NM RPD-41375 2018 free printable template

Show details

State of New Mexico Taxation and Revenue DepartmentRPD41375 2018

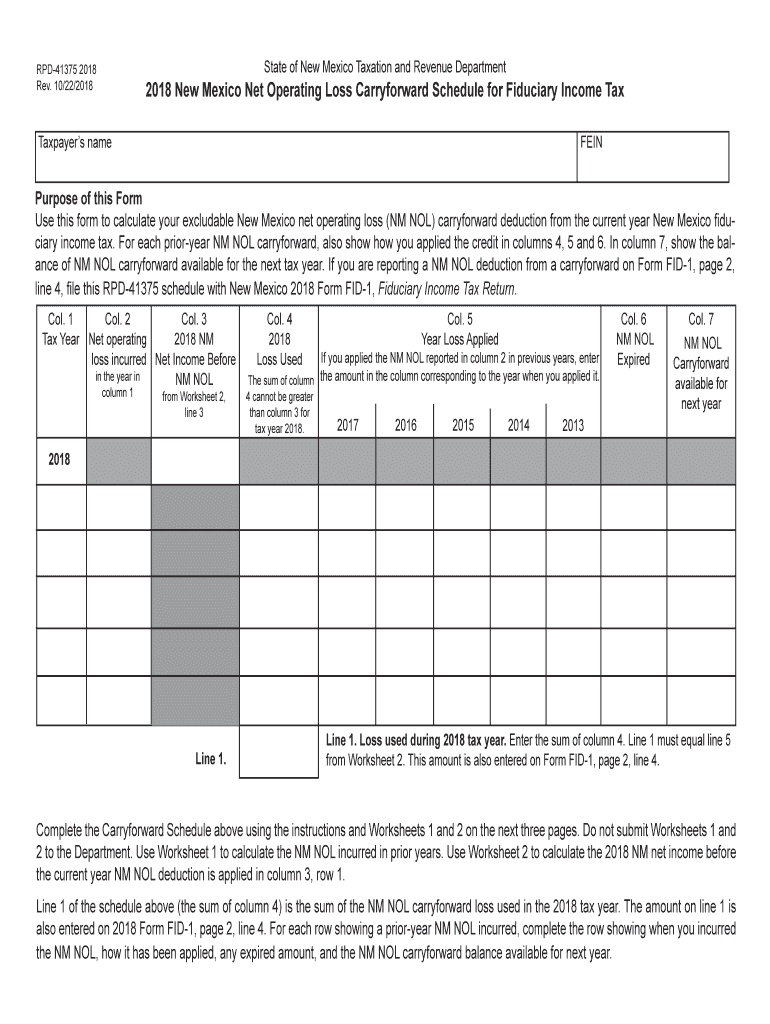

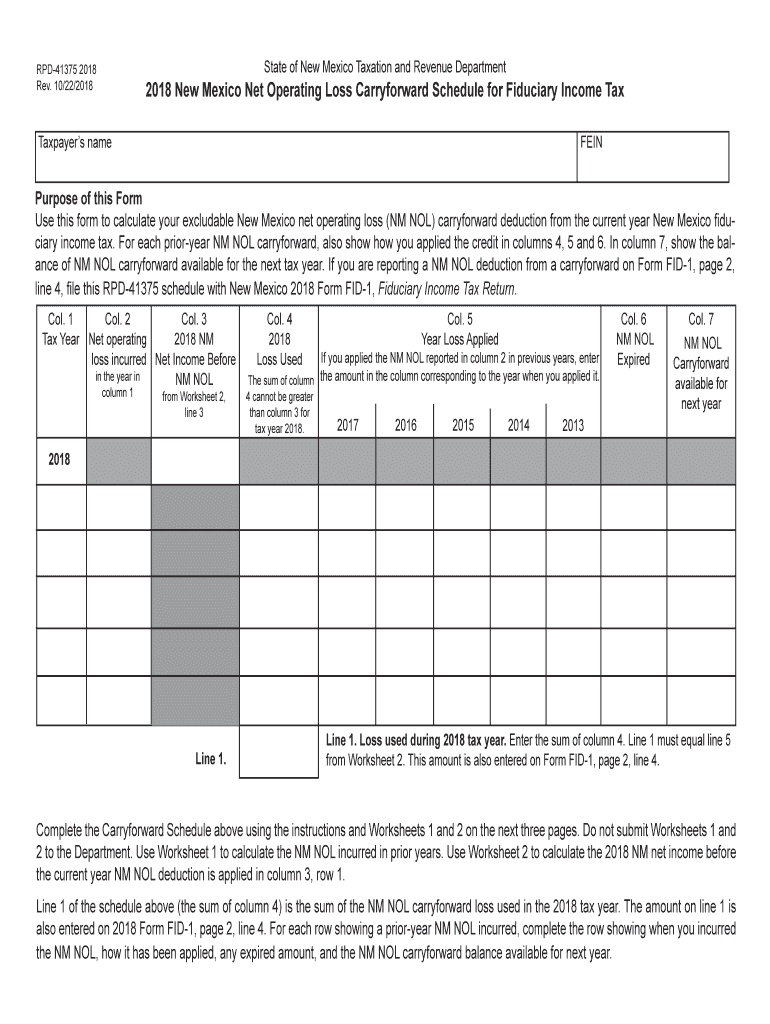

Rev. 10/22/20182018 New Mexico Net Operating Loss Carry forward Schedule for Fiduciary Income Taxpayers nameFEINPurpose of this Form

Use

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM RPD-41375

Edit your NM RPD-41375 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM RPD-41375 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM RPD-41375 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM RPD-41375. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM RPD-41375 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM RPD-41375

How to fill out NM RPD-41375

01

Gather necessary documents and information required for NM RPD-41375.

02

Begin filling out the form by entering your personal details in the designated sections.

03

Provide accurate financial information as requested, ensuring it matches your supporting documents.

04

Review any specific instructions related to your filing category that apply to the form.

05

Double-check all entries for accuracy and completeness before submission.

06

Sign and date the form where indicated.

07

Submit the form electronically or via mail to the appropriate taxing authority.

Who needs NM RPD-41375?

01

Individuals or entities seeking a tax refund for overpayment.

02

Taxpayers who need to report income adjustments.

03

Anyone who has received a notice from the New Mexico Taxation and Revenue Department regarding required filings.

Fill

form

: Try Risk Free

People Also Ask about

Does New Mexico allow passive loss carryover?

While federal net operating loss (NOL) carryforward deductions are added back for New Mexico personal income tax purposes , a New Mexico NOL carryover deduction is allowed.

What is the form 41367 in New Mexico?

The pass-through entity must file and pay the tax using form RPD-41367, Annual Withholding of Net Income From a Pass-Through Entity Detail Report. Form RPD-41367 can be filed and paid electronically on the Department's web file services page or through a third-party software.

Where can I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

What is the limit for net operating loss?

Net Operating Loss (NOL) Carryforward Example The full loss from the first year can be carried forward on the balance sheet to the second year as a deferred tax asset. The loss, limited to 80% of income in the second year, can then be used in the second year as an expense on the income statement.

What is the net operating loss limitation in New Mexico?

The New Mexico NOL deduction includes the 80% limitation to the deduction that may be taken from the taxpayer's apportioned net income and does not allow for the carryback of an NOL deduction to prior years.

Is there an 80% limitation on NOLs?

The Act included a provision limiting net operating losses (NOL) incurred after Dec. 31, 2017, to 80% of taxable income rather than the historical 100%. This change was overshadowed by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and eventually was delayed to tax years beginning after Dec. 31, 2020.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NM RPD-41375 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NM RPD-41375 in seconds.

How do I edit NM RPD-41375 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NM RPD-41375 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit NM RPD-41375 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as NM RPD-41375. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NM RPD-41375?

NM RPD-41375 is a form used in New Mexico for reporting specific tax-related information, particularly related to certain business activities or transactions.

Who is required to file NM RPD-41375?

Businesses and individuals engaged in activities that require reporting specific tax information, as stipulated by the New Mexico taxation authorities, are required to file NM RPD-41375.

How to fill out NM RPD-41375?

To fill out NM RPD-41375, one must provide accurate and complete information as instructed on the form, including relevant financial data, identification details, and specific transaction information.

What is the purpose of NM RPD-41375?

The purpose of NM RPD-41375 is to ensure compliance with New Mexico tax laws by collecting essential information on certain transactions or business activities for taxation purposes.

What information must be reported on NM RPD-41375?

NM RPD-41375 requires reporting of various details, including taxpayer identification, financial transactions, and any other specific information mandated by New Mexico tax regulations.

Fill out your NM RPD-41375 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM RPD-41375 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.