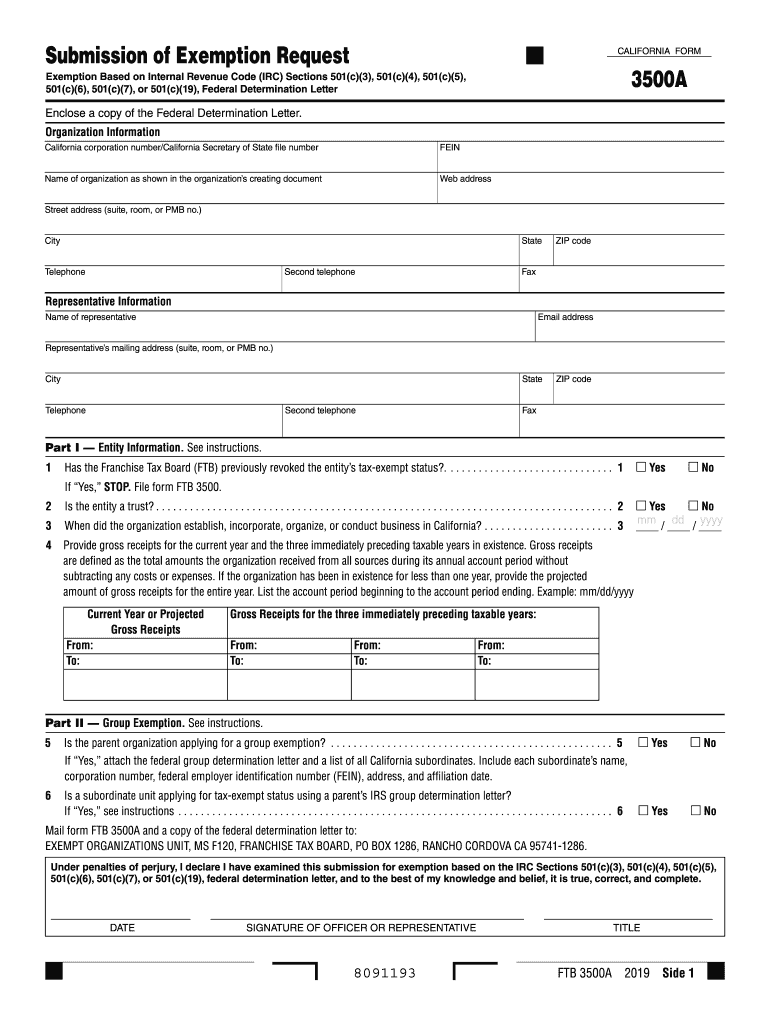

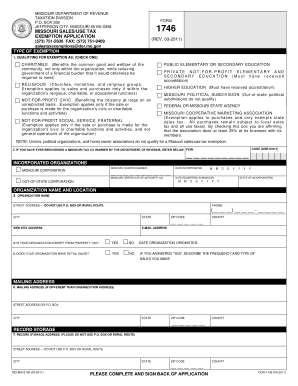

Who needs a CA form 3500A?

Only non-profit organizations who have already obtained federal determination letter, can apply for California tax exemption. If their exempt status is not approved by IRS and they did not receive federal tax exemption, they should not apply to California Franchise Tax Board.

What is form 3500A for?

Regardless of whether they have an exempt status or not, all nonprofit organizations are to pay state taxes to California Franchise Tax Board, which is why they must file this form, Submission of Exemption Request. Otherwise they will have to pay the same state taxes as corporations and other business entities do.

Is it accompanied by other forms?

Yes, it is. Form 3500A must be filed only with a copy of federal determination letter.

When is form 3500A due?

Send it whenever you need to apply for tax exemption.

How do I fill out a CA form 3500A?

First you must write organization information and representative information. This part should contain California corporation number, FEIN, name and address of the organization, name, address and a telephone number of the representative. In Part I you have to give details about the entity, answering a series of questions and filling out a couple of tables. In Part II you only answer the questions, if the organization applies for a group extension. In Part III you should specify the purpose and main activities of your organization.

Where do I send it?

Paper copies must be filed at:

Exempt Organizations Unit

MS F120

Franchise Tax Board

PO Box 1286

Rancho Cordova CA 95741-1286