Get the free Know how much insurance cover you need - The Economic Times

Show details

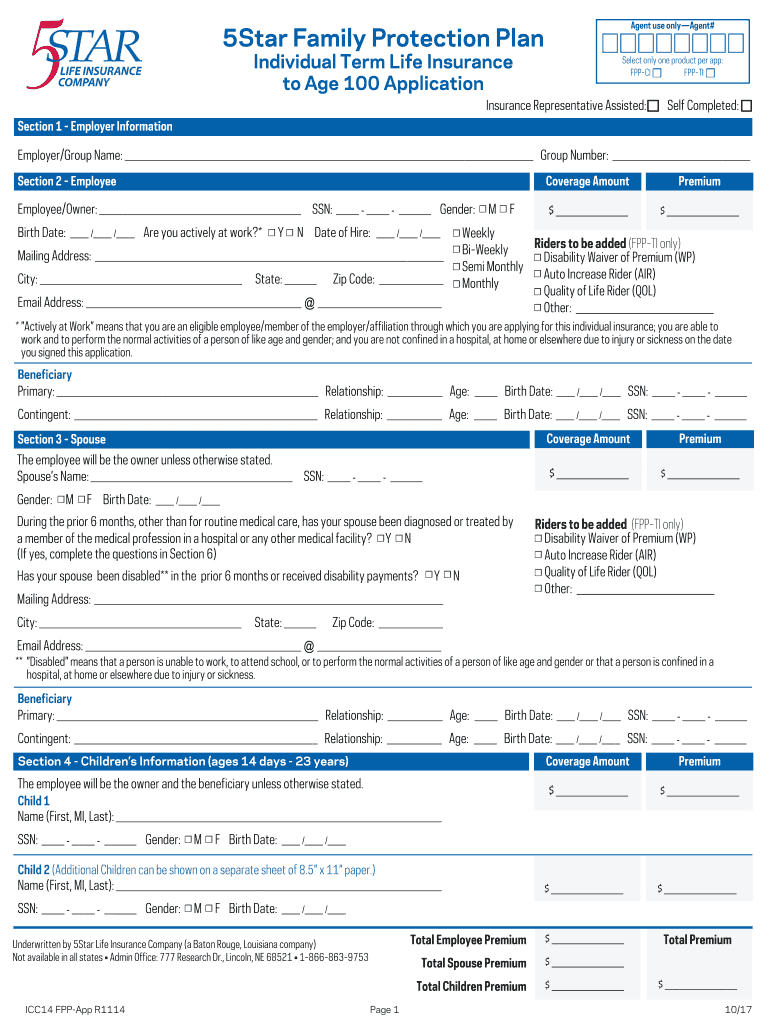

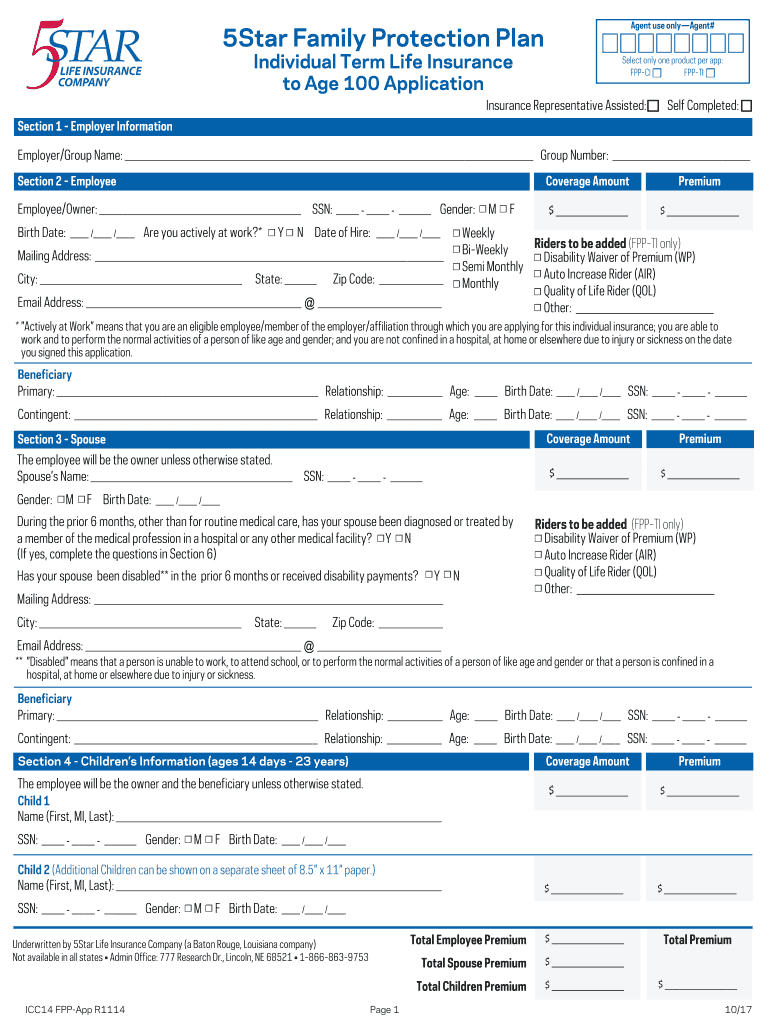

Agent use onlyAgent#5Star Family Protection Plan Individual Term Life Insurance to Age 100 Application Select only one product per app: FP PCI FPPTIInsurance Representative Assisted:Self Completed:Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign know how much insurance

Edit your know how much insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your know how much insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing know how much insurance online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit know how much insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out know how much insurance

How to fill out know how much insurance

01

Gather all the necessary information about your assets and liabilities, including your home, vehicles, personal belongings, and any outstanding debts or loans.

02

Calculate the total value of your assets by adding the estimated cost of each item. This may require some research or professional appraisal for certain items.

03

Determine the appropriate coverage types for each asset based on their value and level of risk. For example, you may need higher coverage for expensive jewelry or a comprehensive auto insurance policy for a luxury vehicle.

04

Research and compare insurance providers to find the best policies and rates. Consider factors such as customer reviews, financial stability, and the claims process.

05

Contact the chosen insurance provider and request a quote based on the coverage types and values you determined earlier. Provide all the necessary information accurately to get an accurate quote.

06

Evaluate the quotes received and choose the insurance policy that offers the right balance of coverage and affordability for your needs.

07

Fill out the insurance application form provided by the insurance provider. Provide all the requested information truthfully and accurately.

08

Review the filled-out form carefully before submitting it. Make sure all details are correct and nothing is missing.

09

Pay the required premium amount to activate your insurance policy. This can usually be done online or through various payment methods accepted by the insurance provider.

10

Keep a copy of the filled-out form, receipts of premium payments, and any other relevant documents for future reference and claims.

Who needs know how much insurance?

01

Anyone who owns valuable assets or has financial liabilities may need to know how much insurance to have.

02

Homeowners: Knowing how much insurance to have is crucial for homeowners to protect their property and belongings against damage or loss due to various risks like fire, theft, or natural disasters.

03

Vehicle Owners: Having the right amount of auto insurance coverage is necessary for vehicle owners to be financially protected in case of accidents, theft, or damages to their vehicle.

04

Business Owners: Entrepreneurs and business owners need to evaluate their business assets, liabilities, and potential risks to determine the adequate level of commercial insurance coverage.

05

Renters: While not owning a home, renters can still benefit from renter's insurance to cover their personal belongings against theft or damage caused by fire, water or vandalism.

06

Individuals with Debts: People with outstanding debts, such as mortgages, loans, or credit card balances, should consider having enough insurance to cover those liabilities in case of unexpected events that may cause difficulty in repayment.

07

Families: Families with dependents should ensure they have enough life insurance coverage to provide financial support and protection for their loved ones in case of an untimely death.

08

Entrepreneurs: Individuals starting a new venture should assess the potential risks associated with their business and obtain adequate insurance to safeguard against any unforeseen events or accidents.

09

High-Net-Worth Individuals: People with substantial assets and wealth should have comprehensive insurance coverage to protect their valuable possessions and investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify know how much insurance without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your know how much insurance into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send know how much insurance for eSignature?

To distribute your know how much insurance, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in know how much insurance?

The editing procedure is simple with pdfFiller. Open your know how much insurance in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is know how much insurance?

Know how much insurance refers to the amount of coverage an individual or entity has to protect themselves or their assets in case of a financial loss.

Who is required to file know how much insurance?

Anyone who owns property or assets that need to be protected should have know how much insurance. It is usually a requirement for individuals or businesses with loans or mortgages.

How to fill out know how much insurance?

Filling out know how much insurance involves calculating the value of assets or property that need to be covered, determining the level of coverage needed, and selecting a suitable insurance policy.

What is the purpose of know how much insurance?

The purpose of know how much insurance is to provide financial protection in case of unexpected events, such as accidents, natural disasters, or theft.

What information must be reported on know how much insurance?

Information such as the value of assets, the level of coverage, the insurance policy details, and any relevant personal or business information must be reported on know how much insurance forms.

Fill out your know how much insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Know How Much Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.