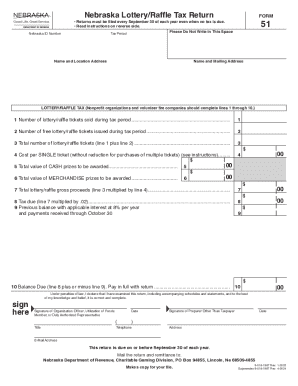

NE Form 51 2021 free printable template

Show details

Any questions regarding the completion of the Nebraska Lottery/Raffle Tax Return Form 51 should be addressed to the Nebraska Department of Revenue Charitable Gaming Division P. O. Box 94855 Lincoln Nebraska 68509-4855. PREIDENTIFIED RETURN. This return must be used only by the licensed organization whose name is printed on it. Do not file returns which are photocopies are for another tax period or have not been preidentified. If you have not rece...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE Form 51

Edit your NE Form 51 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE Form 51 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE Form 51 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NE Form 51. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Form 51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE Form 51

How to fill out NE Form 51

01

Obtain a copy of NE Form 51 from the appropriate authority or official website.

02

Read the instructions provided with the form carefully.

03

Fill out your personal information in the designated fields, including name, address, and contact details.

04

Provide any required identification numbers or codes as specified.

05

Complete the sections related to the purpose of the form as per the guidelines.

06

Review all the entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as directed, either in person or electronically, if applicable.

Who needs NE Form 51?

01

Individuals applying for a specific benefit or service that requires NE Form 51.

02

Applicants seeking tax exemptions or similar fiscal considerations.

03

Organizations or businesses looking to register for certain permits or licenses.

Fill

form

: Try Risk Free

People Also Ask about

How much is the Nebraska Lottery taxed?

By law, the Nebraska Lottery automatically checks for back taxes and child support on prizes of more than $500. Prizes above $5,000 have state and federal taxes automatically withheld, at 5 and 24 percent, respectively.

How much is taxed if you win 1.6 billion?

The IRS will automatically take 24% of your winnings off the top, and the rest will be due at tax time. Around $17.82 million in federal income tax will be owed, per year, for each of the remaining 27 payments.

Does Nebraska have a state tax form?

Nebraska State Income Tax Forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed in conjunction with a IRS Income Tax Return.

What states do not pay tax on lottery winnings?

Best States To Win Powerball There are eight states that do not tax Powerball winnings: California, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming. Pennsylvania, North Dakota, Indiana and Ohio also make our list of best states. Food Stamps: What Is the Maximum SNAP EBT Benefit for 2023?

When can I file my Nebraska tax return?

Find IRS or Federal Tax Return deadline details. The 2022 Nebraska State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 due date.

What is the Lottery and Raffle Act in Nebraska?

The Nebraska Lottery and Raffle Act governs lotteries which exceed $1,000 in gross proceeds (ticket sales) and raffles which exceed $5,000 in gross proceeds. The Nebraska Small Lottery and Raffle Act governs lotteries and raffles which do not exceed the $1,000/$5,000 thresholds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NE Form 51?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific NE Form 51 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit NE Form 51 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your NE Form 51 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit NE Form 51 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing NE Form 51.

What is NE Form 51?

NE Form 51 is a tax form used in certain jurisdictions to report income and other financial information for nonresidents engaged in business activities.

Who is required to file NE Form 51?

Nonresidents who receive income from sources within the jurisdiction and meet the filing criteria are required to file NE Form 51.

How to fill out NE Form 51?

To fill out NE Form 51, taxpayers must provide their identifying information, income details, and any applicable deductions or credits as specified in the form instructions.

What is the purpose of NE Form 51?

The purpose of NE Form 51 is to facilitate the reporting and taxation of income earned by nonresidents from business activities within the jurisdiction.

What information must be reported on NE Form 51?

NE Form 51 must report personal identification details, total income earned, applicable deductions, credits, and any taxes withheld.

Fill out your NE Form 51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Form 51 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.