IRS 3520 2019 free printable template

Show details

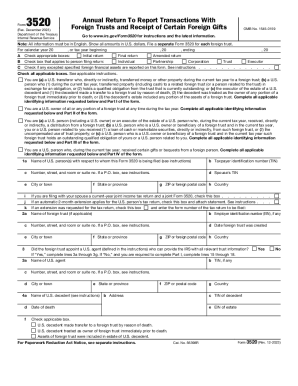

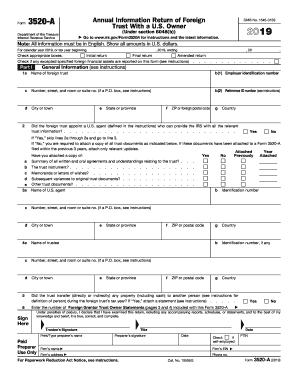

If these documents have been attached to a Form 3520-A or Form 3520 filed within the previous 3 years attach only relevant updates. If No to the best of your ability complete and attach a substitute Form 3520-A for the foreign trust. If these documents have been attached to a Form 3520 filed within the previous 3 years attach only relevant updates. You are a U.S. person who during the current tax year received certain gifts or bequests from a foreign person. Complete all applicable Name of U.S....person s with respect to whom this Form 3520 is being filed see instructions b Identification number c Number street and room or suite no. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust. For calendar year 2017 or tax year beginning 2017 ending A Check appropriate boxes Initial return Final return Amended return B Check box that applies to person filing return Individual Partnership Corporation Trust Executor C Check if any excepted specified foreign financial...assets are reported on this form see instructions. For Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 19594V Form 3520 2017 Page 2 Part I Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year see instructions 5a Name of trust creator 6a Country code of country where trust was created 7a Will any person other than the U.S. transferor or the foreign trust be treated as the owner of the transferred assets after the transfer. If a P. O. box see...instructions d Spouse s identification number e City or town i j Check the box if you are married and filing a joint 2017 income tax return but you are filing separate Forms 3520. Service center where U.S. person s tax return is filed. k If an extension was requested for the tax return check this box 1a f State or province g ZIP or foreign postal code h Country and enter the form number of the tax return to be filed. Name of foreign trust if applicable b 1 Employer identification number if any b...2 Reference ID number see instructions d 2a Did the foreign trust appoint a U.S. agent defined in the instructions who can provide the IRS with all relevant trust information. Form Department of the Treasury Internal Revenue Service Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts OMB No* 1545-0159 Go to www*irs*gov/Form3520 for instructions and the latest information* Note All information must be in English. Check all applicable boxes. a You are a...U*S* transferor who directly or indirectly transferred money or other property during the current tax year to a foreign trust b You held an outstanding obligation of a related foreign trust or a person related to the trust issued during the current tax year that you reported as a qualified obligation defined in the instructions during the current tax year or c You are the executor of the estate of a U*S* decedent and 1 the decedent made a transfer to a foreign trust by reason of death 2 the...decedent was treated as the owner of any portion of a foreign trust immediately prior to death or 3 the decedent s estate included any portion of the assets of a foreign trust.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

Instructions and Help about IRS 3520

How to edit IRS 3520

To edit IRS 3520, access the completed form in your chosen editing software, such as pdfFiller. Utilize the editing features to make necessary adjustments, ensuring all information remains accurate. After making changes, be sure to review the form before finalizing it for submission.

How to fill out IRS 3520

Fill out IRS 3520 by following a structured approach. Begin by gathering all required information, such as details on foreign trusts and distributions. Complete each section of the form methodically, ensuring clarity and accuracy. Once filled, verify all entries before submission.

About IRS 3 previous version

What is IRS 3520?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 3 previous version

What is IRS 3520?

IRS 3520 is a tax form utilized by U.S. taxpayers to report certain transactions with foreign trusts, as well as the receipt of certain foreign gifts. This form is integral for compliance with U.S. tax laws when dealing with foreign assets.

What is the purpose of this form?

The purpose of IRS 3520 is to ensure that taxpayers report foreign transactions accurately. It helps the IRS monitor and track property held in foreign trusts and the receipt of significant gifts from foreign entities to prevent tax evasion and ensure proper tax compliance.

Who needs the form?

Taxpayers who have engaged in transactions with foreign trusts or received gifts exceeding a specified threshold from foreign individuals are required to file IRS 3520. This includes individuals who are beneficiaries of foreign trusts or those who transfer property to a foreign trust.

When am I exempt from filling out this form?

You are exempt from filing IRS 3520 if you do not have any foreign trusts or have not received significant gifts from foreign individuals during the tax year. Additionally, certain low-value gifts and distributions may not require reporting.

Components of the form

IRS 3520 consists of several sections that capture detailed information about foreign trusts and transactions. Key components include the taxpayer’s identification information, details about the foreign trust, and specifics about any gifts received. Each section must be completed accurately to avoid penalties.

What are the penalties for not issuing the form?

The penalties for failing to file IRS 3520 can be severe. Taxpayers may face penalties ranging from $10,000 to 35% of the unreported amounts, depending on the circumstances. Additionally, failing to report can result in increased scrutiny from the IRS and potential legal consequences.

What information do you need when you file the form?

When filing IRS 3520, gather information such as your taxpayer identification number, details about the foreign trust, and any records related to gifts received. This may include the names and addresses of the trust or donors and the amounts involved.

Is the form accompanied by other forms?

IRS 3520 may require accompanying documents depending on your specific situation. If applicable, you may need to file IRS Form 3520-A for foreign trusts with U.S. owners. These forms work together to provide the IRS with a complete picture of your foreign transactions.

Where do I send the form?

Send IRS 3520 to the address specified in the instructions on the form. Depending on your location and whether you are enclosing a payment, the submission address may vary, so always verify the correct address before mailing.

See what our users say