Get the free Request for ProposalsDebt (Tax and Non-tax) Collection ...

Show details

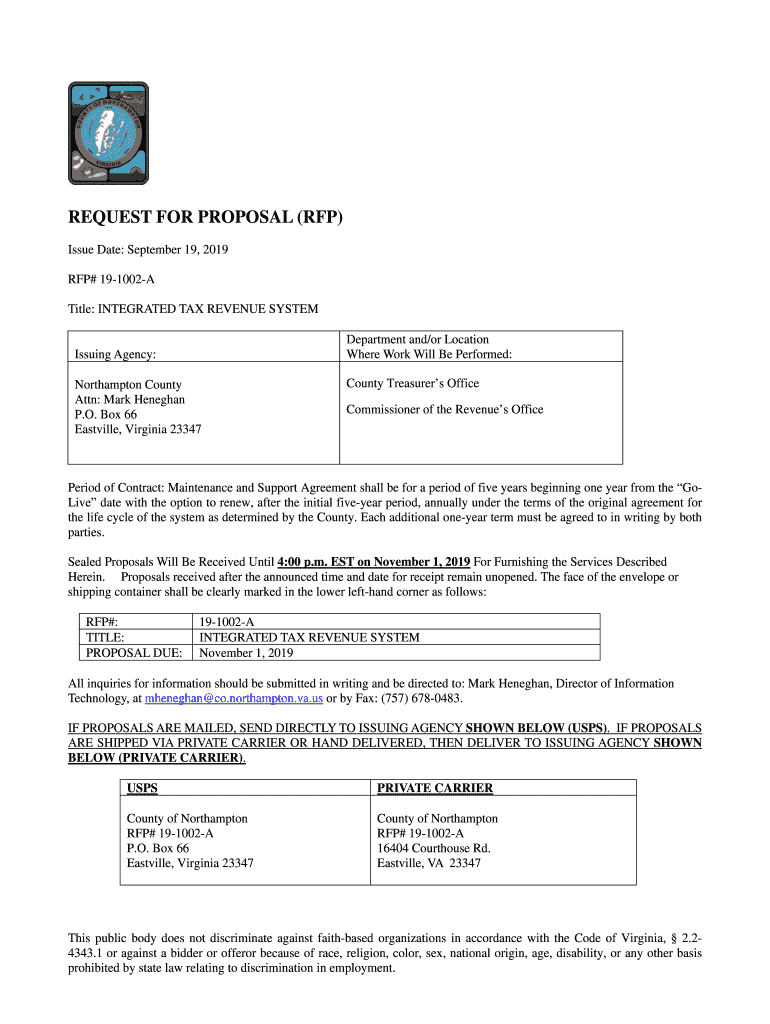

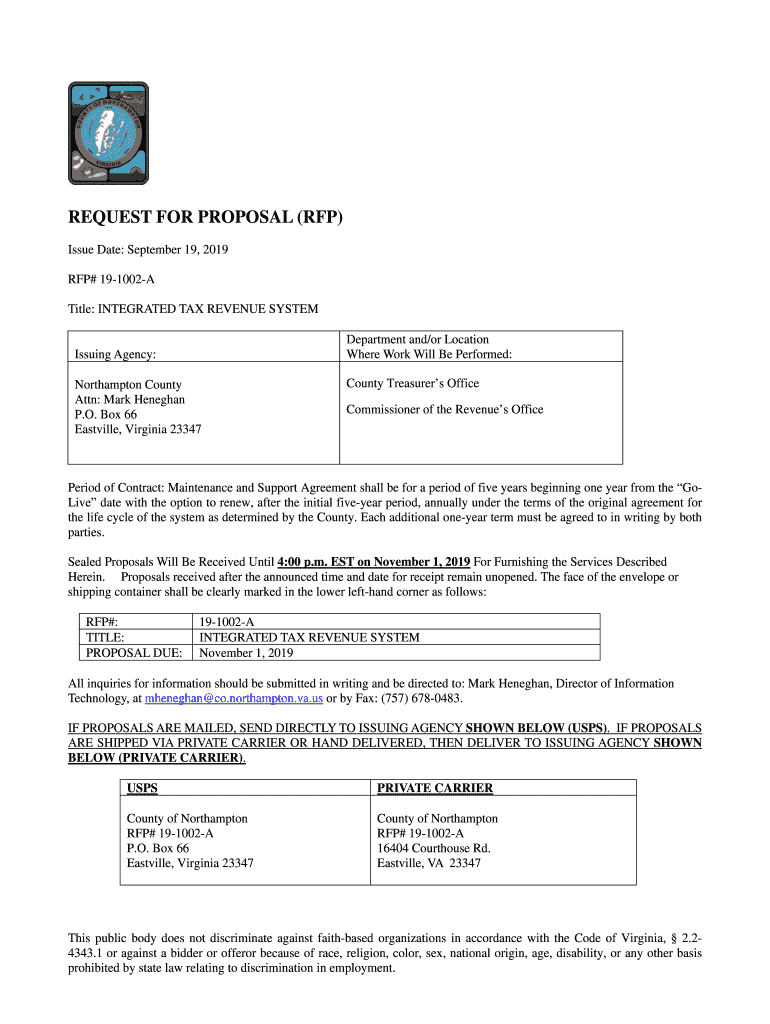

REQUEST FOR PROPOSAL (RFP)

Issue Date: September 19, 2019,

RFP# 191002A

Title: INTEGRATED TAX REVENUE SYSTEM

Department and/or Location

Where Work Will Be Performed:Issuing Agency:

Northampton County

Attn:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for proposalsdebt tax

Edit your request for proposalsdebt tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for proposalsdebt tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for proposalsdebt tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit request for proposalsdebt tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for proposalsdebt tax

How to fill out request for proposalsdebt tax

01

To fill out a request for proposals on debt tax, follow these steps:

02

Start by researching and understanding the specific requirements for submitting a debt tax proposal. Familiarize yourself with any regulations or guidelines that may be relevant.

03

Gather all the necessary information and documents related to the debt tax proposal. This may include financial statements, tax records, and any other relevant supporting documentation.

04

Carefully review the request for proposals (RFP) document to understand the scope, timeline, and evaluation criteria of the project. Take note of any specific sections or questions that need to be addressed in your proposal.

05

Develop a clear and concise proposal that addresses all the requirements outlined in the RFP. Clearly explain the purpose and objectives of the debt tax proposal, and how your proposed solution meets the needs and objectives of the organization issuing the RFP.

06

Structure your proposal in a point-by-point format, addressing each requirement or question separately. Use headings and subheadings to organize the content and make it easy for evaluators to follow.

07

Provide accurate and detailed information about your experience, qualifications, and expertise in dealing with debt tax. Highlight any successes or notable achievements in similar projects or initiatives.

08

Include a proposed timeline and budget for the debt tax project, if applicable. Provide a breakdown of costs and explain how the proposed budget aligns with the objectives of the RFP.

09

Proofread and edit your proposal to ensure it is free of any errors or inconsistencies. Make sure all required documents are attached and properly formatted.

10

Submit your completed proposal by the specified deadline. Follow any submission guidelines provided in the RFP document, such as mailing address, email, or online submission portal.

11

Keep track of the status of your proposal and be prepared to address any questions or provide additional information if requested by the organization issuing the RFP.

12

Remember to tailor your proposal to the specific needs and requirements of the debt tax project, and emphasize how your expertise and solution can add value to the organization.

Who needs request for proposalsdebt tax?

01

Various entities may require a request for proposals (RFP) for debt tax, including:

02

- Government agencies or departments responsible for tax collection and enforcement

03

- Municipalities or local governments seeking to undertake tax-related initiatives or projects

04

- Non-profit organizations or foundations involved in debt management or tax assistance programs

05

- Accounting firms or financial consulting companies offering tax-related services

06

- Corporations or businesses in need of assistance with debt tax planning and compliance

07

- Legal firms specializing in tax law and debt-related matters

08

These entities use the RFP process to solicit proposals from qualified individuals, firms, or organizations that can provide expertise, solutions, or services related to debt tax. By issuing an RFP, they can ensure a fair and competitive selection process, evaluate different proposals, and choose the most suitable provider based on their specific needs and requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit request for proposalsdebt tax in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your request for proposalsdebt tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the request for proposalsdebt tax electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your request for proposalsdebt tax in minutes.

How do I edit request for proposalsdebt tax straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing request for proposalsdebt tax.

What is request for proposalsdebt tax?

Request for proposalsdebt tax is a process through which entities ask for proposals from potential debt providers in order to secure funding for a project or initiative.

Who is required to file request for proposalsdebt tax?

Entities or organizations looking to secure debt funding for a project or initiative are required to file request for proposalsdebt tax.

How to fill out request for proposalsdebt tax?

To fill out request for proposalsdebt tax, entities must provide detailed information about the project or initiative requiring funding, as well as financial information and other relevant data.

What is the purpose of request for proposalsdebt tax?

The purpose of request for proposalsdebt tax is to solicit competitive proposals from potential debt providers in order to secure the best possible terms for funding a project or initiative.

What information must be reported on request for proposalsdebt tax?

Information such as project details, financial information, funding requirements, and other relevant data must be reported on request for proposalsdebt tax.

Fill out your request for proposalsdebt tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Proposalsdebt Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.