Get the free Tax Increment Financing in North Carolina: Great ...

Show details

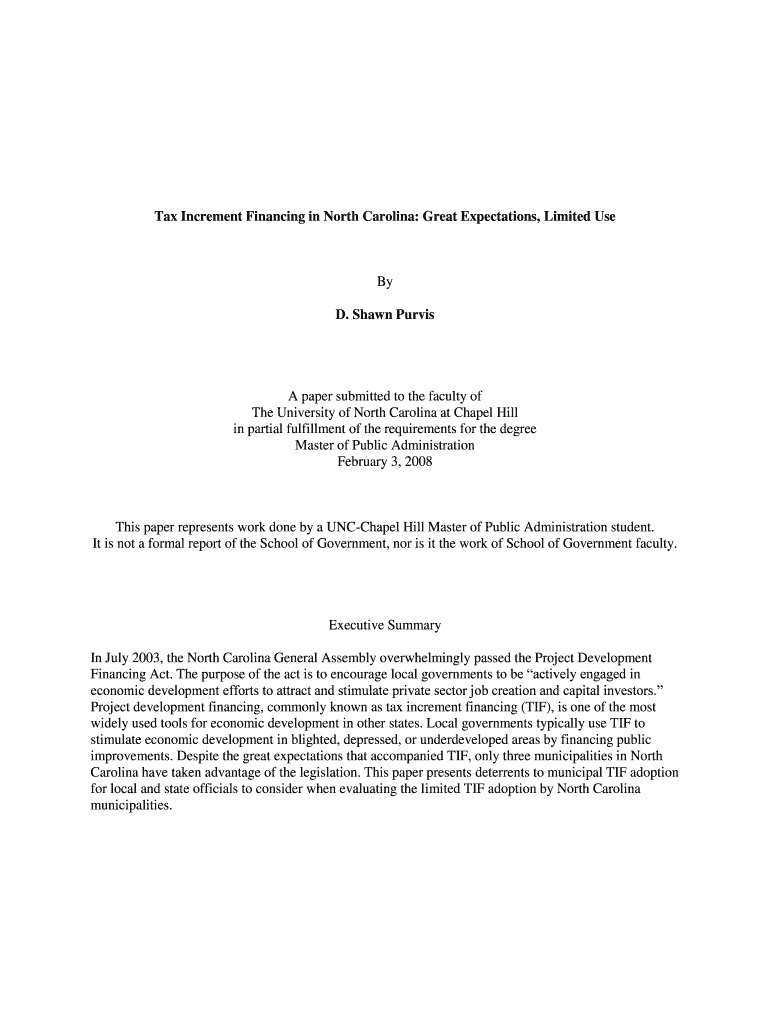

Tax Increment Financing in North Carolina: Great Expectations, Limited Used

D. Shawn Purview paper submitted to the faculty of

The University of North Carolina at Chapel Hill

in partial fulfillment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing in

Edit your tax increment financing in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing in online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment financing in. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing in

How to fill out tax increment financing in

01

To fill out tax increment financing (TIF), follow these steps:

02

Gather all necessary documents such as financial statements, tax returns, and property records.

03

Determine if your project qualifies for TIF. This usually involves meeting certain criteria such as being located in a designated TIF district and demonstrating a need for financial assistance.

04

Contact the local government agency responsible for administering TIF in your area. They will provide you with the necessary forms and guidance on how to fill them out.

05

Complete the TIF application form, providing accurate and detailed information about your project, including its scope, timeline, and expected benefits.

06

Attach all required supporting documents to your application, such as architectural plans, cost estimates, and market studies.

07

Submit your completed application and supporting documents to the local government agency.

08

Wait for the agency to review your application. They may require additional information or clarification before making a decision.

09

Once your application is approved, you will enter into a TIF agreement with the local government agency. This agreement outlines the terms and conditions for receiving TIF funds.

10

Fulfill your obligations as outlined in the TIF agreement, such as completing the project within the agreed timeline and providing regular progress reports.

11

Receive TIF funds as they become available, typically in the form of reimbursements for eligible project expenses.

12

Maintain accurate records of all TIF-related activities, expenses, and revenues for reporting purposes.

13

Periodically evaluate the impact of the TIF program on your project and the surrounding community, and make any necessary adjustments or improvements.

14

By following these steps, you can successfully fill out tax increment financing and potentially receive the financial assistance you need for your project.

Who needs tax increment financing in?

01

Tax increment financing can be beneficial for various entities, including:

02

- Local governments: TIF can help municipalities stimulate economic development, revitalize blighted areas, and attract private investment. It allows them to fund infrastructure improvements and public facilities without relying solely on tax revenues.

03

- Developers: TIF can provide developers with the financial support needed to undertake large-scale projects that may have otherwise been economically unviable. It can help cover costs such as land acquisition, site preparation, and infrastructure upgrades.

04

- Businesses: TIF can incentivize businesses to establish or expand their operations in designated areas by offering financial assistance for things like building renovations, equipment purchases, and employee training.

05

- Non-profit organizations: TIF can assist non-profit organizations in funding community development initiatives, such as affordable housing projects or the construction of community centers.

06

Overall, tax increment financing is a tool that can benefit a wide range of stakeholders by promoting economic growth, job creation, and community improvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax increment financing in in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your tax increment financing in along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find tax increment financing in?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tax increment financing in in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete tax increment financing in online?

Easy online tax increment financing in completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is tax increment financing in?

Tax increment financing is a public financing method used as a subsidy for redevelopment, infrastructure, and other community-improvement projects.

Who is required to file tax increment financing in?

Property owners, developers, and local government entities are typically required to file tax increment financing.

How to fill out tax increment financing in?

Tax increment financing forms can typically be filled out online or submitted manually to the local government entity overseeing the project.

What is the purpose of tax increment financing in?

The purpose of tax increment financing is to stimulate economic development and investment in blighted or underdeveloped areas.

What information must be reported on tax increment financing in?

Information such as the assessed value of properties in the TIF district, projected tax revenues, and planned use of funds must be reported on tax increment financing forms.

Fill out your tax increment financing in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.