Get the free AA UNDERLYING RATING: Standard & Poor's - CA.gov - emma msrb

Show details

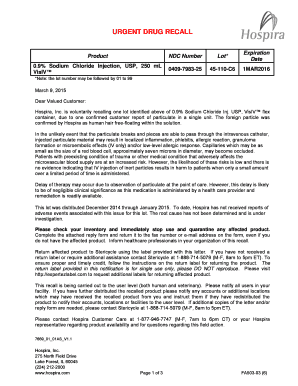

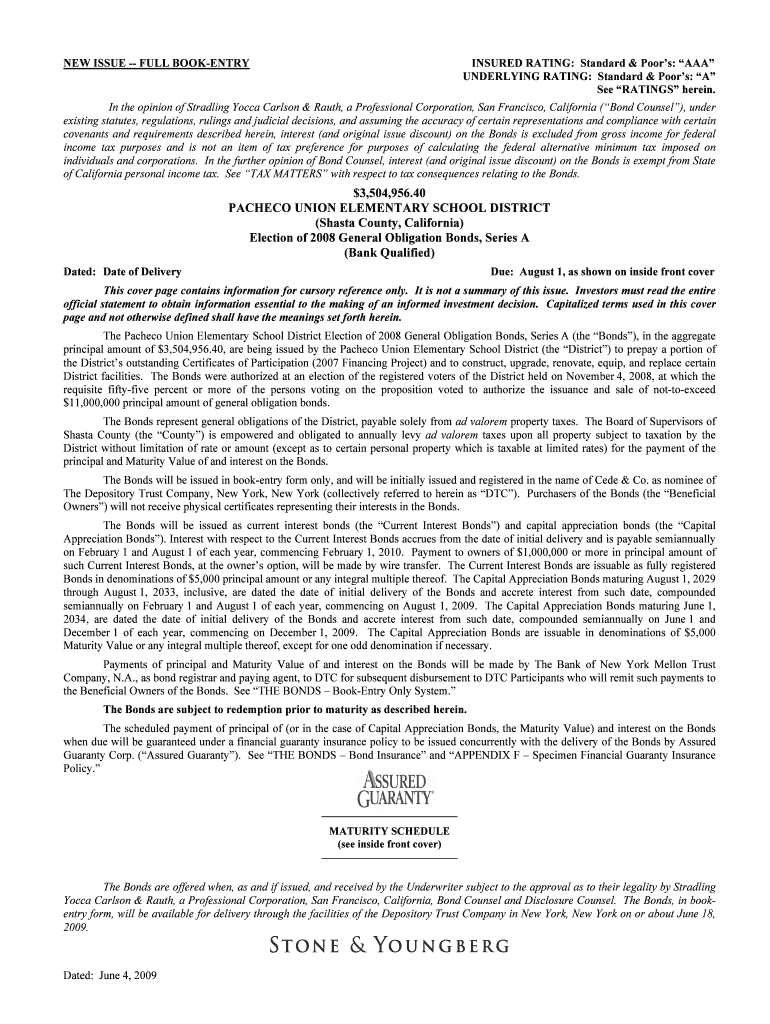

NEW ISSUE FULL BOOKENTRYINSURED RATING: Standard & Poor: AAA UNDERLYING RATING: Standard & Poor: A See RATINGS herein. In the opinion of Straddling Yucca Carlson & Ruth, a Professional Corporation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aa underlying rating standard

Edit your aa underlying rating standard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aa underlying rating standard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aa underlying rating standard online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aa underlying rating standard. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aa underlying rating standard

How to fill out aa underlying rating standard

01

To fill out an underlying rating standard, follow these steps:

02

Start by understanding the purpose of the rating standard. This may involve conducting research or consulting relevant guidelines or manuals.

03

Review the categories or criteria included in the rating standard. Familiarize yourself with the different factors that will be evaluated or measured.

04

Collect the necessary data or information required to assess each category or criteria. This may involve conducting surveys, interviews, or data analysis.

05

Determine the rating scale or system to be used. This could be a numerical scale, a series of options (e.g., low, medium, high), or a qualitative scale.

06

Evaluate each category or criteria based on the collected data and assign a rating or score accordingly.

07

Document the rationale or justification for each rating assigned. This helps to provide transparency and clarity in the rating process.

08

Double-check the completeness and accuracy of the filled-out rating standard before finalizing it.

09

Communicate the results or ratings to the relevant stakeholders, ensuring that they understand the implications and implications of the ratings.

10

Periodically review and update the rating standard to ensure its relevance and effectiveness over time.

11

By following these steps, you can successfully fill out an underlying rating standard.

Who needs aa underlying rating standard?

01

Various entities and organizations may need an underlying rating standard, including:

02

- Regulatory bodies or government agencies: Rating standards can be used to assess the compliance or performance of businesses, industries, or sectors.

03

- Financial institutions: Rating standards help in evaluating the creditworthiness or risk associated with borrowers or financial instruments.

04

- Quality assurance departments: Rating standards assist in measuring and monitoring the quality or performance of products, services, or processes.

05

- Educational institutions: Rating standards aid in assessing the proficiency or competence of students, teachers, or educational programs.

06

- Research organizations: Rating standards facilitate the evaluation or comparison of research studies, methodologies, or outcomes.

07

Overall, any entity involved in evaluating, assessing, or benchmarking various aspects can benefit from having an underlying rating standard.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in aa underlying rating standard?

The editing procedure is simple with pdfFiller. Open your aa underlying rating standard in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit aa underlying rating standard in Chrome?

Install the pdfFiller Google Chrome Extension to edit aa underlying rating standard and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit aa underlying rating standard on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share aa underlying rating standard on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is aa underlying rating standard?

The underlying rating standard is a set of criteria used to assess the creditworthiness of a security or entity.

Who is required to file aa underlying rating standard?

Entities such as financial institutions, investment firms, and publicly traded companies may be required to file an underlying rating standard.

How to fill out aa underlying rating standard?

The underlying rating standard can typically be filled out by providing financial information, credit history, and other relevant data as requested.

What is the purpose of aa underlying rating standard?

The purpose of the underlying rating standard is to help investors evaluate the risk associated with a particular security or entity.

What information must be reported on aa underlying rating standard?

Information such as financial statements, credit ratings, and market data may need to be reported on an underlying rating standard.

Fill out your aa underlying rating standard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aa Underlying Rating Standard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.