Get the free Voter-Approval Tax Rate Election Ballot for School Districts

Show details

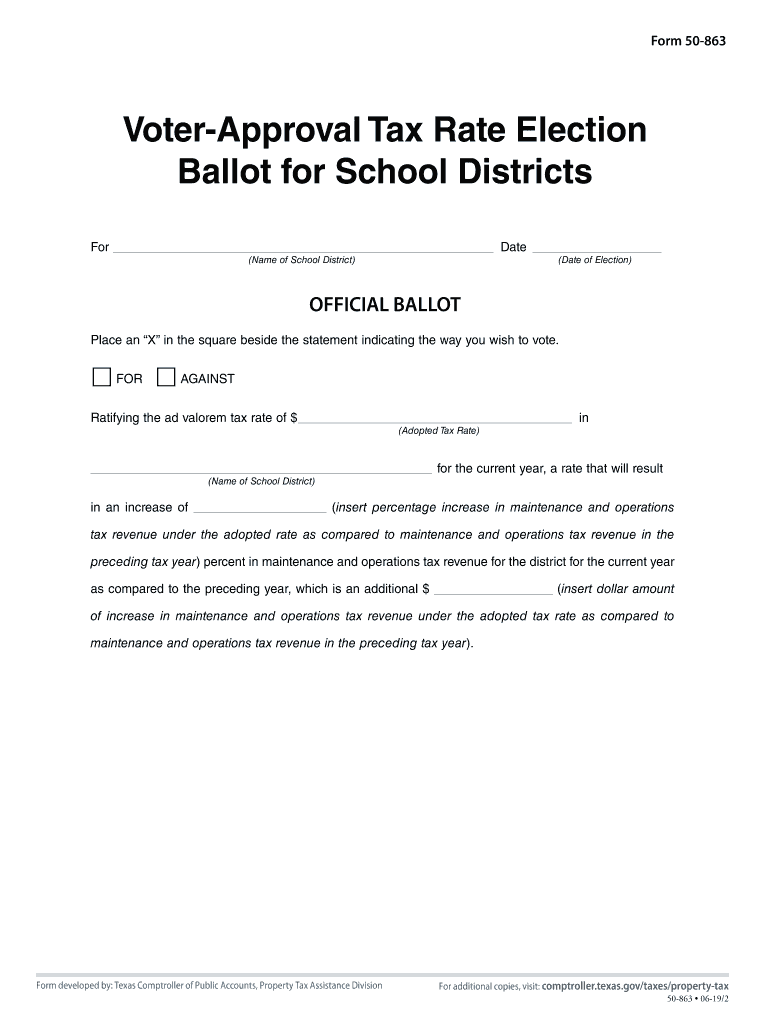

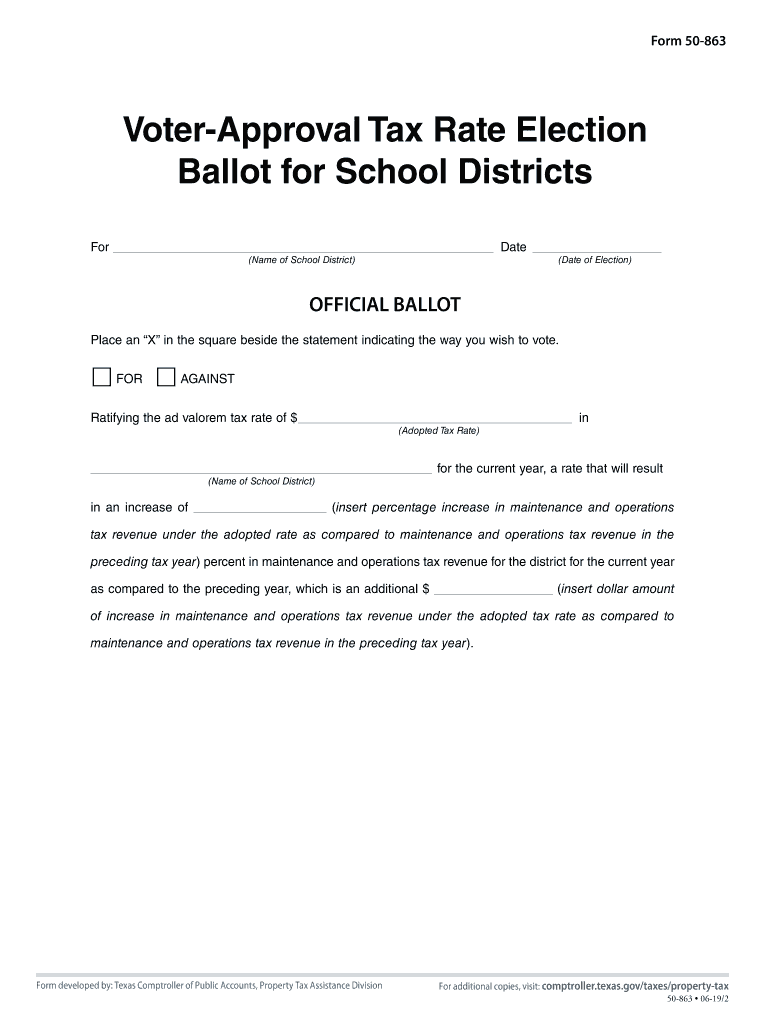

Form 50863VoterApproval Tax Rate Election Ballot for School Districts For Date (Name of School District)(Date of Election)OFFICIAL BALLOT Place an X in the square beside the statement indicating the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voter-approval tax rate election

Edit your voter-approval tax rate election form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voter-approval tax rate election form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voter-approval tax rate election online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit voter-approval tax rate election. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voter-approval tax rate election

How to fill out voter-approval tax rate election

01

Obtain the necessary forms for the voter-approval tax rate election from your local election office.

02

Familiarize yourself with the specific instructions and requirements for filling out the forms.

03

Begin by providing the requested information about the entity or organization proposing the tax rate.

04

Clearly state the purpose for which the tax rate is being proposed.

05

Indicate the current tax rate and the proposed tax rate, along with the reasoning for the proposed change.

06

Attach any supporting documentation or evidence to substantiate the need for the proposed tax rate.

07

Ensure that all required signatures, certifications, and notarizations are obtained and properly recorded.

08

Review the completed forms to ensure accuracy and compliance with all applicable regulations.

09

Submit the filled-out forms to the designated election office within the specified deadline.

10

Await further instructions or notifications regarding the voter-approval tax rate election.

Who needs voter-approval tax rate election?

01

A voter-approval tax rate election is needed by entities or organizations that wish to propose a change in the tax rate imposed on a particular area or jurisdiction.

02

This can include local government bodies, school districts, or other entities responsible for managing and allocating tax revenues.

03

The purpose of such an election is to allow the affected residents or taxpayers to have a say in whether the proposed tax rate should be implemented or rejected.

04

Ultimately, it is the public's approval or disapproval that determines whether the proposed tax rate becomes law, ensuring democratic decision-making in matters of taxation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send voter-approval tax rate election to be eSigned by others?

When you're ready to share your voter-approval tax rate election, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete voter-approval tax rate election on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your voter-approval tax rate election. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete voter-approval tax rate election on an Android device?

On Android, use the pdfFiller mobile app to finish your voter-approval tax rate election. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is voter-approval tax rate election?

A voter-approval tax rate election is a process that allows voters to approve or disapprove a proposed tax rate increase by a taxing entity.

Who is required to file voter-approval tax rate election?

A taxing entity such as a school district, municipality, or county is required to file a voter-approval tax rate election if they plan to increase their tax rate above a certain threshold.

How to fill out voter-approval tax rate election?

To fill out a voter-approval tax rate election, the taxing entity must provide information on the proposed tax rate increase, the reason for the increase, and the impact on taxpayers.

What is the purpose of voter-approval tax rate election?

The purpose of a voter-approval tax rate election is to give taxpayers a say in whether or not a taxing entity can increase their tax rate.

What information must be reported on voter-approval tax rate election?

The voter-approval tax rate election must include information on the proposed tax rate increase, the reason for the increase, and the impact on taxpayers.

Fill out your voter-approval tax rate election online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voter-Approval Tax Rate Election is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.