IRS 1120-F - Schedule M-1 & M-2 2019 free printable template

Show details

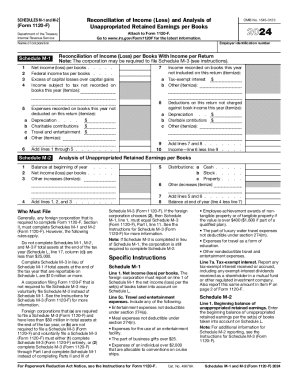

Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per BooksSCHEDULES M1 and M2(Form 1120F)Department of the Treasury Internal Revenue Service1 2 3 42019Go to www.irs.gov/Form1120F

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-F - Schedule M-1 M-2

How to edit IRS 1120-F - Schedule M-1 M-2

How to fill out IRS 1120-F - Schedule M-1 M-2

Instructions and Help about IRS 1120-F - Schedule M-1 M-2

How to edit IRS 1120-F - Schedule M-1 M-2

To edit the IRS 1120-F - Schedule M-1 M-2 form, you can download the form from the IRS website or platforms that provide tax forms. Utilize pdfFiller’s tools to import the form into the platform, and then use editing features to fill in or modify necessary fields. Save your changes to ensure proper documentation when you file.

How to fill out IRS 1120-F - Schedule M-1 M-2

Filling out the IRS 1120-F - Schedule M-1 M-2 involves several steps. First, gather all financial documents that report income, deductions, and credits relevant to your business. The following steps outline the process:

01

Obtain the latest version of the IRS 1120-F - Schedule M-1 M-2 form from the IRS website.

02

Review any instructions that accompany the form for specific guidelines.

03

Input the necessary information regarding the corporation’s income, expenses, and adjustments.

04

Ensure all entries comply with IRS regulations and provide additional documentation as needed.

05

Review the completed form for accuracy before submission.

About IRS 1120-F - Schedule M-1 M-2 2019 previous version

What is IRS 1120-F - Schedule M-1 M-2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-F - Schedule M-1 M-2 2019 previous version

What is IRS 1120-F - Schedule M-1 M-2?

IRS 1120-F - Schedule M-1 M-2 is a tax form used by foreign corporations to report their income effectively connected with a U.S. trade or business, as well as other related financial adjustments. This schedule is part of the IRS Form 1120-F, which enables foreign entities to comply with U.S. tax reporting requirements.

What is the purpose of this form?

The main purpose of the IRS 1120-F - Schedule M-1 M-2 is to reconcile the differences between a foreign corporation’s book income and its taxable income as reported for U.S. tax purposes. This ensures that the corporation accurately reports income and expenses, reflecting proper tax liability.

Who needs the form?

Foreign corporations engaged in business activities in the United States are required to file the IRS 1120-F - Schedule M-1 M-2 if they have effectively connected income. It is essential for these corporations to report accurately to avoid penalties and ensure compliance with U.S. tax laws.

When am I exempt from filling out this form?

You are exempt from filling out the IRS 1120-F - Schedule M-1 M-2 if your foreign corporation does not have any effectively connected income in the U.S. Additionally, if the corporation is exempt under certain provisions of the tax code, it may not be required to file this form.

Components of the form

The IRS 1120-F - Schedule M-1 M-2 includes components that capture various types of income and expenses, including gross income, deductions, and any adjustments necessary to arrive at taxable income. Key components may also include the reconciliation of book income versus tax liability.

What are the penalties for not issuing the form?

Penalties for not filing the IRS 1120-F - Schedule M-1 M-2 can include hefty fines. Specifically, failing to file or include necessary information may result in penalties calculated based on the amount of tax owed. It is crucial for foreign corporations to understand these risks to avoid financial liabilities.

What information do you need when you file the form?

When filing the IRS 1120-F - Schedule M-1 M-2, you will need comprehensive financial records, including income statements, balance sheets, and details of any deductions and credits. Additionally, you may require previous filings and documentation related to business expenses in the U.S.

Is the form accompanied by other forms?

The IRS 1120-F - Schedule M-1 M-2 is typically filed along with IRS Form 1120-F. In some cases, additional forms may need to be included depending on the nature of the income or credits claimed by the corporation, such as Form 1118 for foreign tax credits.

Where do I send the form?

The completed IRS 1120-F - Schedule M-1 M-2 form should be mailed to the appropriate IRS address specified for Form 1120-F. Ensure that you reference the IRS guidelines to confirm the correct mailing address based on your specific situation.

See what our users say