Get the free Tax Increment Finance Village of Wheeling Southeast-II ...

Show details

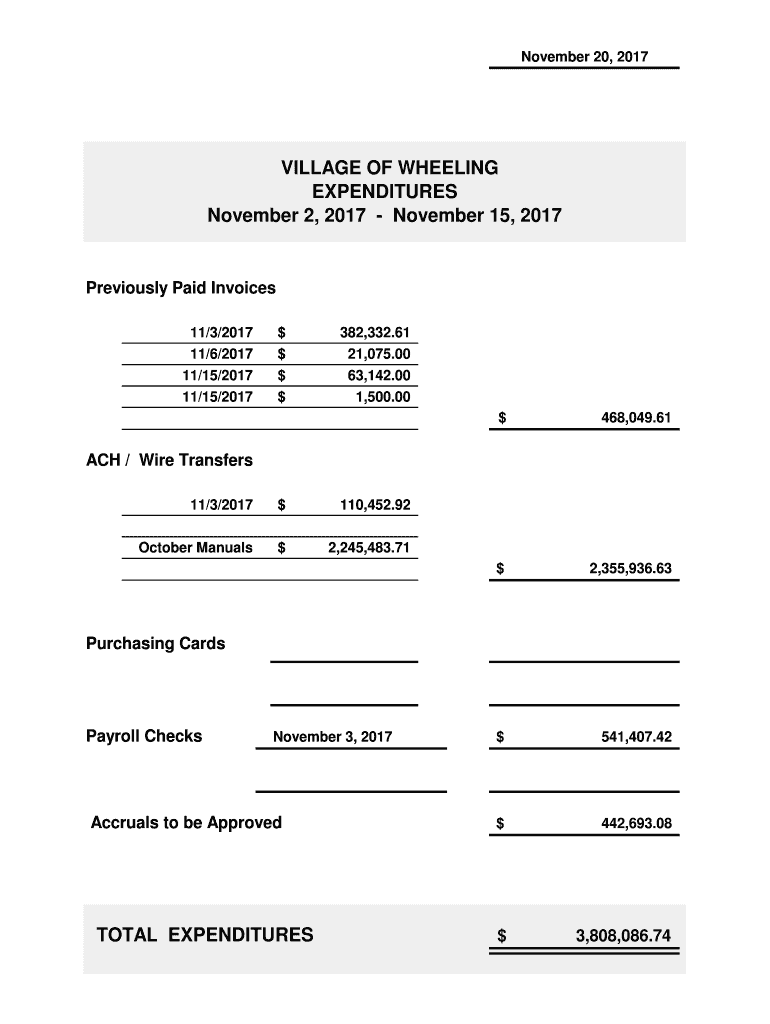

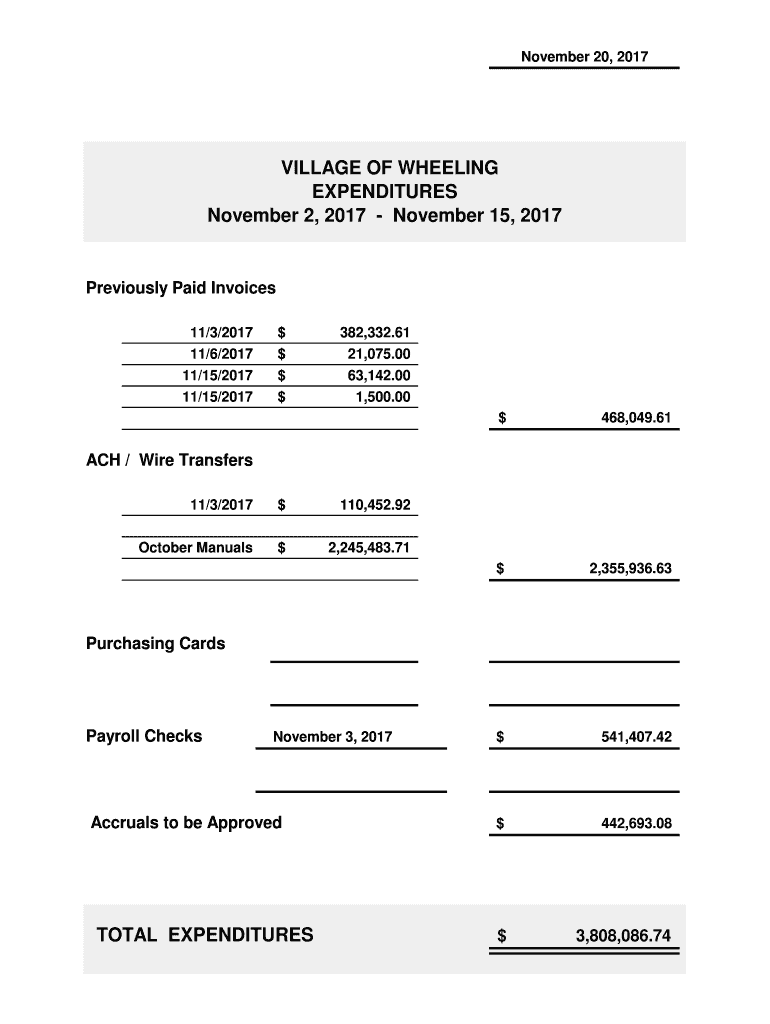

November 20, 2017VILLAGE OF WHEELING EXPENDITURES November 2, 2017, November 15, 2017Previously Paid Invoices 11/3/2017 11/6/2017 11/15/2017 11/15/$$$$2017382,332.61 21,075.00 63,142.00 1,500.00 ×468,049.61×2,355,936.63×541,407.42×442,693.08×3,808,086.74ACH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment finance village

Edit your tax increment finance village form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment finance village form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment finance village online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment finance village. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment finance village

How to fill out tax increment finance village

01

To fill out a tax increment finance village, follow these steps:

02

Obtain the necessary forms from the local taxation office or government website.

03

Gather all the required financial information, such as income statements, balance sheets, and details of taxable transactions.

04

Review the instructions provided with the forms to understand the specific requirements and regulations for your jurisdiction.

05

Carefully fill out the forms, providing accurate and complete information.

06

Double-check all the entered data for errors or omissions before submitting the forms.

07

Attach any supporting documents as required, such as proof of income or receipts of taxable transactions.

08

Submit the filled-out forms and supporting documents to the designated authority, either in-person, by mail, or online, according to the prescribed deadline.

09

Keep a copy of the filled-out forms and the supporting documents for your records.

10

Await confirmation or further communication from the tax department regarding the status of your tax increment finance village application.

11

If any additional information or corrections are requested, promptly provide the requested documentation and comply with any instructions given by the tax department.

12

Once the tax increment finance village is approved, ensure timely and accurate payment of the required taxes as per the payment schedule.

13

Consult with a tax professional or seek assistance from the tax department if you have any questions or need further guidance during the filling process.

Who needs tax increment finance village?

01

Tax increment finance villages are primarily required by local governments, municipalities, or urban development agencies.

02

These entities utilize tax increment financing to finance infrastructure projects, redevelopment initiatives, or community improvement plans.

03

Tax increment finance villages are also beneficial for property owners or developers who want to invest in a specific area and tap into the potential tax increment revenue.

04

Additionally, businesses or individuals looking to benefit from the revitalization or development of an area may be interested in tax increment finance villages.

05

Overall, tax increment finance villages are useful for promoting economic growth, attracting investments, and improving the overall quality of life in designated areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax increment finance village online?

pdfFiller has made it simple to fill out and eSign tax increment finance village. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in tax increment finance village without leaving Chrome?

tax increment finance village can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the tax increment finance village in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tax increment finance village right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is tax increment finance village?

Tax Increment Finance Village is a financing method used for funding infrastructure and economic development projects within a specified area.

Who is required to file tax increment finance village?

Local governments or municipalities are typically required to file tax increment finance village reports.

How to fill out tax increment finance village?

Tax increment finance village reports are typically filled out by local government officials or finance departments.

What is the purpose of tax increment finance village?

The purpose of tax increment finance village is to generate funding for public infrastructure projects and stimulate economic development in designated areas.

What information must be reported on tax increment finance village?

Information reported on tax increment finance village typically includes project expenses, revenue generated, and economic development impacts.

Fill out your tax increment finance village online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Finance Village is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.