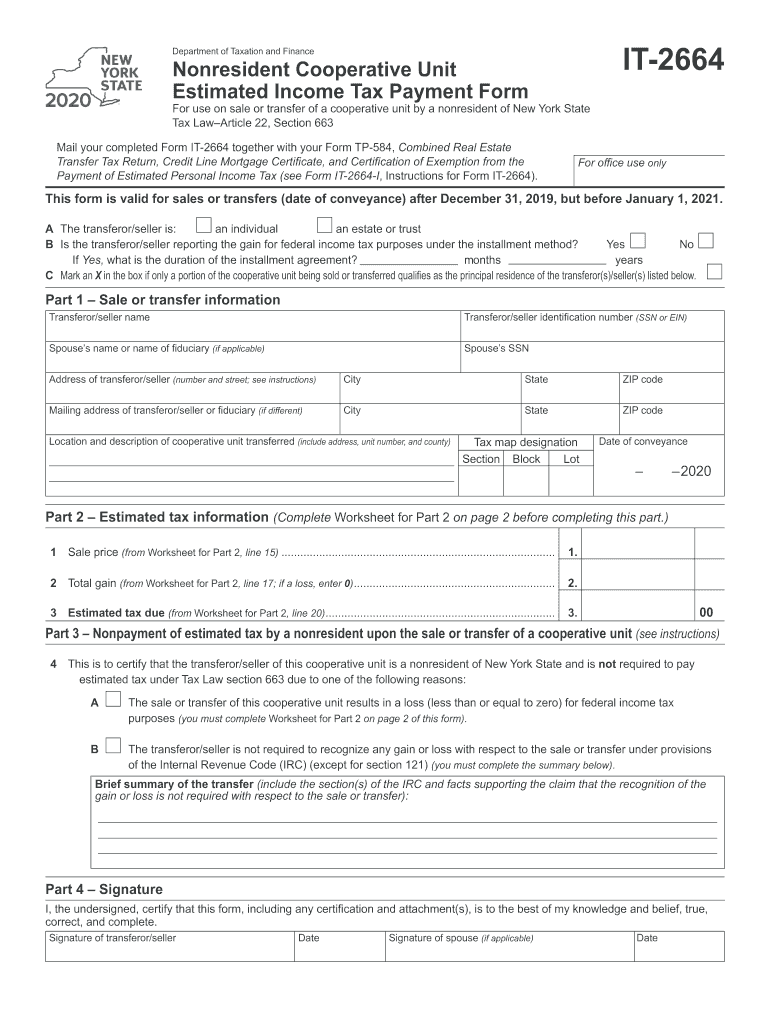

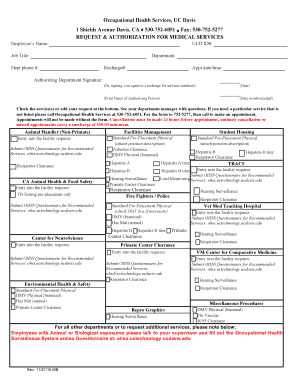

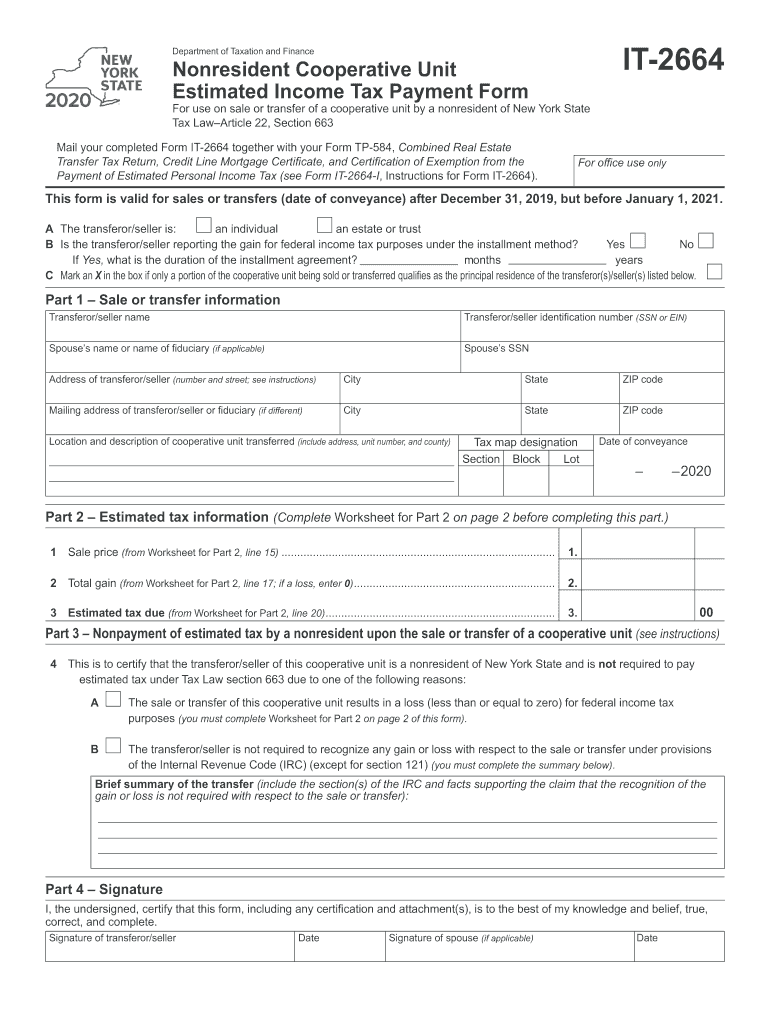

NY DTF IT-2664 2020 free printable template

Get, Create, Make and Sign NY DTF IT-2664

Editing NY DTF IT-2664 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF IT-2664 Form Versions

How to fill out NY DTF IT-2664

How to fill out NY DTF IT-2664

Who needs NY DTF IT-2664?

Instructions and Help about NY DTF IT-2664

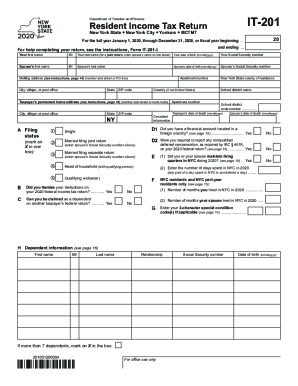

The New York state tax department is making it easier to follow your taxes by offering enhanced fill in forms available for download from our website filling forms are PDF files that let you enter your data using your computer instead of filling it in by hand enhanced filling forms have fields that populate automatically as you complete the form eliminating the need to look up information like school codes and some feature drop-down menus that make it easier to select entries enhanced filling forms even do most of the math for you reducing the chances of an error that could delay the processing of your return, but before you begin using these new forms here are some helpful tips to make your experience as smooth as possible first it×39’s importanfalloutut the pages in order beginning with your personal information at the top of page 1 hit the tab key to advance your cursor to the next field the fields highlighted in yellow will automatically populate as you complete the form buttons indicate drop-down menus can be clicked to list your choices for those fields you must select your country before you enter your address but otherwise it×39’s bescompletedhe fields in order since later calculations are based on data entered earlier ocean×39’ve completed the forPlayboybclickingng the green print button in the upper left-hand corner of the first pageant error message will warn you if you skip a required field to clear your form click the red reset button on the right the links button can direct you to additional forms you might need to complete your return when you print your forms the data is captured in a 2dbarcode this barcode will be scanned your automated systems to capture all your tax data if you need to make changes to your form you must make your changes within the PDF and then reprint to update these barcodes finally don'ttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttforget to sign your return in blue or black ink before mailing it to the tax department your signature is the only handwritten entry permitted on the Normand remember taxpayers who choose direct deposit as their refund method receive their refunds faster than those who Otto receives a check it×39’s thSafewayay Toto get you refund for more information visit our website at well.com you

People Also Ask about

What is nyc tax 2020?

Who needs to pay nyc tax?

What is New York adjusted gross income?

How much is NYC tax?

What is New York City income tax 2020?

How do I pay estimated taxes for New York State?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

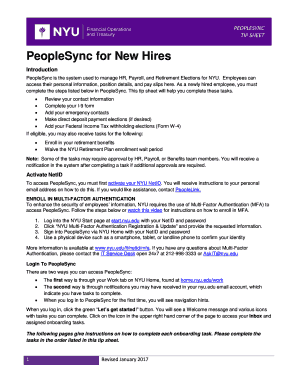

How can I edit NY DTF IT-2664 from Google Drive?

How do I edit NY DTF IT-2664 on an iOS device?

How do I fill out NY DTF IT-2664 on an Android device?

What is NY DTF IT-2664?

Who is required to file NY DTF IT-2664?

How to fill out NY DTF IT-2664?

What is the purpose of NY DTF IT-2664?

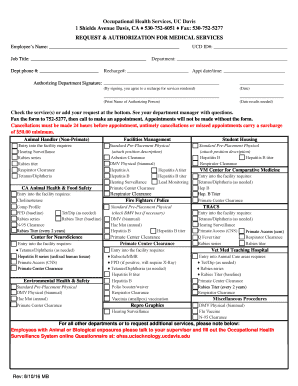

What information must be reported on NY DTF IT-2664?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.