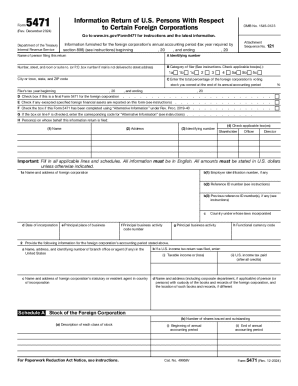

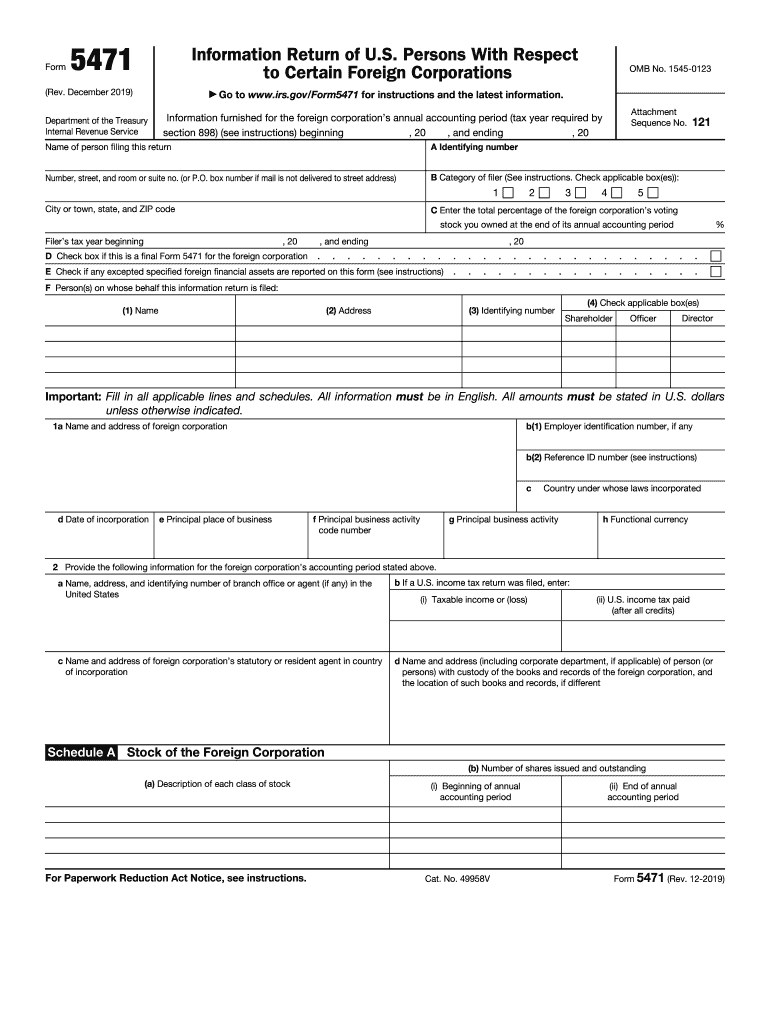

IRS 5471 2019 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

About IRS 5 previous version

What is IRS 5471?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5471

What should I do if I realize I've made a mistake on my filed form 5471?

If you've filed a form 5471 and notice an error, you can submit an amended return to correct it. It’s crucial to do this as soon as possible, as failure to file an accurate form can result in penalties. Be sure to clearly indicate the changes made to ensure accurate processing.

How can I verify the status of my form 5471 submission?

You can verify the status of your form 5471 submission by checking the IRS's online system, if you e-filed. If you mailed the form, consider following up with the IRS directly or checking the status through the confirmation received upon submission. Make sure to have your tracking number handy if applicable.

What are common mistakes to avoid when filing form 5471?

Common mistakes when filing form 5471 include inaccuracies in foreign financial account information and not properly including all required schedules. It's essential to double-check all entries and ensure that information aligns with supporting documentation to avoid rejection and penalties.

How do e-signatures work for form 5471 submissions?

E-signatures for form 5471 are generally accepted when e-filing, provided the software used meets IRS requirements. Ensure that the electronic filing system you use complies with the IRS standards to prevent delays in processing. Always keep records of your signed documents for your records.

What steps should I take if I receive an audit notice related to my form 5471?

If you receive an audit notice regarding your form 5471, start by reviewing the notice carefully to understand the issues raised. Gather all relevant documents and correspondence to support your case. Consider consulting a tax professional to help prepare your response and ensure that you address the concerns adequately.