Get the free Occurrence vs. Claims-Made Insurance: Why It Matters ...

Show details

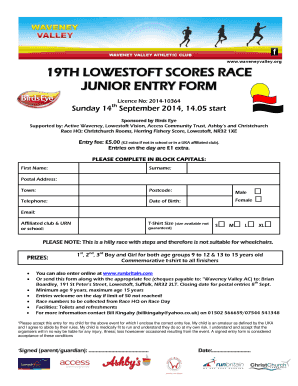

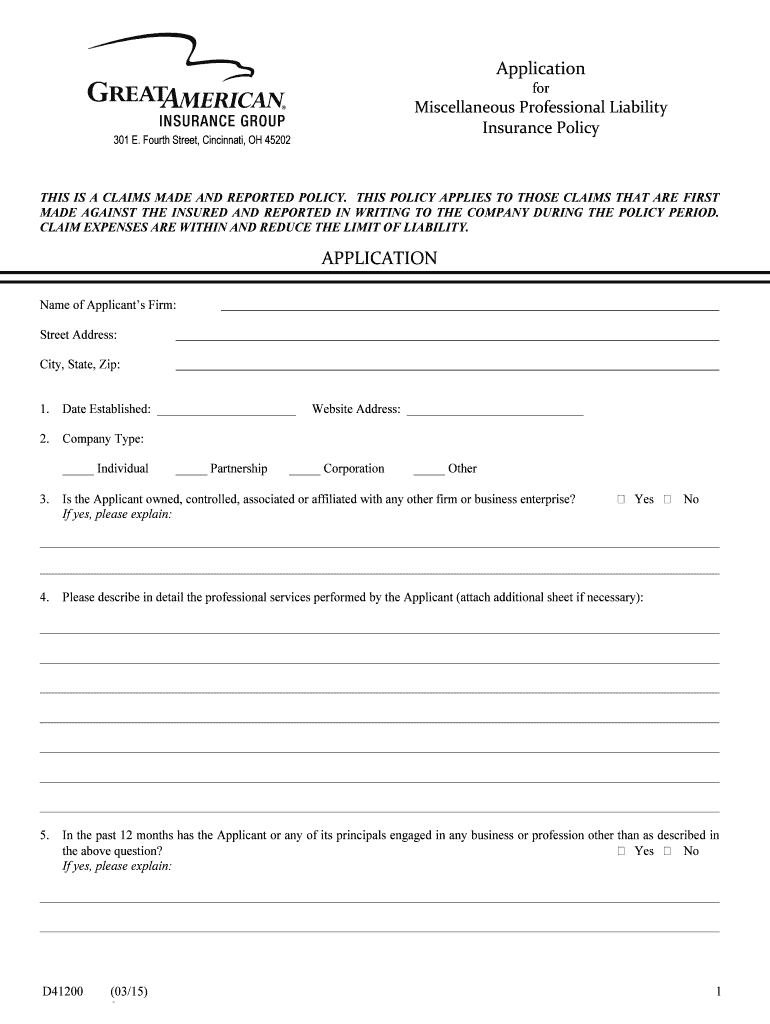

Application miscellaneous Professional Liability Insurance Policy301 E. Fourth Street, Cincinnati, OH 45202THIS IS A CLAIMS MADE AND REPORTED POLICY. THIS POLICY APPLIES TO THOSE CLAIMS THAT ARE FIRST

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occurrence vs claims-made insurance

Edit your occurrence vs claims-made insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occurrence vs claims-made insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occurrence vs claims-made insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit occurrence vs claims-made insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occurrence vs claims-made insurance

How to fill out occurrence vs claims-made insurance

01

Understand the difference between occurrence and claims-made insurance. Occurrence insurance covers claims that arise from an incident that occurred during the policy period, regardless of when the claim is made. Claims-made insurance covers claims that are reported to the insurance carrier during the policy period.

02

Determine the type of insurance coverage you need based on your specific circumstances. Occurrence insurance may be preferable if you want coverage for incidents that occurred in the past but were only discovered later. Claims-made insurance may be more suitable if you want coverage for claims that are reported during the current policy period.

03

Research and compare different insurance providers and policies. Look for reputable insurance companies that offer occurrence and claims-made insurance options. Evaluate the coverage limits, premiums, and any exclusions or conditions associated with each policy.

04

Understand the policy terms and conditions before making a decision. Read the policy documents thoroughly to ensure you understand the coverage provided, the reporting requirements for claims, and any limitations or exclusions that may apply.

05

Consult with an insurance agent or professional for advice. They can help you assess your insurance needs and guide you in choosing the most suitable type of insurance for your specific situation.

06

Complete the application process. Provide all the necessary information requested by the insurance provider accurately and honestly. Fill out the application form, disclosing any relevant details about your business or personal circumstances.

07

Review the policy documents and make sure you have a clear understanding of the coverage provided, including any limits or exclusions.

08

Pay the premium as required by the insurance provider. Ensure that you meet all payment deadlines to maintain the coverage.

09

Keep records of all correspondence with the insurance company, including policy documents, claims made, and any other relevant documentation.

10

Regularly review your insurance coverage and reassess your needs to ensure you have adequate protection.

Who needs occurrence vs claims-made insurance?

01

Different individuals or businesses may have different needs for occurrence vs claims-made insurance. Here are some examples of who may benefit from each type:

02

Occurrence insurance may be suitable for businesses that want coverage for incidents that occurred in the past but were not immediately discovered or reported. This could include industries with long-tail liability risks, such as construction, healthcare, or manufacturing.

03

Claims-made insurance may be preferred by individuals or businesses that want coverage specifically for claims reported during the current policy period. This could be beneficial for professionals such as doctors, lawyers, or consultants who face potential liability claims based on their professional services.

04

It is important to assess your specific circumstances and consult with an insurance professional to determine which type of insurance coverage is most suitable for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify occurrence vs claims-made insurance without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including occurrence vs claims-made insurance, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send occurrence vs claims-made insurance for eSignature?

When your occurrence vs claims-made insurance is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit occurrence vs claims-made insurance online?

The editing procedure is simple with pdfFiller. Open your occurrence vs claims-made insurance in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is occurrence vs claims-made insurance?

Occurrence insurance covers claims that occur during the policy period, regardless of when the claim is reported. Claims-made insurance covers claims only if they are reported while the policy is in effect.

Who is required to file occurrence vs claims-made insurance?

Individuals or businesses purchasing insurance coverage may be required to choose between occurrence and claims-made policies based on their needs and preferences.

How to fill out occurrence vs claims-made insurance?

To fill out occurrence vs claims-made insurance, individuals or businesses must carefully review the policy terms and choose the option that best suits their needs.

What is the purpose of occurrence vs claims-made insurance?

The purpose of occurrence vs claims-made insurance is to provide coverage for potential liabilities and claims that may arise during the policy period.

What information must be reported on occurrence vs claims-made insurance?

Information such as the nature of the claim, the date it occurred, and any relevant documentation must be reported on both occurrence and claims-made insurance policies.

Fill out your occurrence vs claims-made insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occurrence Vs Claims-Made Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.