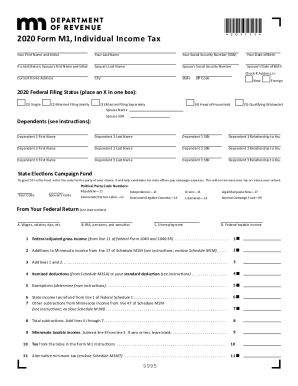

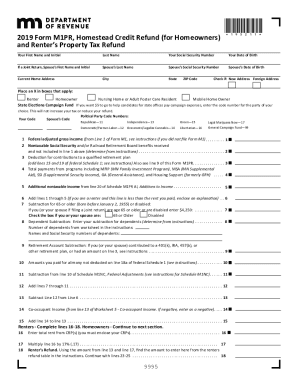

MN DoR M1 2019 free printable template

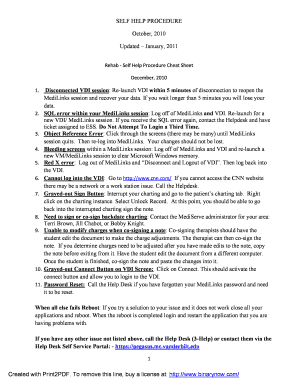

Instructions and Help about MN DoR M1

How to edit MN DoR M1

How to fill out MN DoR M1

About MN DoR M1 2019 previous version

What is MN DoR M1?

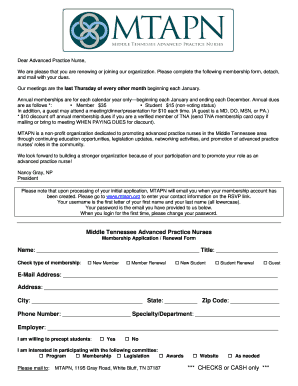

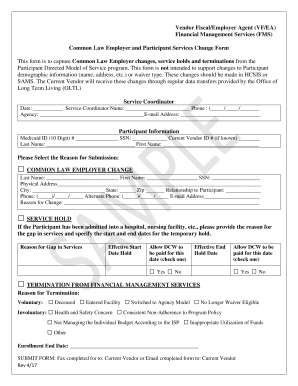

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MN DoR M1

What should I do if I need to correct an error on my MN DoR M1 after it's been submitted?

If you discover an error on your MN DoR M1 after it has been submitted, you should file an amended version of the form. Ensure that you clearly indicate that it is a corrected submission to avoid any confusion. Keep a copy of both the original and amended forms for your records.

How can I track the status of my submitted MN DoR M1?

To track the status of your MN DoR M1, you can utilize the state's online tracking system or contact the Minnesota Department of Revenue directly. If you filed electronically, confirm your submission was accepted to prevent any delays in processing.

What should I know about e-signatures when filing the MN DoR M1?

When submitting your MN DoR M1 electronically, e-signatures are accepted as per Minnesota rules. Ensure that your e-signature complies with the required verification processes to avoid processing issues with your submission.

What are common reasons for rejection when e-filing the MN DoR M1?

Common reasons for e-filing rejection of your MN DoR M1 include mismatched information such as Social Security numbers or taxpayer names. Ensure all details match your official documents, and recheck for any additional error codes provided during the e-filing process.

What documentation should I prepare if I receive a notice regarding my MN DoR M1?

If you receive a notice regarding your MN DoR M1, gather all related documents, including copies of the submitted form, correspondence from the Minnesota Department of Revenue, and any supporting records. This will help you respond accurately and efficiently to the notice.

See what our users say