Get the free USA Patriot Act ComplianceCherokee State Bank

Show details

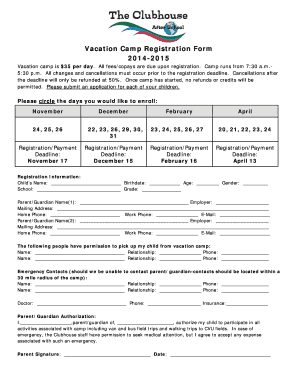

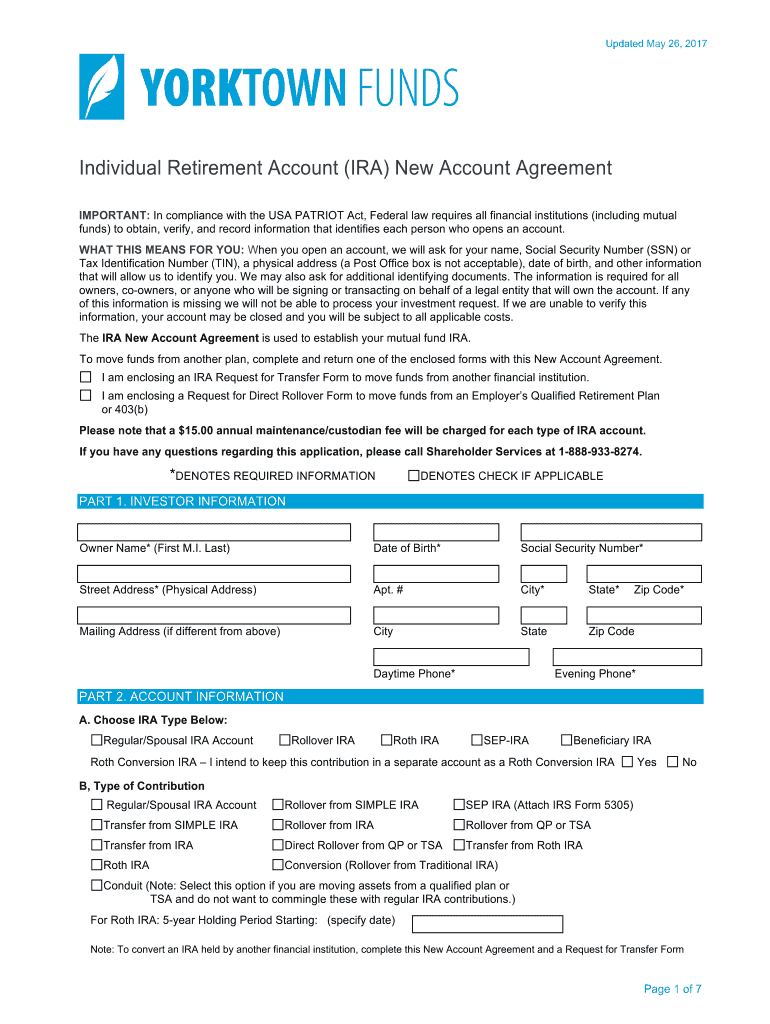

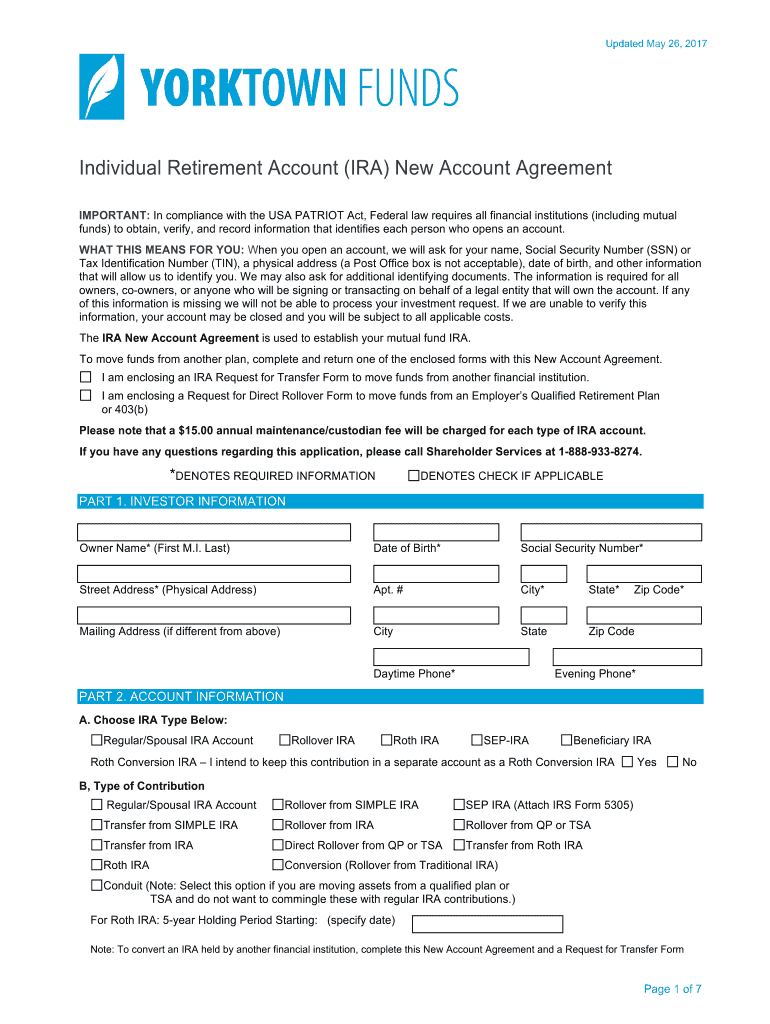

Updated May 26, 2017Individual Retirement Account (IRA) New Account Agreement

IMPORTANT: In compliance with the USA PATRIOT Act, Federal law requires all financial institutions (including mutual

funds)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usa patriot act compliancecherokee

Edit your usa patriot act compliancecherokee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usa patriot act compliancecherokee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usa patriot act compliancecherokee online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit usa patriot act compliancecherokee. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

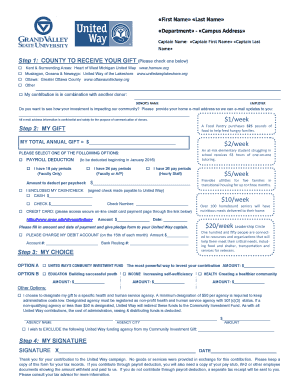

How to fill out usa patriot act compliancecherokee

How to fill out usa patriot act compliancecherokee

01

To fill out the USA Patriot Act Compliance form, follow these steps:

02

Begin by gathering all the necessary information, such as the entity's name, address, and ownership details.

03

Determine the entity's legal structure (e.g., corporation, partnership, sole proprietorship).

04

Provide documentation to verify the entity's formation and legal status.

05

Identify the beneficial owners of the entity, including any individuals who own or control 25% or more of the entity's equity or voting rights.

06

Obtain the required identification information for each beneficial owner, such as their name, address, date of birth, and Social Security Number (SSN).

07

Verify the identity of each beneficial owner through reliable and independent documentation, such as a government-issued ID or passport.

08

Complete the compliance form accurately and thoroughly, making sure to provide all required information.

09

Submit the completed form to the appropriate institution or authority as specified in the instructions.

10

Keep a copy of the filled-out form for your own records and ensure it is stored securely.

11

Update the compliance form whenever there are changes in the entity's ownership or beneficial owners.

Who needs usa patriot act compliancecherokee?

01

Various entities and individuals may require USA Patriot Act Compliance, including:

02

- Financial institutions such as banks, credit unions, and money service businesses.

03

- Securities brokers and dealers.

04

- Insurance companies.

05

- Mortgage companies.

06

- Casinos and other gaming establishments.

07

- Precious metal dealers and jewelers.

08

- Real estate agents and brokers.

09

- Travel agencies.

10

- Private investment firms.

11

- Non-profit organizations engaged in certain financial activities.

12

- Any entity or individual involved in transactions that may involve money laundering or terrorist financing.

13

It is important to consult the specific regulations and guidelines provided by the relevant authorities to determine if your entity falls under the scope of USA Patriot Act Compliance requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit usa patriot act compliancecherokee online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your usa patriot act compliancecherokee to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the usa patriot act compliancecherokee in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your usa patriot act compliancecherokee in minutes.

How can I fill out usa patriot act compliancecherokee on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your usa patriot act compliancecherokee from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is usa patriot act compliance?

The USA PATRIOT Act is a federal law that requires financial institutions to create and implement an anti-money laundering program to prevent and detect money laundering activities.

Who is required to file usa patriot act compliance?

All financial institutions, including banks, credit unions, and other entities that deal with money transfers and financial transactions, are required to file USA PATRIOT Act compliance.

How to fill out usa patriot act compliance?

To fill out USA PATRIOT Act compliance, financial institutions must conduct customer due diligence, monitor transactions for suspicious activities, report suspicious activities to the authorities, and maintain proper records.

What is the purpose of usa patriot act compliance?

The purpose of USA PATRIOT Act compliance is to prevent and detect money laundering, terrorist financing, and other financial crimes by ensuring that financial institutions have adequate controls in place.

What information must be reported on usa patriot act compliance?

Financial institutions must report information about customer transactions, suspicious activities, and any other relevant information that may indicate money laundering or terrorist financing.

Fill out your usa patriot act compliancecherokee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usa Patriot Act Compliancecherokee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.