Get the free Minor Individual Retirement Account (IRA) Application-TDA 0619

Show details

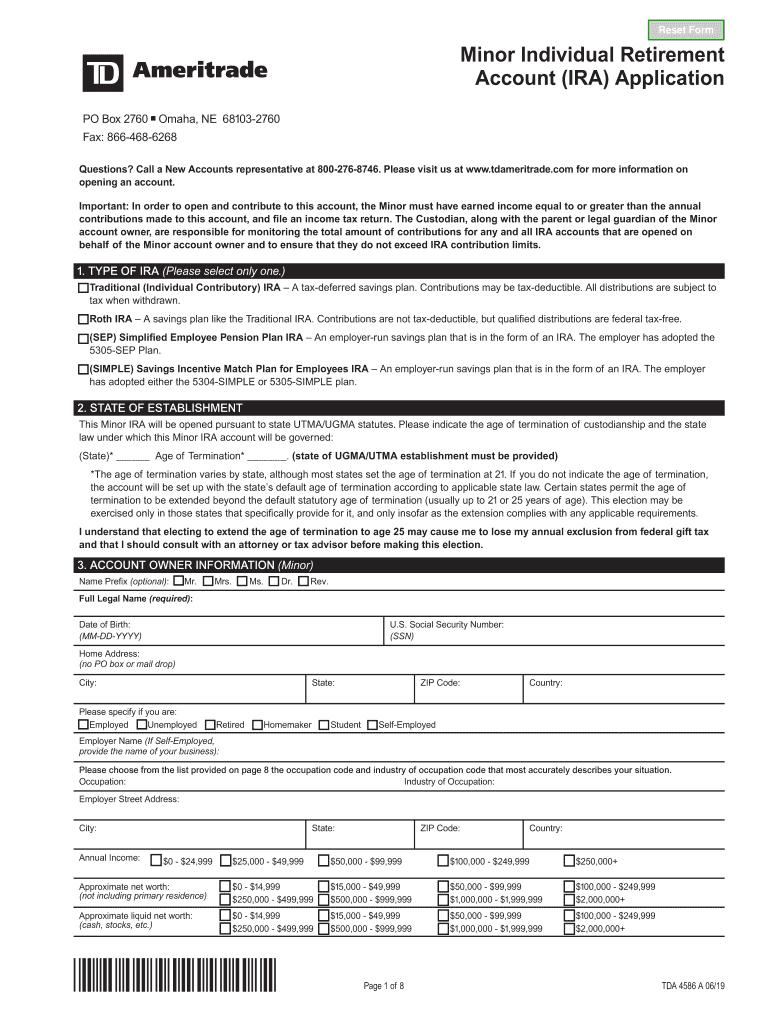

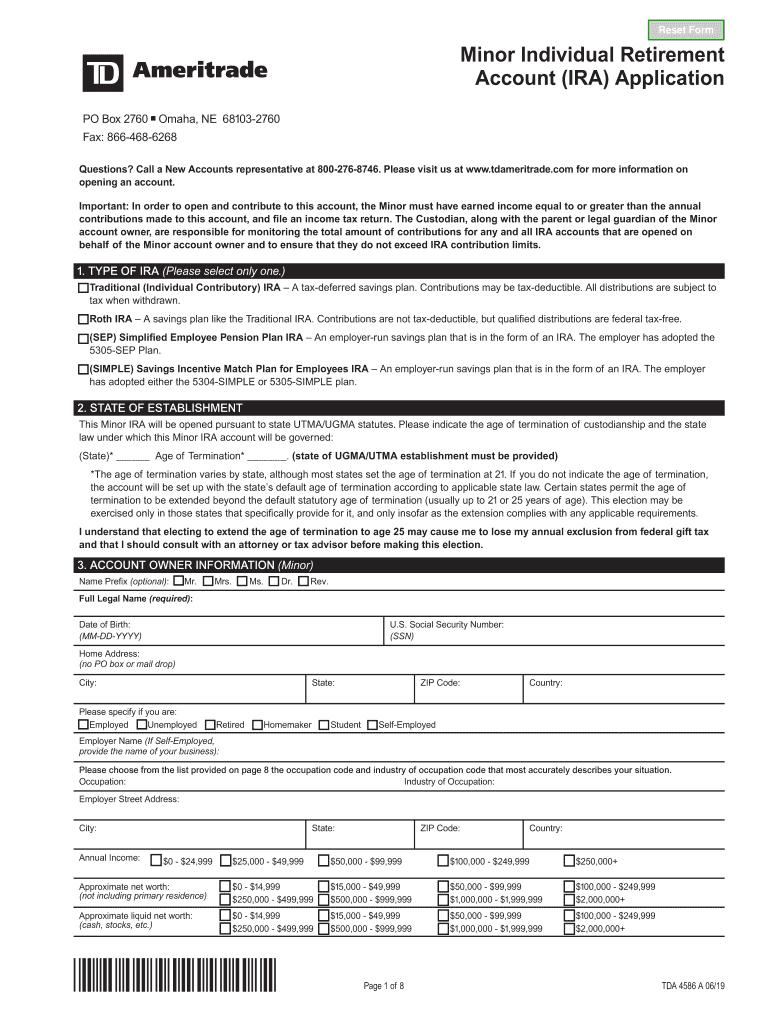

Reset Forming Individual Retirement Account (IRA) Application PO Box 2760 Omaha, NE 681032760 Fax: 8664686268 Questions? Call a New Accounts representative at 8002768746. Please visit us at www.tdameritrade.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign minor individual retirement account

Edit your minor individual retirement account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minor individual retirement account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing minor individual retirement account online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit minor individual retirement account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minor individual retirement account

How to fill out minor individual retirement account

01

To fill out a minor individual retirement account (IRA), follow these steps:

02

Determine the type of IRA you want to open for the minor. There are two types of IRAs: traditional and Roth. Each has its own eligibility requirements and tax benefits.

03

Check the age eligibility criteria for opening a minor IRA. The rules may vary depending on the type of IRA and the financial institution.

04

Choose a financial institution or bank that offers minor IRAs. Consider factors like fees, investment options, and customer service.

05

Gather required documents, such as the minor's social security number, birth certificate, and proof of parent/guardian's identity.

06

Contact the chosen financial institution and inquire about their application process for opening a minor IRA. They will provide you with the necessary forms and instructions.

07

Fill out the application form accurately, providing all required information. It may include the minor's personal details, parent/guardian information, and beneficiary designation.

08

Submit the completed application form along with the required documents to the financial institution, either online or in person.

09

Make an initial contribution to the IRA account. The minimum amount may vary depending on the institution and type of IRA.

10

Choose investment options for the IRA funds. This could include stocks, bonds, mutual funds, or other investment vehicles offered by the financial institution.

11

Monitor and manage the minor IRA account regularly. Keep track of contributions, investment performance, and make any necessary adjustments over time.

12

Remember, it is always recommended to consult with a financial advisor or tax professional to ensure compliance with applicable laws and to maximize the benefits of a minor IRA.

Who needs minor individual retirement account?

01

A minor individual retirement account (IRA) is beneficial for individuals who:

02

- Have earned income and want to start saving for retirement at an early age.

03

- Want to teach their children the importance of saving and investing for the future.

04

- Wish to provide their child or grandchild with a head start in building retirement savings.

05

- Seek to take advantage of the potential tax benefits offered by IRAs for minor beneficiaries.

06

- Have a child who has earned income and is looking for a tax-advantaged way to save for the future.

07

Opening and contributing to a minor IRA can help young individuals develop good financial habits and potentially accumulate significant savings over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my minor individual retirement account in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign minor individual retirement account and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in minor individual retirement account without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your minor individual retirement account, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit minor individual retirement account on an Android device?

You can make any changes to PDF files, like minor individual retirement account, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is minor individual retirement account?

A minor individual retirement account is a retirement account that is set up for a minor who has earned income.

Who is required to file minor individual retirement account?

The parent or legal guardian of the minor is required to file the minor individual retirement account.

How to fill out minor individual retirement account?

The parent or legal guardian can fill out the minor individual retirement account by providing the minor's personal information, including their earned income.

What is the purpose of minor individual retirement account?

The purpose of a minor individual retirement account is to allow minors to save for their retirement while benefiting from tax advantages.

What information must be reported on minor individual retirement account?

The minor's personal information, including their earned income, must be reported on the minor individual retirement account.

Fill out your minor individual retirement account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minor Individual Retirement Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.