Get the free (Solved) - Revenue recognition at a point in time On July 1 ...

Show details

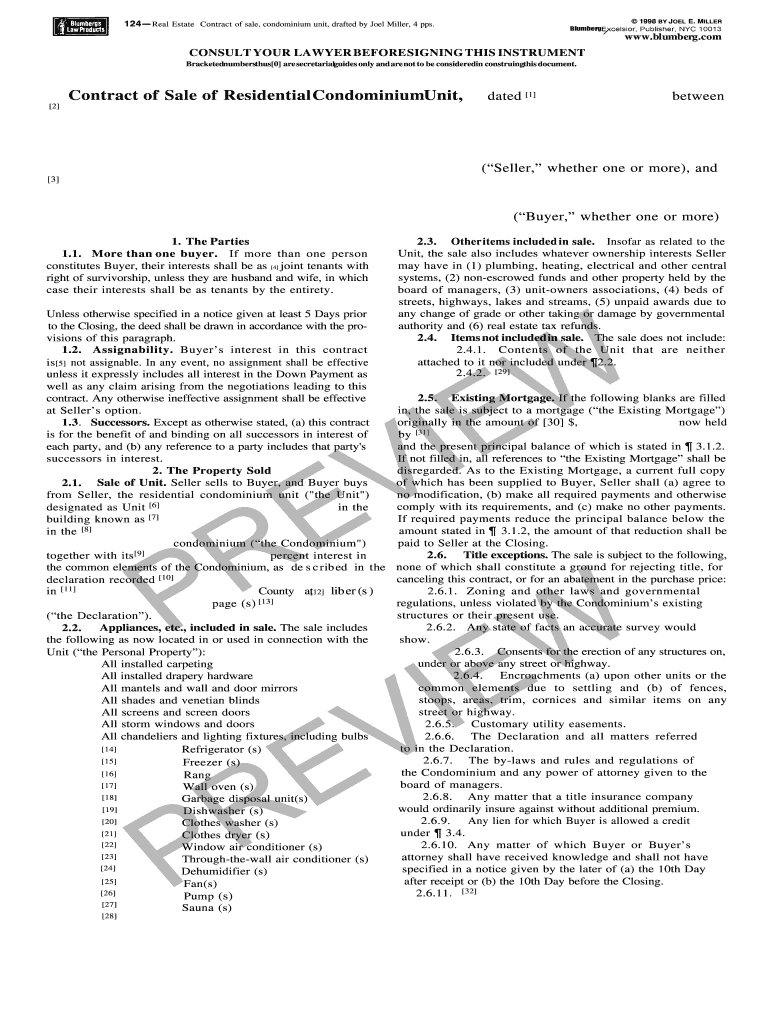

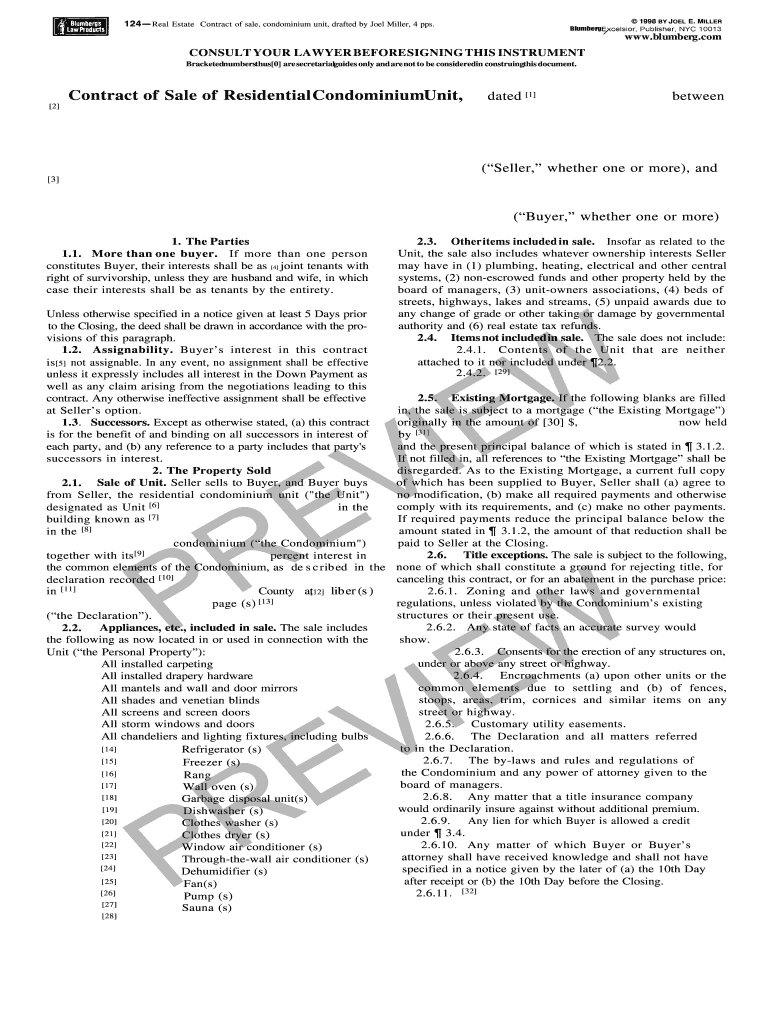

Reset Show Field BordersPurchase Click Here 1998 BY JOEL E. MILLER124 Real Estate Contract of sale, condominium unit, drafted by Joel Miller, 4 PPS.www.blumberg.comCONSULT YOUR LAWYER BEFORE SIGNING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign solved - revenue recognition

Edit your solved - revenue recognition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your solved - revenue recognition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing solved - revenue recognition online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit solved - revenue recognition. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out solved - revenue recognition

How to fill out solved - revenue recognition

01

Start by understanding the basics of revenue recognition. Familiarize yourself with the principles and guidelines set by the Financial Accounting Standards Board (FASB) or the International Financial Reporting Standards (IFRS).

02

Gather all relevant financial information, including sales transactions, contracts, invoices, and any other relevant documents.

03

Analyze each sales transaction to determine the appropriate revenue recognition method to be used. This may include identifying the performance obligations, estimating the transaction price, and allocating the revenue to each obligation.

04

Apply the chosen revenue recognition method to recognize revenue in accordance with the recognized criteria. This may involve recognizing revenue over time or at a specific point in time.

05

Document your revenue recognition process and ensure proper documentation for audits and compliance purposes.

06

Regularly review and update your revenue recognition policies and procedures to ensure compliance with any accounting standard changes or updates.

07

Utilize accounting software or tools that can automate the revenue recognition process and improve accuracy and efficiency.

08

Seek professional advice from a certified public accountant (CPA) or financial advisor to ensure proper adherence to revenue recognition standards and guidelines.

Who needs solved - revenue recognition?

01

Companies across various industries need to understand and implement proper revenue recognition practices. This includes publicly traded companies, private companies, non-profit organizations, and government entities.

02

Financial professionals, such as accountants, auditors, and financial analysts, also require a strong understanding of revenue recognition to accurately analyze and report financial statements.

03

Investors and stakeholders rely on accurate revenue recognition to make informed decisions about the financial health and performance of a company.

04

Regulatory bodies and authorities, such as the Securities and Exchange Commission (SEC), also monitor and enforce proper revenue recognition practices to ensure transparency and prevent financial fraud.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my solved - revenue recognition directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your solved - revenue recognition and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find solved - revenue recognition?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the solved - revenue recognition in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in solved - revenue recognition?

With pdfFiller, it's easy to make changes. Open your solved - revenue recognition in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is solved - revenue recognition?

Revenue recognition refers to the process of recording revenue earned by a company in its financial statements.

Who is required to file solved - revenue recognition?

All companies that follow generally accepted accounting principles (GAAP) are required to file revenue recognition.

How to fill out solved - revenue recognition?

Revenue recognition should be filled out accurately and in accordance with the specific guidelines provided by GAAP.

What is the purpose of solved - revenue recognition?

The purpose of revenue recognition is to accurately depict the financial performance of a company by recording revenue when it is earned.

What information must be reported on solved - revenue recognition?

Information such as total revenue earned, specific revenue sources, and any adjustments or allowances must be reported on revenue recognition.

Fill out your solved - revenue recognition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Solved - Revenue Recognition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.