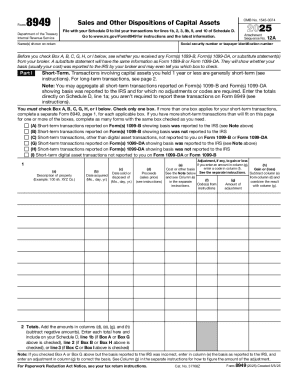

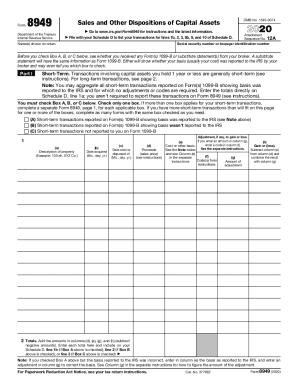

IRS 8949 2019 free printable template

Instructions and Help about IRS 8949

How to edit IRS 8949

How to fill out IRS 8949

About IRS 8 previous version

What is IRS 8949?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

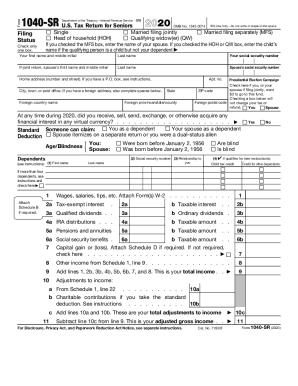

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8949

What should I do if I discover an error after submitting my IRS 8949?

If you find a mistake after filing your IRS 8949, you can file an amended return using Form 1040-X to correct the errors. Ensure that you provide accurate details regarding the changes, and consult IRS guidelines for any specific requirements related to your amendment.

How can I verify if my IRS 8949 submission has been received?

To check the status of your IRS 8949 submission, you can use the IRS 'Where's My Refund?' tool if you filed electronically or contact the IRS directly for information on paper submissions. Make sure to have your details ready for reference.

Are e-signatures acceptable when filing IRS 8949 electronically?

Yes, e-signatures are accepted for IRS 8949 submissions when filing electronically. Ensure that your e-filing provider complies with IRS requirements regarding electronic signatures to guarantee the integrity of your submission.

What are common errors when filing IRS 8949 and how can they be avoided?

Common errors when filing IRS 8949 include incorrect transaction dates, miscalculating gains or losses, and failing to categorize transactions properly. To avoid these mistakes, double-check all entries and use reliable accounting software that can streamline the process.

See what our users say