Get the free INSURANCE LEVELS IN

Show details

VIRGINIA SOIL AND WATER CONSERVATION BOARD GUIDANCE DOCUMENT ON THE DETERMINATION OF INSURANCE LEVELS IN ACCORDANCE WITH 10.1605 OF THE CODE OF VIRGINIA (Approved September 7, 2016) Summary: This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance levels in

Edit your insurance levels in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance levels in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance levels in online

To use the professional PDF editor, follow these steps:

1

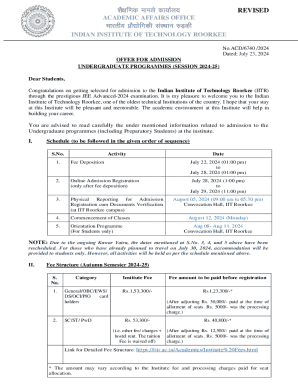

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance levels in. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance levels in

How to fill out insurance levels in

01

To fill out insurance levels, follow these steps:

02

Understand the types of insurance levels: Insurance levels typically refer to the amount of coverage provided by an insurance policy. The most common insurance levels include basic, standard, and comprehensive coverage.

03

Assess your needs: Determine the level of coverage you require based on your individual circumstances. Consider factors like your financial situation, the value of the item you're insuring, and the potential risks involved.

04

Research insurance companies: Look for reputable insurance companies that offer the types of insurance you need with different coverage levels.

05

Compare quotes: Get quotes from multiple insurance companies to compare premiums and coverage levels.

06

Select the appropriate level: Choose the insurance level that best suits your needs and budget. Ensure that the coverage provided aligns with your requirements.

07

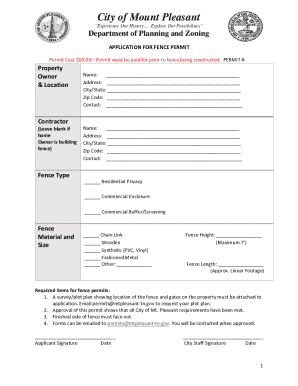

Fill out the application: Complete the insurance application form with accurate information. Provide details about the insurance levels you've selected, including any additional coverage options you may require.

08

Review the policy: Carefully review the policy document to ensure that the insurance levels and coverage details are correctly stated. Seek clarification from the insurance company if anything is unclear.

09

Make payment: Pay the premium amount as specified by the insurance company to activate your policy.

10

Keep records: Maintain copies of your insurance policy documents, receipts, and any communication with the insurance company for future reference.

11

Periodic review: Regularly reassess your insurance needs and adjust your insurance levels accordingly. Update your policy if necessary to ensure adequate coverage.

Who needs insurance levels in?

01

Insurance levels are needed by anyone who wants to protect their assets, reduce financial risks, and have a safety net in case of unexpected events. Some specific individuals who may need insurance levels include:

02

- Homeowners: Home insurance levels help protect your property against damage or loss caused by fire, theft, natural disasters, and other covered perils.

03

- Vehicle owners: Auto insurance levels are required by law in most places and provide coverage for accidents, theft, and damages to your vehicle or third-party property.

04

- Business owners: Business insurance levels safeguard against potential liabilities, property damage, legal claims, and other risks associated with running a business.

05

- Renters: Renters insurance levels protect your personal belongings, provide liability coverage, and offer additional living expenses in case of a covered event that renders your rented property uninhabitable.

06

- Individuals with valuable assets: Insurance levels are crucial for protecting valuable assets like jewelry, artwork, expensive electronics, or collectibles.

07

- Families: Life insurance levels provide financial protection for dependents in the event of the policyholder's death.

08

- Health-conscious individuals: Health insurance levels ensure access to quality healthcare and help cover medical expenses, preventive care, prescription drugs, and hospitalization costs.

09

- Travelers: Travel insurance levels offer financial protection against trip cancellation, lost baggage, medical emergencies, and other travel-related risks.

10

These are just a few examples, but insurance levels can benefit anyone looking to mitigate financial risks and protect their assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit insurance levels in on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing insurance levels in, you can start right away.

How do I fill out insurance levels in using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign insurance levels in and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit insurance levels in on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share insurance levels in from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is insurance levels in?

Insurance levels refer to the coverage amounts and details specified in an insurance policy.

Who is required to file insurance levels in?

Insurance levels must be filed by policyholders or insured individuals.

How to fill out insurance levels in?

Insurance levels can be filled out by providing detailed information about the coverage amounts and policy details.

What is the purpose of insurance levels in?

The purpose of insurance levels is to define the extent of coverage provided by an insurance policy.

What information must be reported on insurance levels in?

Information such as coverage amounts, policy details, and related terms and conditions must be reported on insurance levels.

Fill out your insurance levels in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Levels In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.