OK SOS 0097 2019-2025 free printable template

Show details

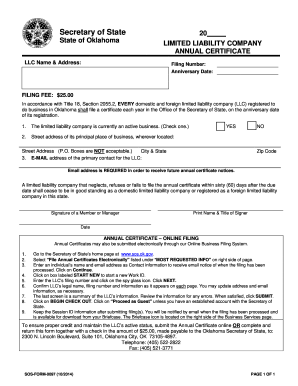

Secretary of State State of Oklahoma LIMITED LIABILITY COMPANY ANNUAL CERTIFICATE LLC Name Address Filing Number Anniversary Date FILING FEE 25. O. Boxes are NOT acceptable. City State 3. E-MAIL address of the primary contact for the LLC NO Zip Code Email address is REQUIRED in order to receive future annual certificate notices. A limited liability company that neglects refuses or fails to file the annual certificate within sixty 60 days after the due date shall cease to be in good standing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma form certificate

Edit your oklahoma limited form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma liability company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ok 0097 certificate online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma annual certificate form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK SOS 0097 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma limited liability form

How to fill out OK SOS 0097

01

Gather all necessary personal information including name, address, and contact details.

02

Obtain the form OK SOS 0097 from the official website or relevant office.

03

Clearly fill out the sections of the form, ensuring all fields are completed accurately and legibly.

04

Attach any required documentation or supporting materials as indicated on the form.

05

Review the completed form for accuracy and completeness.

06

Submit the form either online or in person as specified in the instructions.

Who needs OK SOS 0097?

01

Individuals or entities who require official documentation for specific applications or requests.

02

Applicants seeking licenses, permits, or other regulatory approvals.

03

Businesses that need to comply with certain regulatory requirements.

Fill

oklahoma annual certificate

: Try Risk Free

People Also Ask about ok limited company annual certificate llc

What are 3 disadvantages of an LLC?

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.

What are the 2 main advantages of having an LLC?

An LLC's simple and adaptable business structure is perfect for many small businesses. While both corporations and LLCs offer their owners limited personal liability, owners of an LLC can also take advantage of LLC tax benefits, management flexibility and minimal recordkeeping and reporting requirements.

What are the risks of an LLC?

The following are some of the key risks to consider: Loss of Limited Liability. Although an LLC enjoys limited liability, poor practices could result in an LLC losing its liability shield. Difficulty Obtaining Investors. Pass-Through Taxation.

How much does it cost to maintain an LLC in Oklahoma?

To maintain an LLC in Oklahoma you will need to pay an annual fee of $25 along with state sales & use tax at 4.5%, state income tax at 0.5% to 5.25% and federal taxes.

What taxes does an LLC pay in Oklahoma?

The State of Oklahoma, like almost every other state, has a corporation income tax. In Oklahoma, the corporate tax is a flat 6% of Oklahoma taxable income. If your LLC is taxed as a corporation you'll need to pay this tax. The state's corporate income tax return (Form 512) is filed with the Oklahoma Tax Commission.

What is the downside to an LLC?

Disadvantages of creating an LLC States charge an initial formation fee. Many states also impose ongoing fees, such as annual report and/or franchise tax fees. Check with your Secretary of State's office. Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.

What are the benefits of an LLC in Oklahoma?

The benefits of starting an LLC in Oklahoma: Separates and protects your personal assets from your business liability and debts. Quick and simple filing, management, compliance, regulation and administration. Easy tax filing and tax treatment advantages. Low filing fee ($100)

Does Oklahoma recognize single member LLC?

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Oklahoma LLC net income must be paid just as you would with any self-employment business.

What are the three main advantages of the LLC?

Limited Personal Liability. Less Paperwork. Tax Advantages of an LLC. Ownership Flexibility. Management Flexibility. Flexible Profit Distributions.

What are the tax disadvantages of an LLC?

Tax Disadvantages of the LLC LLC members must pay taxes on their distributive share of the profit of the company, even if they have not received a distribution of those profits. Owners of a corporation do not pay taxes on profits unless they are distributed, usually in the form of dividends.

Which state is best for single member LLC?

The best state for forming a single-member LLC is Nevada. Nevada is the top choice for a single-member LLC because: Privacy--there is no need to disclose the members of your LLC. No state taxes.

What is the pros and cons of LLC?

Pros and Cons of Limited Liability Corporations (LLC) The ProsThe ConsMembers are protected from some (or sometimes all) liability if the company runs into legal issues or debts.Unless you are running the LLC alone, the ownership of the business is spread across its members (this can also be a pro)5 more rows

Is it better to be a single member LLC or multi member LLC?

A single-member LLC is easier for tax purposes because no federal tax return is required, unless the business decides to be treated as a corporation for tax purposes. The income is reported on the member's tax return. A multiple member LLC must file tax return, and give the members K-1 forms to file with their returns.

How are LLCs taxed in Oklahoma?

The State of Oklahoma, like almost every other state, has a corporation income tax. In Oklahoma, the corporate tax is a flat 6% of Oklahoma taxable income. If your LLC is taxed as a corporation you'll need to pay this tax. The state's corporate income tax return (Form 512) is filed with the Oklahoma Tax Commission.

Can you file LLC online in Oklahoma?

There are forms for domestic LLCs and professional LLCs; nonprofessional LLCs have the option to complete the entire process online. The associated filing fee is $100. Meanwhile, out-of-state entities registering LLCs in Oklahoma complete a separate form and pay $300.

Does Oklahoma allow single member LLC?

The Oklahoma single-member LLC operating agreement is a legal document that is utilized by the sole proprietor of a business to establish basic aspects of their business and to immediately create the needed separation between the individual and the owner of the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my oklahoma limited liability company in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your oklahoma sos annual certificate online along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an eSignature for the oklahoma sos annual certificate form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ok sos annual certificate online right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out oklahoma sos annual certificate on an Android device?

Use the pdfFiller mobile app to complete your oklahoma sos annual certificate llc on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is OK SOS 0097?

OK SOS 0097 is a form used by businesses in Oklahoma to report specific financial information to the Secretary of State's office.

Who is required to file OK SOS 0097?

Businesses operating within Oklahoma that meet certain criteria regarding their financial activities are required to file OK SOS 0097.

How to fill out OK SOS 0097?

To fill out OK SOS 0097, businesses need to provide accurate financial details including income, expenses, and other required data as specified on the form.

What is the purpose of OK SOS 0097?

The purpose of OK SOS 0097 is to ensure transparency and compliance in financial reporting for businesses operating in Oklahoma.

What information must be reported on OK SOS 0097?

OK SOS 0097 requires reporting of financial information such as revenue, expenditures, and other economic activities of the business.

Fill out your oklahoma sos form 0097 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Form Certificate Print is not the form you're looking for?Search for another form here.

Keywords relevant to liability company annual certificate llc

Related to oklahoma company certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.