Get the free To Profit or Not to Profit: The Commercial Transformation ...

Show details

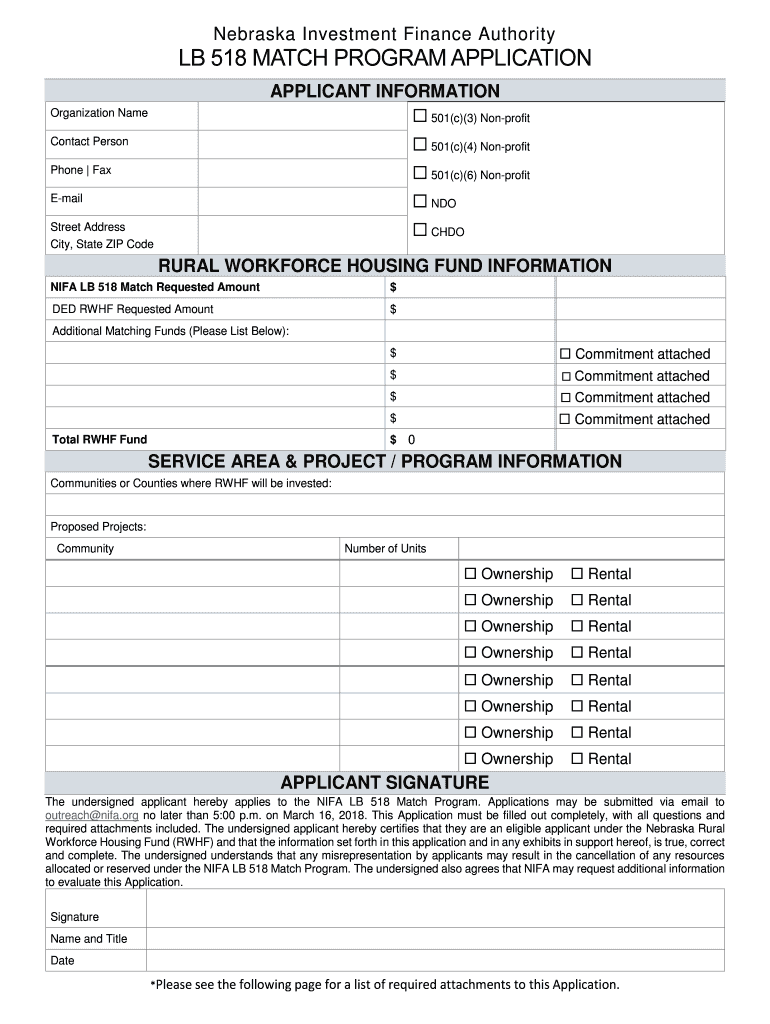

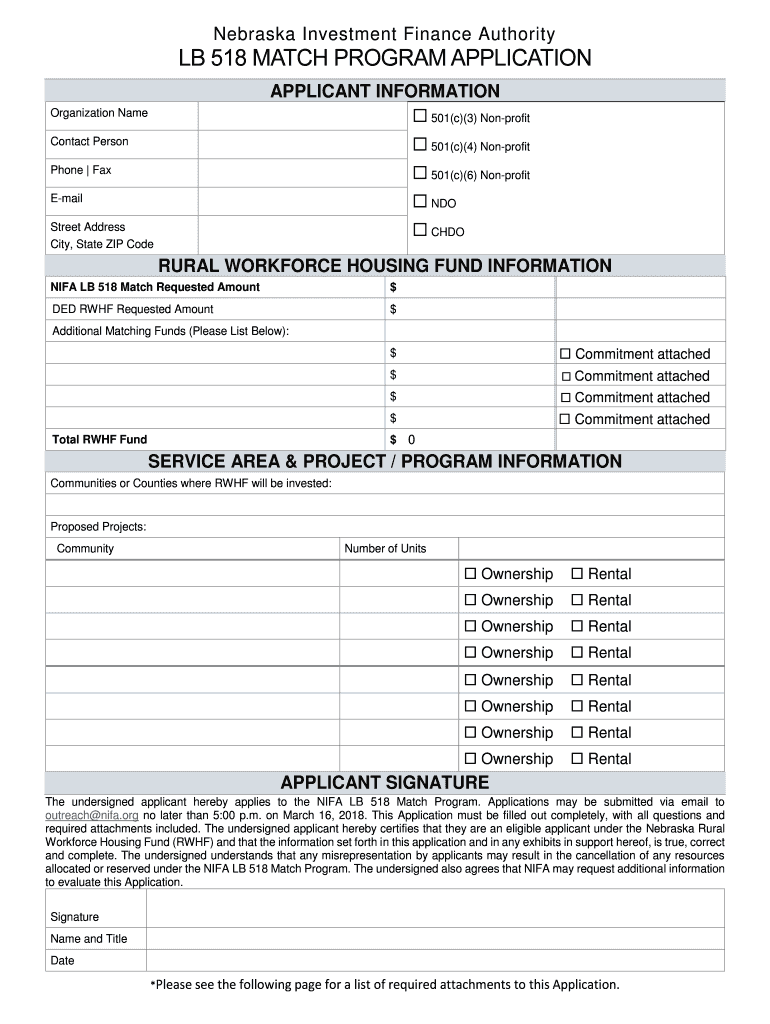

Nebraska Investment Finance Authority 518 MATCH PROGRAM APPLICATION APPLICANT INFORMATION 501(c)(3) NonprofitOrganization Name Contact Person 501(c)(4) NonprofitPhone Fax 501(c)(6) NonprofitEmail

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to profit or not

Edit your to profit or not form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to profit or not form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to profit or not online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to profit or not. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to profit or not

How to fill out to profit or not

01

Assess your current financial situation: Before you can determine whether to profit or not, you need to analyze your income, expenses, debts, and savings.

02

Set financial goals: Identify what you want to achieve financially, whether it's saving for retirement, buying a house, or paying off debts.

03

Create a budget: Make a detailed plan of your income and expenses, including allocating funds for saving and investments.

04

Evaluate potential profit options: Research different investment opportunities, such as stocks, real estate, or starting a small business.

05

Analyze risks versus rewards: Consider the potential risks and rewards associated with each profit option and assess whether they align with your financial goals and risk tolerance.

06

Seek professional advice: If you're unsure about the best way to profit, consider consulting a financial advisor who can provide personalized guidance based on your unique situation.

07

Implement your profit strategy: Once you have determined the most suitable profit option, take the necessary steps to execute your strategy.

08

Monitor and adjust: Regularly review your progress, make adjustments as needed, and stay informed about market conditions or changes that may impact your profit plans.

Who needs to profit or not?

01

Anyone who wants to improve their financial situation or achieve specific financial goals can benefit from considering whether to profit or not.

02

Individuals with disposable income who are looking to maximize their returns and grow their wealth may also find it relevant to explore profit opportunities.

03

Entrepreneurs or business owners seeking to increase profitability or expand their ventures may need to evaluate different profit strategies.

04

People who have excess savings and want to make their money work for them may also be interested in exploring profit options.

05

Ultimately, the decision to profit or not depends on individual circumstances, goals, and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit to profit or not on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing to profit or not.

How do I fill out to profit or not using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign to profit or not and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete to profit or not on an Android device?

Use the pdfFiller mobile app and complete your to profit or not and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is to profit or not?

To profit or not is a form or document used to report whether an individual or entity made a profit or incurred a loss during a specific period of time.

Who is required to file to profit or not?

Individuals or entities who have earned income or incurred losses during the tax year are required to file the to profit or not form.

How to fill out to profit or not?

To fill out the to profit or not form, one must provide detailed information about their income, expenses, and any losses incurred during the specified period.

What is the purpose of to profit or not?

The purpose of to profit or not is to accurately report financial information to the relevant tax authorities in order to determine tax liability or eligibility for tax deductions.

What information must be reported on to profit or not?

Information such as income, expenses, losses, and any relevant deductions must be reported on the to profit or not form.

Fill out your to profit or not online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Profit Or Not is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.