Get the free $350K in tax dollars spent at NJ League of Municipalities ...

Show details

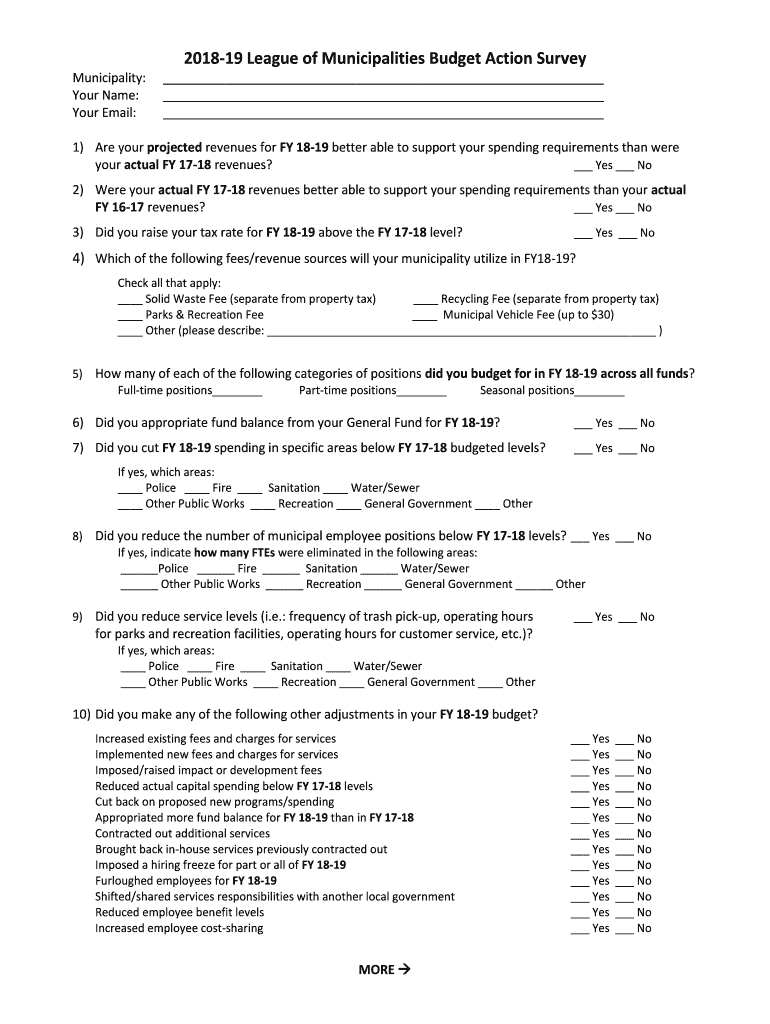

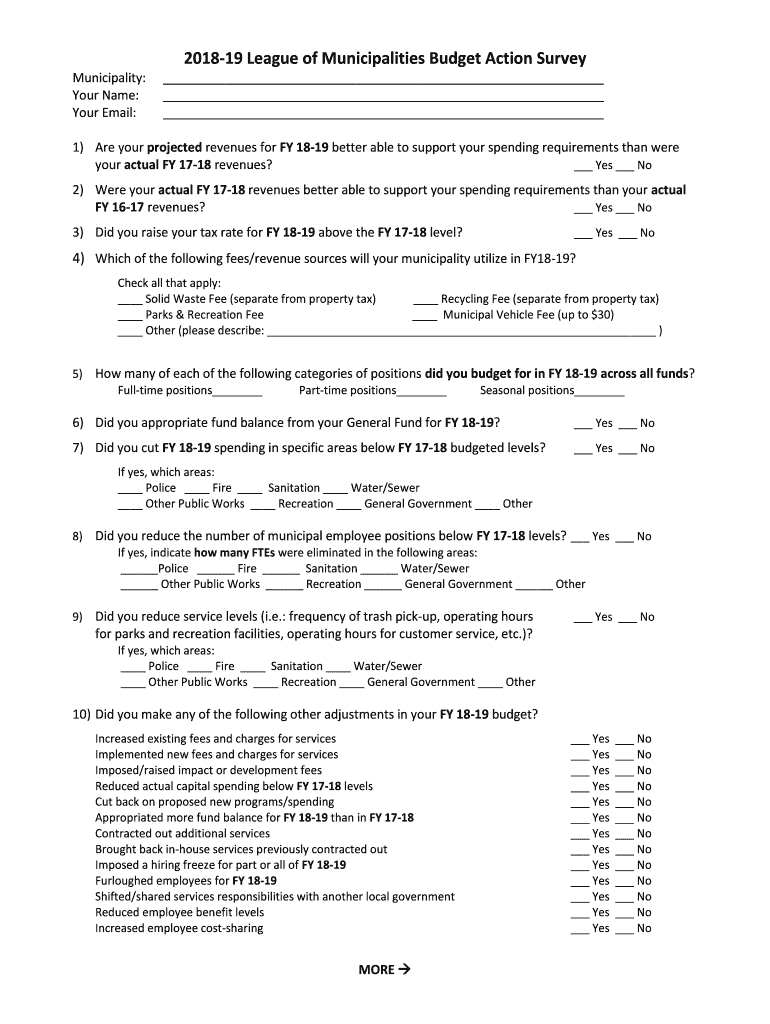

201819 Leagues of Municipalities Budget Action Survey Municipality: Your Name: Your Email: 1) Are your projected revenues for FY 1819 better able to support your spending requirements than were your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 350k in tax dollars

Edit your 350k in tax dollars form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 350k in tax dollars form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 350k in tax dollars online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 350k in tax dollars. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 350k in tax dollars

How to fill out 350k in tax dollars

01

Determine the specific purposes for which the tax dollars will be allocated.

02

Understand the tax regulations and laws governing the allocation of tax dollars.

03

Gather all the necessary financial documents and records related to the tax dollars to be filled out.

04

Identify the appropriate tax forms required for reporting the allocation of 350k in tax dollars.

05

Fill out the tax forms accurately and provide all the required information.

06

Double-check all the information provided before submitting the filled-out tax forms.

07

Submit the filled-out tax forms to the relevant tax authority within the specified deadline.

08

Keep copies of all the filled-out tax forms and supporting documents for future reference or audits.

09

Seek professional assistance or advice if needed to ensure compliance with tax regulations and optimize the allocation of tax dollars.

10

Regularly review and update the allocation of tax dollars to reflect any changes or updates in tax laws or regulations.

Who needs 350k in tax dollars?

01

Various entities and individuals may need 350k in tax dollars, including:

02

- Government agencies or departments for funding public services, infrastructure projects, or social programs.

03

- Non-profit organizations or charities for carrying out their missions and providing assistance to communities.

04

- Educational institutions for improving facilities, research projects, or scholarships.

05

- Small businesses or startups for investment, expansion, or research and development.

06

- Individuals or families eligible for specific tax benefits, deductions, or refunds.

07

- Research institutes or scientists for conducting scientific studies or experiments.

08

- Healthcare organizations or hospitals for improving healthcare facilities or providing medical services.

09

- Environmental agencies or organizations for conservation efforts or environmental projects.

10

- Cultural institutions or artists for promoting arts and cultural activities.

11

It should be noted that the specific recipients of 350k in tax dollars depend on the applicable tax regulations, government policies, and individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 350k in tax dollars directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 350k in tax dollars and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in 350k in tax dollars without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 350k in tax dollars, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the 350k in tax dollars in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 350k in tax dollars in minutes.

What is 350k in tax dollars?

350k in tax dollars refers to the amount of taxes owed or paid to the government, which totals $350,000.

Who is required to file 350k in tax dollars?

Individuals or businesses whose tax liability amounts to $350,000 are required to file 350k in tax dollars.

How to fill out 350k in tax dollars?

To fill out 350k in tax dollars, one must accurately report their income, deductions, credits, and any other relevant information on the appropriate tax forms.

What is the purpose of 350k in tax dollars?

The purpose of 350k in tax dollars is to fulfill one's tax obligations to the government and contribute to funding public services and programs.

What information must be reported on 350k in tax dollars?

On 350k in tax dollars, one must report their income sources, deductions, tax credits, and any other relevant financial information required by the tax authorities.

Fill out your 350k in tax dollars online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

350k In Tax Dollars is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.