Get the free Appeal my tax value - Wake County Government

Show details

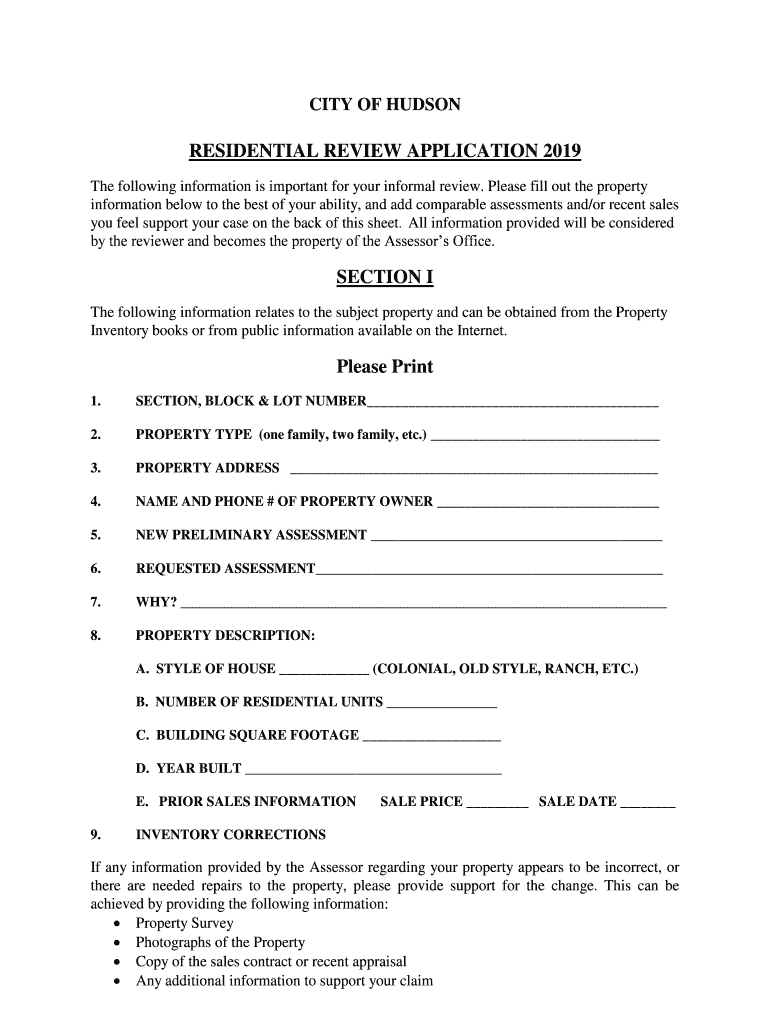

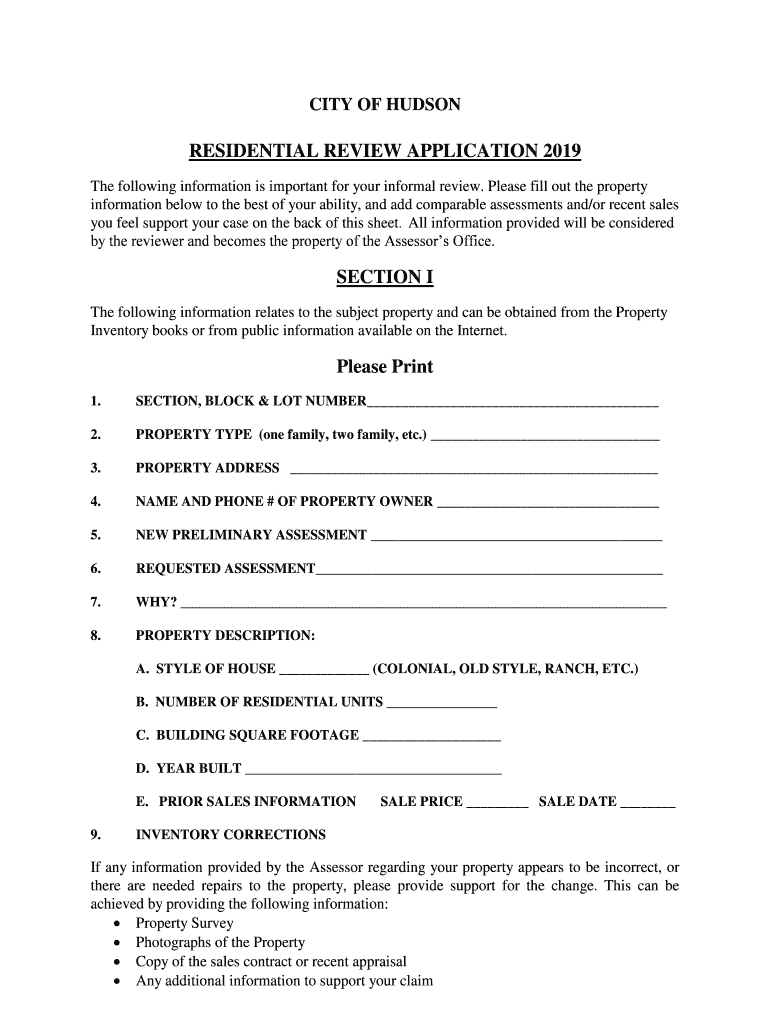

CITY OF HUDSONRESIDENTIAL REVIEW APPLICATION 2019

The following information is important for your informal review. Please fill out the property

information below to the best of your ability, and add

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appeal my tax value

Edit your appeal my tax value form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appeal my tax value form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit appeal my tax value online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appeal my tax value. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appeal my tax value

How to fill out appeal my tax value

01

Gather all the necessary documents, such as the tax assessment notice, property records, and any supporting documentation related to your case.

02

Carefully review your tax assessment notice to ensure that all the information, such as property size, value, and any exemptions, is accurate. Note any discrepancies or errors.

03

Research the local tax laws and regulations to understand the process and requirements for filing an appeal. Check the deadline for submitting your appeal and any specific forms or documentation that may be required.

04

Prepare a written statement explaining the reasons for your appeal. Clearly state the issues you have identified with the tax assessment, provide any evidence or supporting documentation to support your claim, and explain why you believe the value should be adjusted.

05

Complete the necessary appeal forms, if applicable, and attach your written statement and supporting documentation. Make sure to follow any specific formatting or submission instructions provided by the local tax authority.

06

Submit your appeal by the specified deadline. Consider sending it via certified mail or keeping a copy of the submission for your records.

07

Await a response from the tax authority. They may request additional information or schedule a hearing to further review your case.

08

If your appeal is successful, you will receive a revised tax assessment reflecting the adjusted value. If it is not successful, you may need to explore further options, such as mediation or legal representation.

Who needs appeal my tax value?

01

Anyone who believes that their tax assessment value is incorrect or unfairly determined may need to appeal their tax value. This includes property owners who feel their property is overvalued or those who believe they qualify for certain exemptions or deductions that were not properly considered in the assessment. It is important to review your tax assessment notice and assess whether the value accurately reflects the property's market value or meets the requirements for special exemptions or reductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send appeal my tax value to be eSigned by others?

Once your appeal my tax value is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get appeal my tax value?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the appeal my tax value. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the appeal my tax value form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign appeal my tax value and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is appeal my tax value?

Appealing your tax value is the process of requesting a reevaluation of the assessed value of your property for tax purposes.

Who is required to file appeal my tax value?

Property owners who believe their assessed value is too high and want to lower their property taxes are required to file an appeal of their tax value.

How to fill out appeal my tax value?

To fill out an appeal of your tax value, you will need to provide information about your property, comparable sales data, and any other relevant documentation to support your case.

What is the purpose of appeal my tax value?

The purpose of appealing your tax value is to potentially lower your property taxes by demonstrating that the assessed value is inaccurate or unjust.

What information must be reported on appeal my tax value?

On your appeal of tax value, you should report details about your property, any recent improvements, and comparable sales data to support your claim.

Fill out your appeal my tax value online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appeal My Tax Value is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.