OK OTC 737 2019 free printable template

Show details

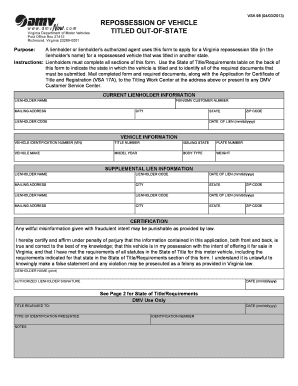

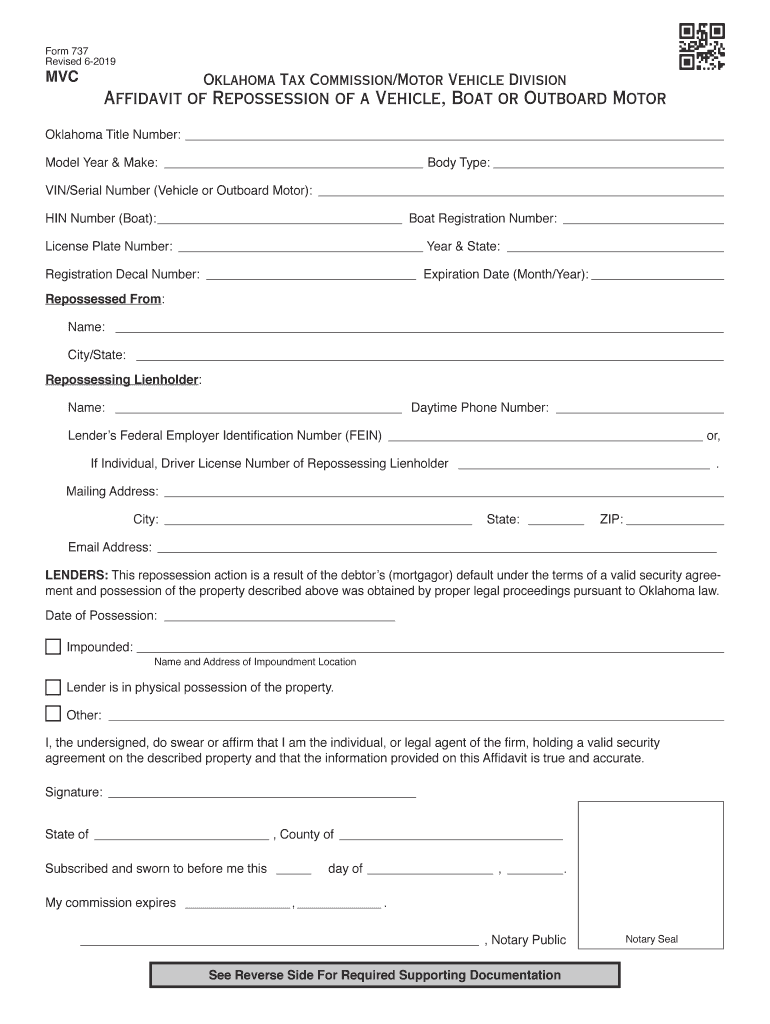

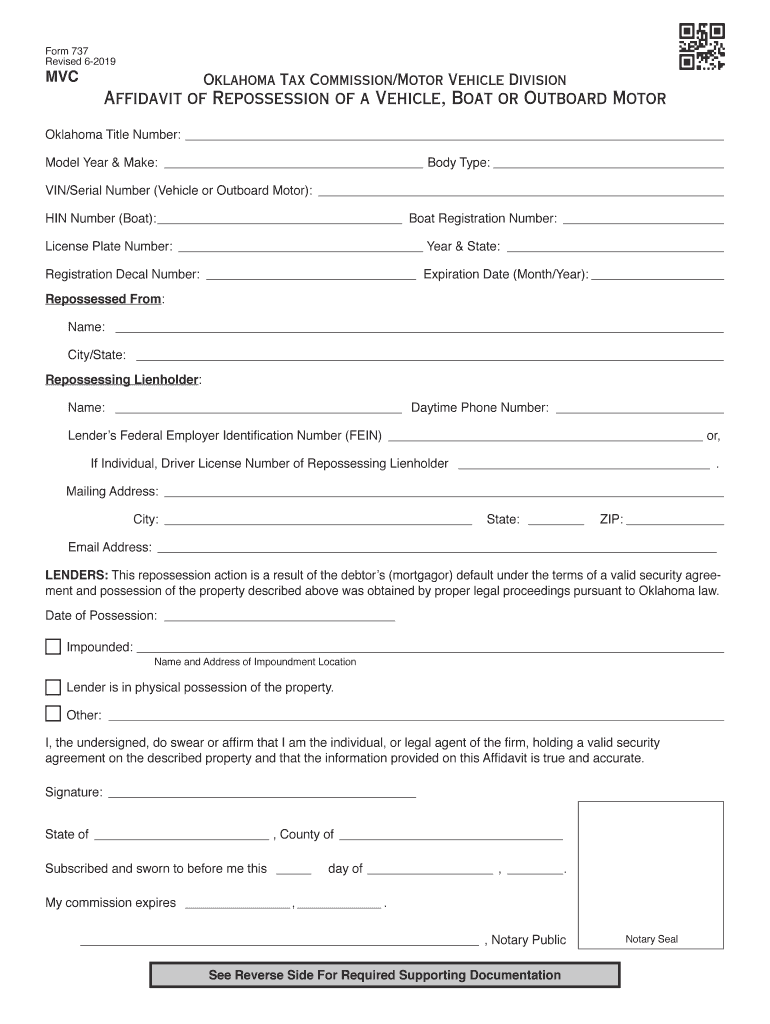

Form 737 Revised 62019MVCOklahoma Tax Commission/Motor Vehicle DivisionAffidavit of Repossession of a Vehicle, Boat or Outboard Motor Oklahoma Title Number: Model Year & Make: Body Type: VIN/Serial

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 737

Edit your OK OTC 737 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 737 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 737 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OK OTC 737. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 737 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 737

How to fill out OK OTC 737

01

Gather all necessary personal and business information.

02

Open the OK OTC 737 form either digitally or in print.

03

Start by filling out the identification section, including your name, address, and contact details.

04

Provide the required details about your business, such as the name and nature of the business.

05

Indicate the type of OTC products you are applying for or managing.

06

Attach any required documents or evidence as specified by the guidelines.

07

Review the filled-out form for accuracy and completeness.

08

Submit the form as instructed, either digitally or through mail.

Who needs OK OTC 737?

01

Individuals or businesses involved in the sale or distribution of over-the-counter (OTC) products.

02

Pharmaceutical companies who need to register their OTC goods.

03

Health professionals who manage OTC pharmaceuticals.

Fill

form

: Try Risk Free

People Also Ask about

What are the repossession laws in Oklahoma?

In Oklahoma, lenders will not have to go through the court in order to take possession of your vehicle. They are allowed to repossess your vehicle as long as they do not disrupt the peace or violate any laws while doing so. Furthermore, they are not obligated to notify you of their plan to repossess the car.

What happens if my car gets repossessed in Oklahoma?

You have a right to redeem your car. That means you can get it back by paying the total balance left on your car loan, along with your lender's repossession expenses. If you're going to redeem your vehicle, you may not have much time. You have to pay the complete redemption amount before your lender sells the vehicle.

How many months until you get Repoed?

Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment. You have options to handle a missed payment, and your lender will likely work with you to find a solution.

How many days past due before repossession?

When you sign an auto loan, you take on the legal responsibility to make monthly payments on time and keep adequate insurance. If you become delinquent or late on the payment by more than 30 days, or if you don't have adequate insurance, the lender has the right to retrieve or repossess their property (your car).

How much are repossession fees in Oklahoma?

Upon each vehicle repossessed by a mortgagee, a fee of Forty-six Dollars ($46.00) shall be assessed.

Is a repo better than a charge off?

While neither scenario is good, in most cases, a charge off is better than a repossession. When a car is repossessed, the lender not only gets to keep the money you've already paid, they take your vehicle and you will still owe the deficiency balance after the vehicle is sold.

Can my car be repossessed after 1 missed payment?

In California, the lender may repossess your car as soon as you default on the loan, even if the payment is just one day late.

What is and how does it work the repossession fee?

Repossession fees are what creditors pay to repossess your car. Towing, storage, and auction fees are common examples. If you're delinquent on your car loan and your car is repossessed, those fees are passed on to you. You must pay them to get your car back.

Can a repossession be reversed?

Your rights after repossession vary depending on your state law. In some states there are laws granting a right to reinstate after repossession. These laws usually provide for a time period after repossession in which you can get your vehicle back by making up any existing overdue payments and the cost of repossession.

How many car payments can you miss before it is repossessed?

Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment. You have options to handle a missed payment, and your lender will likely work with you to find a solution.

How many car payments can I miss before repossession?

Most lenders won't begin repossession until you've missed three or more payments. Although there usually is a grace period between 60 and 90 days, a more staunch lender has the right to give notice of repossession for even one missed payment.

How do I stop my car from being repossessed?

How to Avoid Repossession Communicate With Your Lender. As soon as you think you might miss a car payment, reach out to your lender to discuss your options. Refinance Your Loan. Reinstate the Loan. Sell the Car Yourself. Surrender the Vehicle Voluntarily.

Can you negotiate repossession fees?

It is possible to continue negotiations with a lender even after the car has been repossessed. Another alternative may involve negotiating over the arrears on your loan with the lender.

How can I bounce back from a repossession?

Here are six steps to take. Speak to Your Lender. There are situations where a lender doesn't have the right to repossess your vehicle. Determine Whether You Can Get Your Car Back. Recover Personal Property. Pay Outstanding Debts. Make a Plan. Ask for Help.

What do you say to avoid a repossession?

You can avoid repossession by reinstating or refinancing the loan, selling/surrendering your car, or contacting your lender to ask for other options. If you're having issues handling your car loan or other debt, bankruptcy might be a good option for you.

How do you get around a repossession?

6 ways to avoid repossession Stay in contact with your lender. Keep your lender up to date on your situation, ability to make payments and overall finances. Request a loan modification. Repossession is a significant risk for the lender, too. Get current on the loan. Sell the car. Refinance your loan. Surrender your car.

How far behind can you get on a car payment?

When is a car payment considered late? Most auto loans have a 10 day grace period on payments, meaning you can make a payment within 10 days of the agreed-upon monthly due date without the payment being considered late.

Can you settle a repo car debt?

You can pay the deficiency in full, make payment arrangements with the lender to pay the debt over time, or negotiate a settlement. In some cases, it might be best to do nothing; in others, you might want to consider bankruptcy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OK OTC 737 for eSignature?

Once your OK OTC 737 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute OK OTC 737 online?

pdfFiller has made it simple to fill out and eSign OK OTC 737. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit OK OTC 737 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing OK OTC 737.

What is OK OTC 737?

OK OTC 737 is a form used in Oklahoma for the reporting of certain tax-related information by taxpayers involved in oil and gas operations.

Who is required to file OK OTC 737?

Taxpayers engaged in the production, processing, or transportation of oil and gas in Oklahoma are required to file OK OTC 737.

How to fill out OK OTC 737?

To fill out OK OTC 737, taxpayers must provide detailed information about their oil and gas operations, including production volumes, revenues, and any applicable deductions, ensuring all sections of the form are completed accurately.

What is the purpose of OK OTC 737?

The purpose of OK OTC 737 is to collect necessary data from oil and gas operators to assess and ensure compliance with state tax regulations.

What information must be reported on OK OTC 737?

Information that must be reported on OK OTC 737 includes production amounts, sales data, any applicable costs and deductions, and other relevant financial details related to oil and gas operations.

Fill out your OK OTC 737 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 737 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.