NY DTF ET-85 2019 free printable template

Show details

New York State Department of Taxation and Finance New York State Estate Tax Certification For office use only ET-85 4/14 For an estate of an individual who died on or after April 1 2014 Decedent s last name First name Middle initial Social security number SSN Address of decedent at time of death number and street Date of death City ZIP code County of residence State Mark an X if copy of death certificate is attached see instr. If the decedent was a nonresident of New York State on the date of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ET-85

Edit your NY DTF ET-85 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ET-85 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ET-85 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF ET-85. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ET-85 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ET-85

How to fill out NY DTF ET-85

01

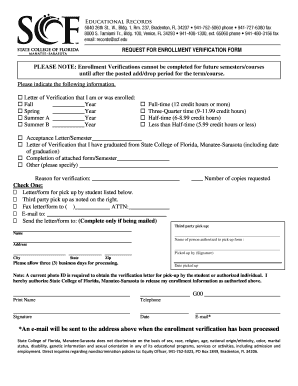

Obtain the NY DTF ET-85 form from the New York State Department of Taxation and Finance website or office.

02

Fill in your name and address in the designated fields.

03

Enter your Social Security Number or Employer Identification Number as required.

04

Provide details regarding the tax period for which you are filing.

05

Indicate the type of income or deduction you are reporting.

06

Complete any additional sections pertinent to your specific tax situation.

07

Review the filled form for any errors or omissions.

08

Sign and date the form at the bottom before submission.

09

Submit the form according to the instructions provided, either by mail or electronically, if applicable.

Who needs NY DTF ET-85?

01

Individuals who receive income from sources subject to state tax in New York.

02

Taxpayers who need to report adjustments to their tax status.

03

Residents and non-residents who have tax obligations in New York state.

04

Organizations that are required to file for tax credits or exemptions.

Instructions and Help about NY DTF ET-85

Fill

form

: Try Risk Free

People Also Ask about

How is the due date on estate tax returns determined?

Generally, the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

What is the extended due date for Form 1041 in 2022?

Trusts. The filing deadline for trusts filing Form 1041 is April 15. The extension due date is September 30.

What happens if a 1041 is filed late?

Form 1041 – April 15 due date, with an extension available until September 30 by filing IRS Form 7004. The late filing penalty is 5% of the tax due for each month or part of a month that a tax return is late, up to a maximum of 25%.

Do you have to pay taxes on inheritance in NY?

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.11 million estate tax exemption, meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

What is the due date for a 1041 tax return?

Form 1041: Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate's tax year. For example, for a trust or estate with a tax year ending December 31, the due date is April 15 of the following year.

What is the due date for form 1041 in 2022?

Form 1041: Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate's tax year. For example, for a trust or estate with a tax year ending December 31, the due date is April 15 of the following year.

How much can you inherit tax free in NY?

For dates of deaththe basic exclusion amount isJanuary 1, 2019, through December 31, 2019$5,740,000April 1, 2017, through December 31, 2018$5,250,000April 1, 2016, through March 31, 2017$4,187,500April 1, 2015, through March 31, 2016$3,125,0005 more rows

What is the extended due date for a 1041?

The filing deadline for trusts filing Form 1041 is April 15. The extension due date is September 30.

Does form 1041 have to be filed every year?

If you're wondering when to file 1041 Forms, you should file it each year the estate is open. As long as the estate exists, a Form 1041 should be filed. The due date for filing a 1041 falls on tax day.

What is the NYS estate tax exemption for 2022?

The current New York estate tax exemption amount is $6,110,000 for 2022. Under current law, this number will remain until January 1, 2023, at which point it will rise again with inflation.

CAN 1041 t be filed late?

See When To File below for the due date for filing Form 1041-T. For the election to be valid, a trust or decedent's estate must file Form 1041-T by the 65th day after the close of the tax year as shown at the top of the form. If the due date falls on a Saturday, Sunday, or legal holiday, file on the next business day.

How much are estate taxes in NY?

The estate tax rate in New York ranges from 3.06% to 16%. Estates over $5.92 million are subject to this tax in 2021, going up to 6.11 million in 2022.

How do I avoid estate tax in NY?

One way to preserve this amount is by establishing a trust equal to the estate tax exemption (federal or NY). Transfers to these trusts leave an individual's estate and are technically subject to the estate tax (or gift tax).

What is the deadline for filing form 1041?

For calendar year estates and trusts, file Form 1041 and Schedule(s) K-1 on or before April 15 of the following year. For fiscal year estates and trusts, file Form 1041 by the 15th day of the 4th month following the close of the tax year.

What is the due date for an estate tax return?

The due date of the estate tax return is nine months after the decedent's date of death, however, the estate's representative may request an extension of time to file the return for up to six months.

What is the due date for filing Form 706 for an estate?

You must file Form 706 to report estate and/or GST tax within 9 months after the date of the decedent's death. If you are unable to file Form 706 by the due date, you may receive an extension of time to file.

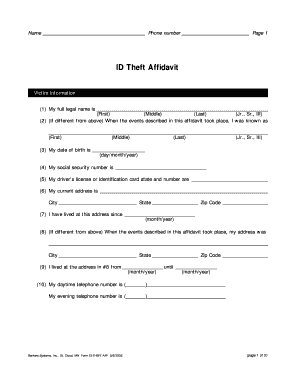

What is et85?

Form ET-85 may be filed by an executor, administrator, a joint owner of property, the decedent's next of kin, or any person having an interest in the estate who has a thorough knowledge of the decedent's assets.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NY DTF ET-85 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NY DTF ET-85 and you'll be done in minutes.

How can I edit NY DTF ET-85 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NY DTF ET-85 right away.

How do I complete NY DTF ET-85 on an Android device?

Use the pdfFiller app for Android to finish your NY DTF ET-85. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY DTF ET-85?

NY DTF ET-85 is a form used for the New York State's Department of Taxation and Finance to report and claim an exemption on the sale of property or services by certain eligible organizations.

Who is required to file NY DTF ET-85?

Organizations that are exempt from New York State sales and use taxes, including certain nonprofits and government entities, are required to file NY DTF ET-85.

How to fill out NY DTF ET-85?

To fill out NY DTF ET-85, you need to provide your organization's information, the nature of the exemption being claimed, and specific details of the transactions that are eligible for exemption.

What is the purpose of NY DTF ET-85?

The purpose of NY DTF ET-85 is to allow qualified organizations to claim sales tax exemptions on eligible purchases, thus ensuring compliance with tax regulations while promoting charitable activities.

What information must be reported on NY DTF ET-85?

The NY DTF ET-85 requires reporting of the organization's name, address, exempt status, type of exemption, details of the purchases, and any other relevant information regarding the claim for exemption.

Fill out your NY DTF ET-85 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ET-85 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.