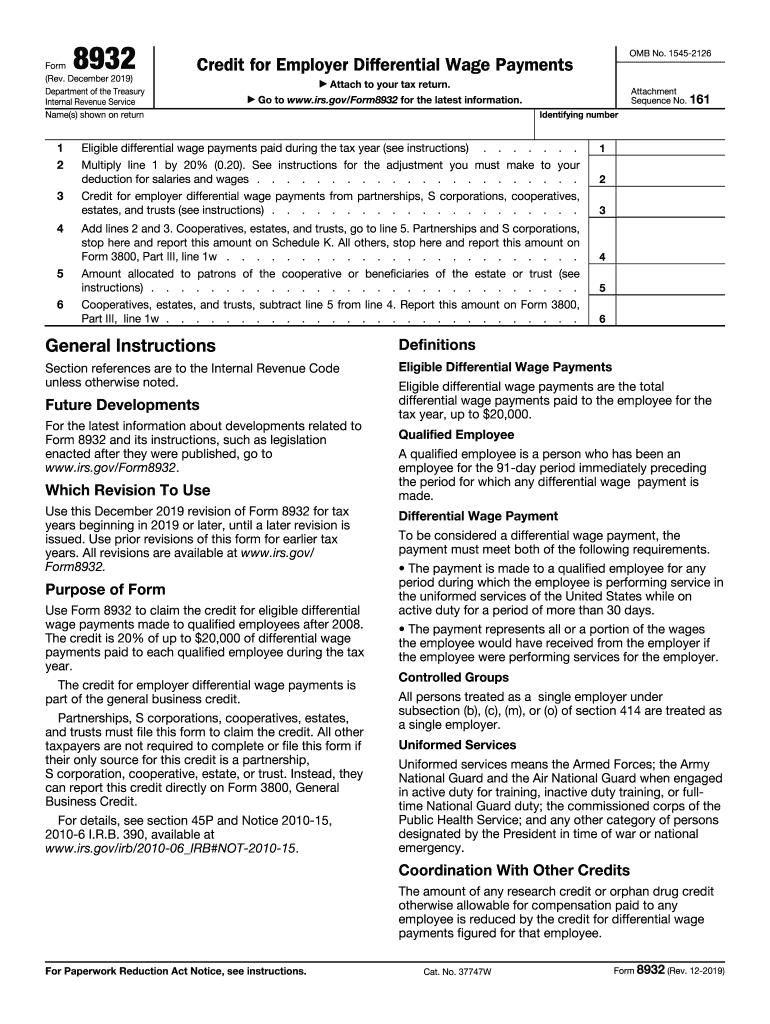

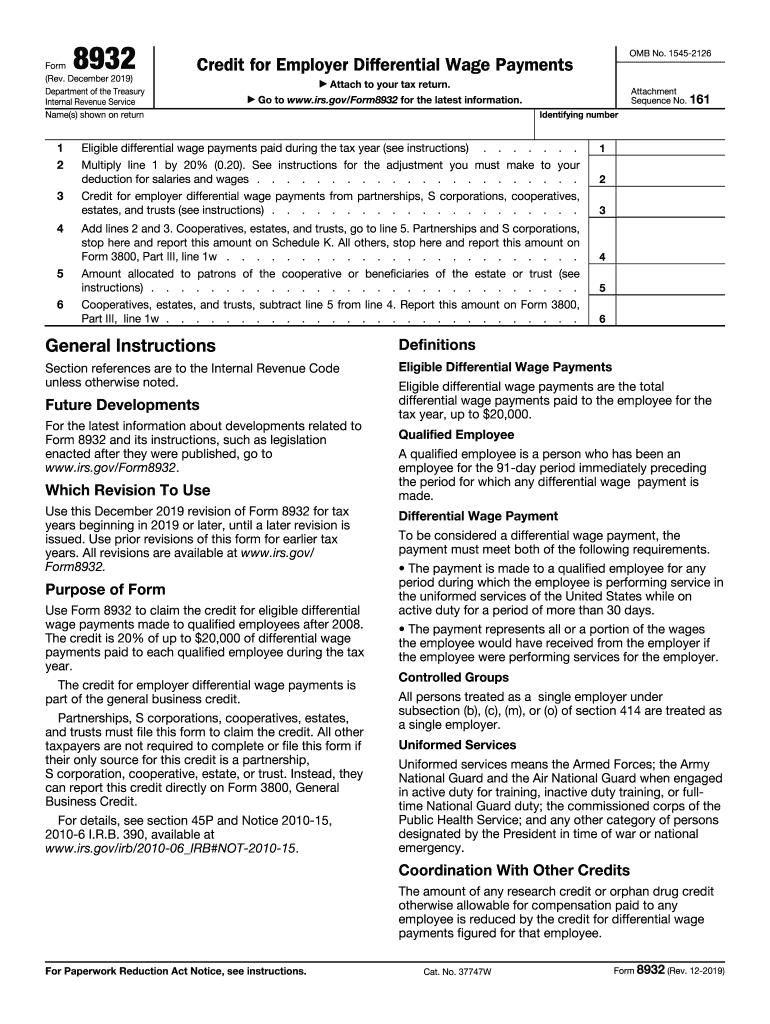

IRS Form 8932 2019 free printable template

Get, Create, Make and Sign IRS Form 8932

Editing IRS Form 8932 online

Uncompromising security for your PDF editing and eSignature needs

IRS Form 8932 Form Versions

How to fill out IRS Form 8932

How to fill out IRS Form 8932

Who needs IRS Form 8932?

Instructions and Help about IRS Form 8932

In this video I want to work through an example of filling out form 8962 for the premium tax credit this is going to be a relatively simple example I'm going to be filling it out for a single person who had uniform coverage throughout the entire course of the tax year so if you have a more complicated scenario or if you're married if you have dependents if you change coverage throughout the year you change jobs all these sorts of different variations that you can have that can affect this form I will link some helpful information down in the video description from the IRS that goes through examples of all these different types of scenarios, so again it can be helpful information, and I'll link it down in the video description, but I just want to run through this example here of a single person so starting off here at the top line the name that's shown on your tax return we're going to write John Doe with our social security number and then moving on since this is a single person we don't need to check this box that says you cannot take the premium tax credit...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS Form 8932 in Gmail?

How do I execute IRS Form 8932 online?

Can I sign the IRS Form 8932 electronically in Chrome?

What is IRS Form 8932?

Who is required to file IRS Form 8932?

How to fill out IRS Form 8932?

What is the purpose of IRS Form 8932?

What information must be reported on IRS Form 8932?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.