Get the free Tax Analysis Division 30 E Broad St, 22nd Floor Columbus ...

Show details

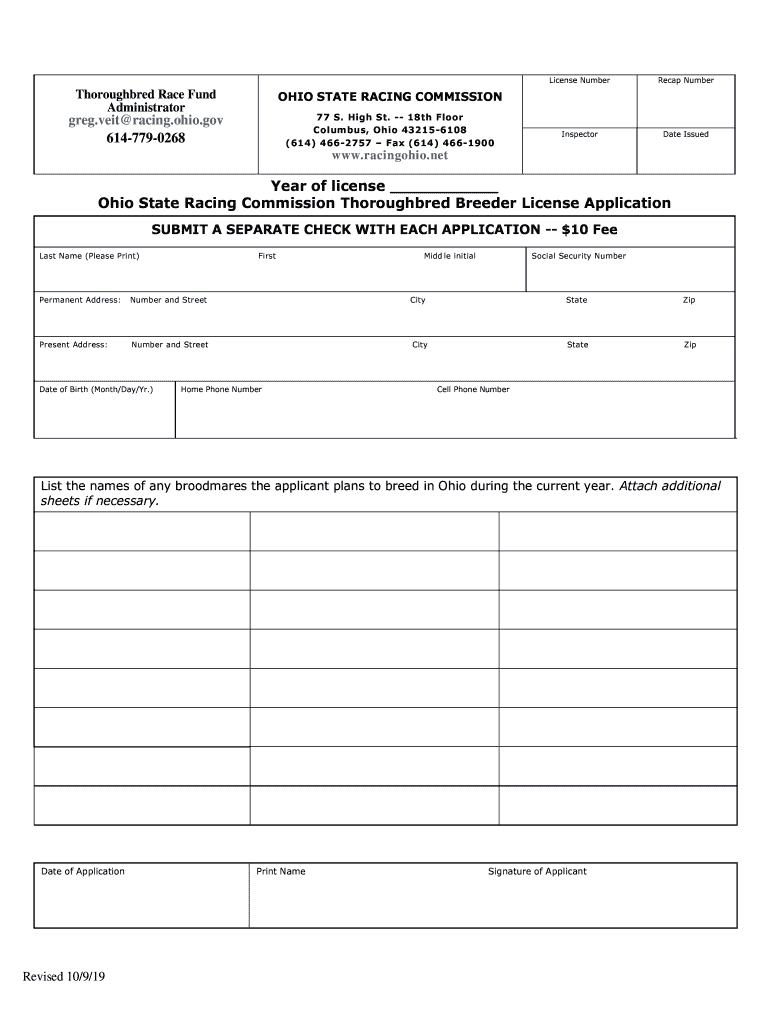

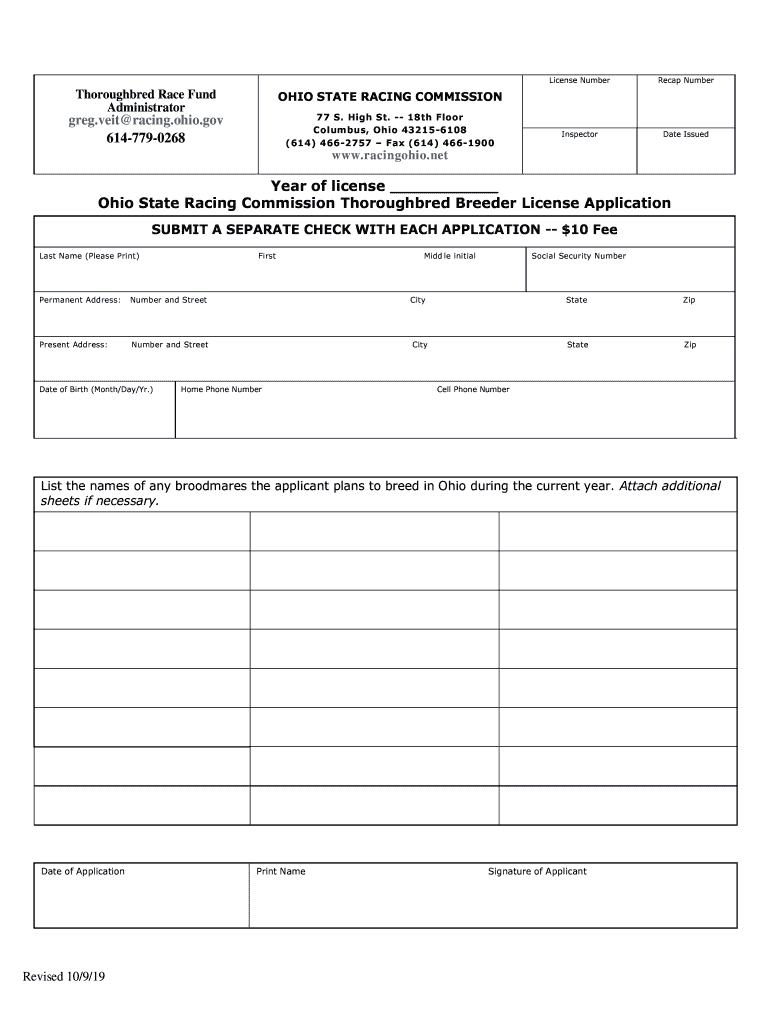

License NumberRecap NumberInspectorDate IssuedOHIO STATE RACING COMMISSION Thoroughbred Race Fund Administrator77 S. High St. 18th Floor Columbus, Ohio 432156108 (614) 4662757 Fax (614) 4661900greg.

We are not affiliated with any brand or entity on this form

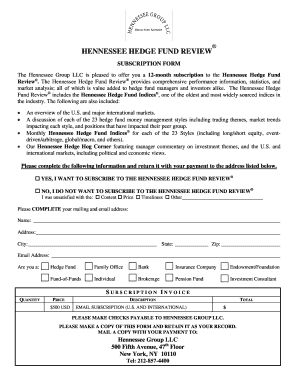

Get, Create, Make and Sign tax analysis division 30

Edit your tax analysis division 30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax analysis division 30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax analysis division 30 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax analysis division 30. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax analysis division 30

How to fill out tax analysis division 30

01

To fill out tax analysis division 30, you can follow these steps:

02

Gather all necessary financial information, including income statements, balance sheets, and records of expenses.

03

Begin by entering the company's name and taxpayer identification number at the top of the form.

04

Complete the sections related to the company's income, deductions, and credits. Provide accurate and detailed information for each item.

05

Calculate the tax liability based on the provided information.

06

Double-check all the entries and ensure the form is properly signed and dated.

07

Submit the completed tax analysis division 30 to the appropriate tax authority.

08

Keep a copy of the filled-out form for your records.

Who needs tax analysis division 30?

01

Tax analysis division 30 is typically needed by businesses or individuals who want to analyze their tax liability and understand the factors affecting it.

02

Accountants, tax professionals, and financial advisors often use tax analysis division 30 to assist their clients in planning and managing their tax obligations.

03

It can be beneficial for companies of all sizes to accurately determine their tax liability and identify potential areas for tax optimization.

04

Individuals who have complex financial situations, such as multiple sources of income or various deductions, can also benefit from using tax analysis division 30.

05

Overall, anyone who wants to have a thorough understanding of their tax situation and ensure compliance with tax laws can make use of tax analysis division 30.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax analysis division 30 to be eSigned by others?

Once your tax analysis division 30 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out tax analysis division 30 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tax analysis division 30 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit tax analysis division 30 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share tax analysis division 30 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your tax analysis division 30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Analysis Division 30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.