IRS 4562 2019 free printable template

Show details

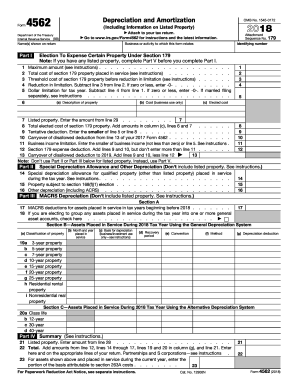

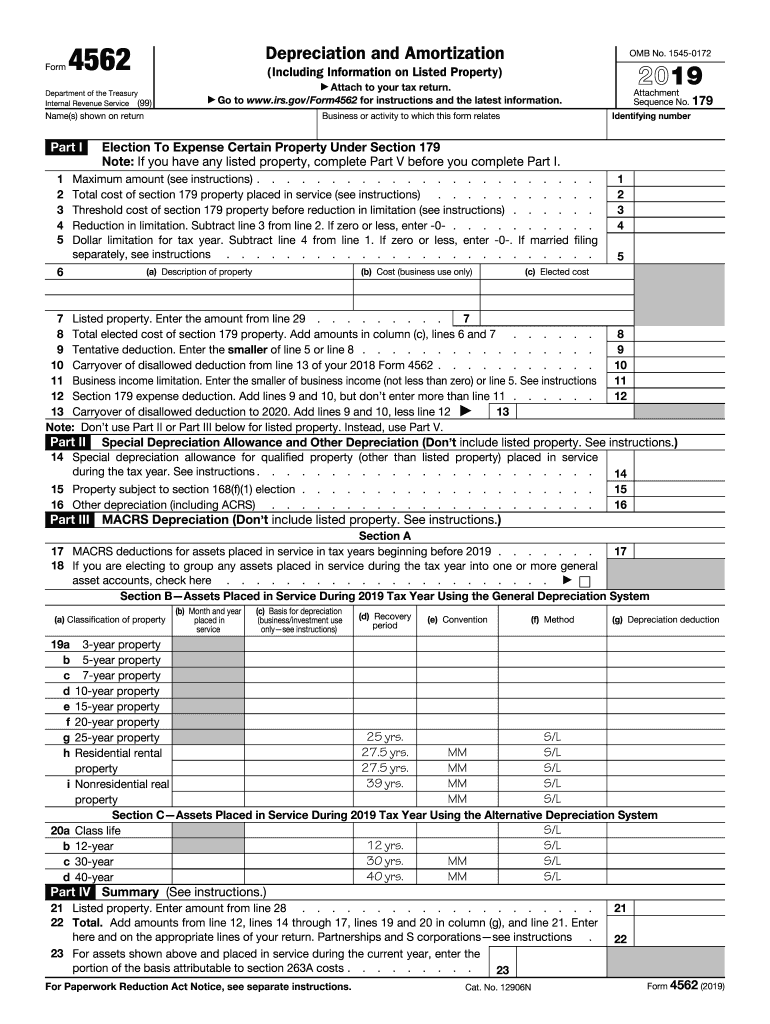

10 Carryover of disallowed deduction from line 13 of your 2016 Form 4562. 11 Business income limitation. Enter the smaller of business income not less than zero or line 5 see instructions 12 Section 179 expense deduction. Add lines 9 and 10 but don t enter more than line 11. Cat. No. 12906N Form 4562 2017 Page 2 used for entertainment recreation or amusement. Part V Note For any vehicle for which you are using the standard mileage rate or deducting lease expense complete only 24a 24b columns a...through c of Section A all of Section B and Section C if applicable. Form Depreciation and Amortization Attach Go to your tax return* to www*irs*gov/Form4562 for instructions and the latest information* Name s shown on return Attachment Sequence No* 179 Identifying number Business or activity to which this form relates Election To Expense Certain Property Under Section 179 Note If you have any listed property complete Part V before you complete Part I. Maximum amount see instructions. Total...cost of section 179 property placed in service see instructions. Threshold cost of section 179 property before reduction in limitation see instructions. Reduction in limitation* Subtract line 3 from line 2. If zero or less enter -0-. Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less enter -0-. If separately see instructions. Including Information on Listed Property Department of the Treasury Internal Revenue Service 99 Part I OMB No* 1545-0172 a Description of property...b Cost business use only. married. filing c Elected cost 7 Listed property. Enter the amount from line 29. 8 Total elected cost of section 179 property. Add amounts in column c lines 6 and 7. 9 Tentative deduction* Enter the smaller of line 5 or line 8. Note Don t use Part II or Part III below for listed property. Instead use Part V. Part II Special Depreciation Allowance and Other Depreciation Don t include listed property. See instructions. 14 Special depreciation allowance for qualified...property other than listed property placed in service during the tax year see instructions. 15 Property subject to section 168 f 1 election. 16 Other depreciation including ACRS. Part III MACRS Depreciation Don t include listed property. See instructions. Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2017. 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts check here. Section B Assets...Placed in Service During 2017 Tax Year Using the General Depreciation System a Classification of property b Month and year placed in service c Basis for depreciation business/investment use only see instructions 19a b c d e f g h 3-year property Residential rental property i Nonresidential real d Recovery period 25 yrs. 39 yrs. e Convention f Method MM S/L 20a Class life b 12-year 40 yrs. c 40-year Part IV Summary See instructions. 22 Total* Add amounts from line 12 lines 14 through 17 lines 19...and 20 in column g and line 21. Enter here and on the appropriate lines of your return* Partnerships and S corporations see instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

Instructions and Help about IRS 4562

How to edit IRS 4562

To edit IRS Form 4562, you can use pdfFiller's intuitive tools that allow you to fill, edit, and save the form electronically. Simply upload the form to the platform, make any necessary changes such as entering or adjusting amounts, and ensure that all details are correct. Once finished, you can download or print the edited form as needed.

How to fill out IRS 4562

Filling out IRS Form 4562 requires accurate information about your assets and depreciation methods. Start by gathering relevant data about your properties, including purchase dates, costs, and the method of depreciation you intend to use. Use the following steps for guidance:

01

Obtain a copy of IRS Form 4562 and read the instructions.

02

Enter your name and identifying information at the top of the form.

03

Provide details about the property being depreciated, including the type of property and the date it was placed into service.

04

Calculate depreciation amounts for each section accurately.

05

Sign and date the form once all fields are completed.

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4562?

IRS Form 4562 is used for claiming deductions for depreciation on property and certain expenses attached to it. This form helps taxpayers report their depreciation and amortization, which allows them to reduce taxable income. It is especially crucial for individuals and businesses that acquire significant assets to track their value over time.

What is the purpose of this form?

The primary purpose of IRS Form 4562 is to outline the depreciation deduction that a taxpayer can claim on their tax return. By showing the depreciation of assets, taxpayers can lower their taxable income, which in turn decreases the amount of taxes owed. The form also serves to document property placed in service and the election of certain depreciation methods.

Who needs the form?

Taxpayers who own assets that are eligible for depreciation must complete IRS Form 4562. This includes individuals and businesses that have purchased property such as buildings, machinery, and vehicles. Partnerships and corporations also need to file this form if they have depreciable assets.

When am I exempt from filling out this form?

You may be exempt from filling out IRS Form 4562 if you do not have any depreciable property or the cost of your property does not exceed the de minimis safe harbor threshold outlined by the IRS. Additionally, if you are claiming the standard deduction and do not have significant business assets, you may not need to file this form.

Components of the form

IRS Form 4562 includes several key components: Part I addresses the election for the 179 expense deduction, while Part II outlines the information for listed property. Part III requires details on non-listed property, and Part IV focuses on the recap of prior depreciation. Each part is crucial for accurately reporting depreciation and ensuring compliance with tax regulations.

Due date

The due date for filing IRS Form 4562 aligns with the taxpayer's income tax return deadlines. For most individuals, this date is typically April 15. However, if you extend your tax return, you must file Form 4562 by the extended deadline to ensure that your depreciation claims are valid.

What payments and purchases are reported?

IRS Form 4562 requires information on payments and purchases related to depreciable assets, including items that qualify for Section 179 deduction. This may include machinery, vehicles, computer equipment, furniture, and other tangible personal property used in a trade or business. Make sure to accurately report costs to maximize your deduction opportunities.

How many copies of the form should I complete?

Generally, one copy of IRS Form 4562 needs to be submitted with your tax return. However, if you are filing multiple returns for different entities or parts of a business, ensure that each entity has its own properly completed form.

What are the penalties for not issuing the form?

Failing to submit IRS Form 4562 when required can result in penalties, which may include fines for underreporting your income or failing to adequately report your depreciation. Accurate and timely submission of this form helps to prevent potential tax discrepancies and liabilities.

What information do you need when you file the form?

When preparing to file IRS Form 4562, you will need detailed information regarding each depreciable asset, including its purchase price, the date it was placed into service, and the specific depreciation method you choose. Additionally, previous depreciation amounts must be accounted for, if applicable, to ensure accuracy.

Is the form accompanied by other forms?

IRS Form 4562 may need to be submitted alongside other forms such as Schedule C (Profit or Loss from Business) or Form 8829 (Expenses for Business Use of Your Home), depending on your filing method and circumstances. Always check the specific requirements for your tax situation to ensure accurate filing.

Where do I send the form?

Where to send IRS Form 4562 depends on your filing method and state of residence. Generally, attached to your tax return, the completed form should be sent to the address corresponding to your tax return type, as specified in the IRS instructions. Always check the current IRS guidelines to ensure your form reaches the correct location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It was just fine - a few learning curve quirks, but relatively easy.

It has been just what I have needed. Love it!

See what our users say