 2019 free printable template

Show details

State of Oklahoma died in 2019 or 2020,

enter date of death:Spouses Social

Security Number:If died in 2019 or 2020,

enter date of death:Instructions on page 2.

Please read carefully as

an incomplete

pdfFiller is not affiliated with any government organization

Instructions and Help about OK 538-S

How to edit OK 538-S

How to fill out OK 538-S

Instructions and Help about OK 538-S

How to edit OK 538-S

To edit the OK 538-S Tax Form, use pdfFiller's tools designed for form editing. Upload the existing form and utilize features such as text editing and signature signing. Once edits are complete, save the changes to maintain version control and ensure that the document reflects the correct information.

How to fill out OK 538-S

Filling out the OK 538-S Tax Form requires entering specific information accurately. Gather all necessary data, including your identification details and relevant financial information. Follow these steps:

01

Download the OK 538-S form from the official website or a trusted source.

02

Review the instructions to understand the requirements and sections of the form.

03

Input your details, ensuring all fields are completed accurately.

04

Double-check for any errors before submission.

About OK 538-S 2019 previous version

What is OK 538-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OK 538-S 2019 previous version

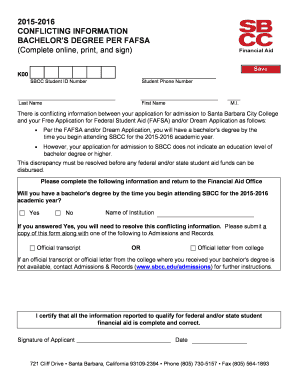

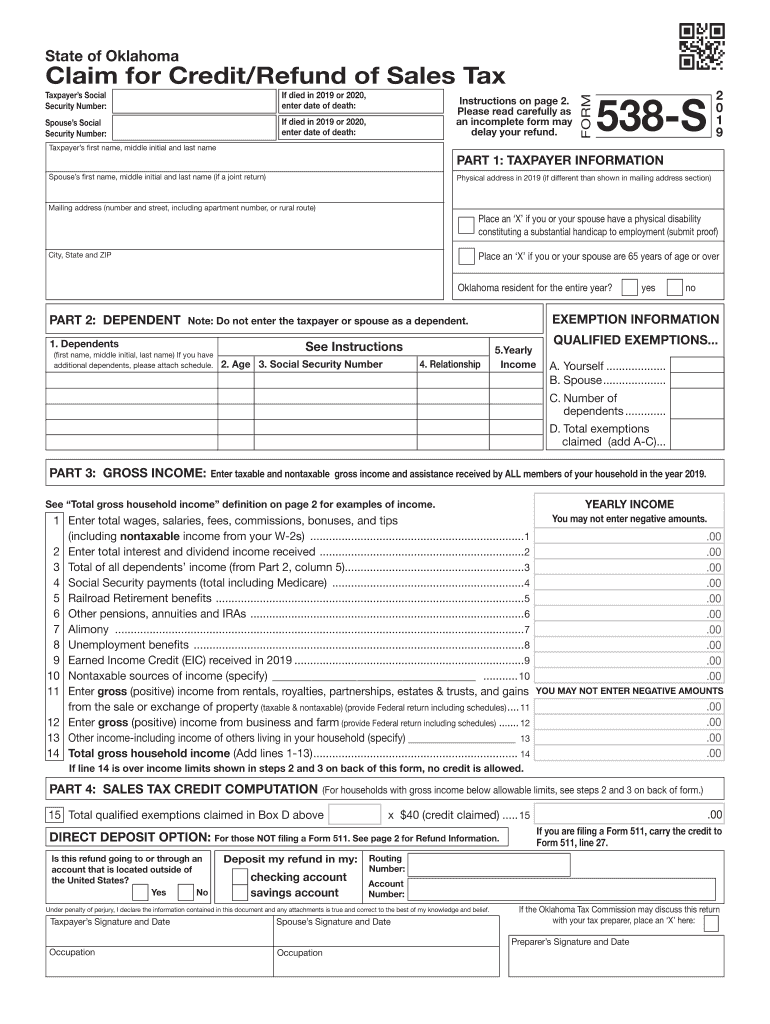

What is OK 538-S?

OK 538-S is an IRS form primarily used for reporting certain payments made in relation to accounts and transactions. It is significant for tax compliance, allowing both the payer and the recipient to accurately report these transactions to the IRS.

What is the purpose of this form?

The purpose of the OK 538-S form is to document and report various types of payments that may be taxable. This form helps ensure that all income is reported, which aids in maintaining transparency between payers and the IRS.

Who needs the form?

Individuals or businesses that make qualifying payments must complete the OK 538-S form. This typically includes payments made to independent contractors or for services rendered that exceed a specified amount during the tax year.

When am I exempt from filling out this form?

You may be exempt from filling out the OK 538-S form if the payments made do not meet the reporting threshold or if the recipient of the payment is exempt from reporting requirements. Additionally, certain payments, such as those to corporations, may not require this form.

Components of the form

The OK 538-S form consists of several key components, including the payer's information, recipient's information, payment amounts, and the purpose of payments. Each section must be filled out accurately to avoid issues with tax compliance.

What are the penalties for not issuing the form?

Failing to issue the OK 538-S form can result in significant penalties. The IRS may impose fines for non-compliance, which can vary based on the duration of the delay and the circumstances surrounding the failure to file. It is crucial to adhere to all IRS deadlines to avoid these consequences.

What information do you need when you file the form?

When filing the OK 538-S form, you will need detailed information about both the payer and the recipient, including names, addresses, and taxpayer identification numbers (TIN). Additionally, accurate reporting of the total amount paid during the tax year is essential. Gathering all necessary documentation before starting the form will streamline the process.

Is the form accompanied by other forms?

The OK 538-S form may accompany other tax forms depending on your specific filing situation. For instance, if there are other payments that require reporting, corresponding forms will need to be submitted alongside the OK 538-S to ensure comprehensive reporting.

Where do I send the form?

Once completed, the OK 538-S form should be sent to the designated IRS address specified in the form instructions. Ensure that you send it to the correct location to facilitate timely processing.

See what our users say