Get the free March 1 - March 31

Show details

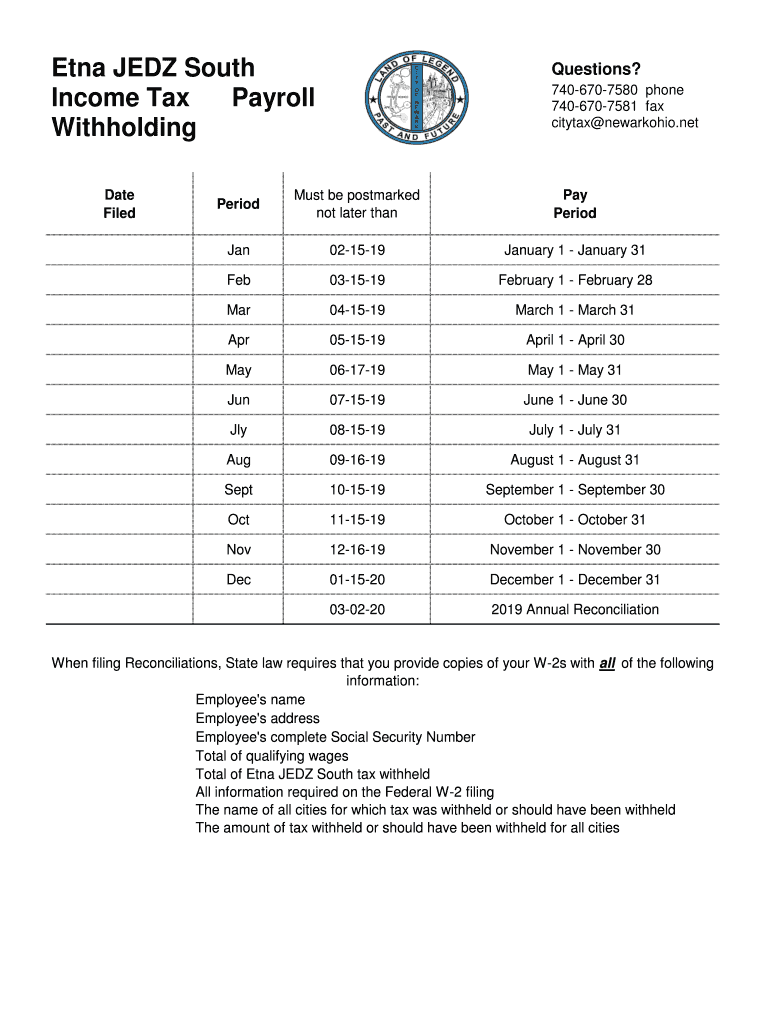

Etna Newark JEDI South Income Tax Office Payroll Withholding Date FiledQuestions? 7406707580 phone 7406707581 fax city tax newarkohio.netPeriodMust be postmarked not later than PeriodJan021519January

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign march 1 - march

Edit your march 1 - march form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your march 1 - march form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit march 1 - march online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit march 1 - march. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out march 1 - march

How to fill out march 1 - march

01

To fill out March 1 - March, follow these steps:

02

Start by gathering all necessary documents and information related to the time period March 1 - March.

03

Access the appropriate form or documentation required for reporting or filing purposes (e.g., tax forms, financial reports, attendance records, etc.).

04

Review the instructions or guidelines provided with the form to understand the specific information and data required for each section.

05

Begin filling out the form or documentation systematically, entering the relevant data for each applicable field.

06

Double-check the accuracy and completeness of the information provided before finalizing the form.

07

Submit the filled-out March 1 - March form according to the designated method or deadline, ensuring compliance with any additional submission requirements or procedures.

08

Keep a copy of the submitted form or documentation for your records.

09

Note: The specific steps may vary depending on the type of form or documentation being filled out. Consult the relevant authority or documentation instructions for more detailed guidance.

Who needs march 1 - march?

01

Various individuals and entities may need to fill out March 1 - March form or documentation, including:

02

- Individuals filing their taxes or claiming tax credits for the period

03

- Employers reporting employee payroll or tax information

04

- Financial institutions providing monthly or quarterly reports

05

- Educational institutions reporting student attendance or performance

06

- Businesses invoicing clients for services rendered in March

07

- Government agencies or departments collecting data or statistics

08

The specific need for filling out March 1 - March forms may vary widely based on individual or organizational requirements and obligations. Consult the specific form or documentation instructions for more details.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my march 1 - march in Gmail?

march 1 - march and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find march 1 - march?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific march 1 - march and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the march 1 - march in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your march 1 - march in seconds.

What is march 1 - march?

March 1 - March is a time period spanning from March 1st to the end of March.

Who is required to file march 1 - march?

Any individual, business, or entity that has income or financial activity during the month of March is required to file for March 1 - March.

How to fill out march 1 - march?

To fill out March 1 - March, you will need to gather all income and financial documents for the month of March, input the relevant information into the designated forms or software, and submit the filing to the appropriate tax authority.

What is the purpose of march 1 - march?

The purpose of March 1 - March filing is to report income, financial transactions, and ensure compliance with tax regulations for the month of March.

What information must be reported on march 1 - march?

On March 1 - March filing, you must report all income sources, financial transactions, deductions, credits, and any other relevant financial information for the month of March.

Fill out your march 1 - march online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

March 1 - March is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.