Get the free 4 Audited 9/20/11 + 2/20/12 FTE Enrollment (Not weighted enrollment and excludes 4 y...

Show details

16 Sep 2013 ... Unified School District 402, Augusta Public Schools, is located in Butler County ... The audited FTE enrollment for 2012-13 .... state aid for the district×39’s Local Option Budget

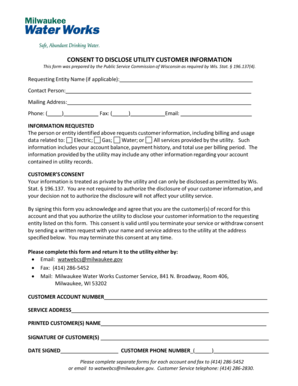

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 4 audited 92011 22012

Edit your 4 audited 92011 22012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 4 audited 92011 22012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 4 audited 92011 22012 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 4 audited 92011 22012. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 4 audited 92011 22012

How to fill out 4 audited 92011 22012:

01

Start by gathering all the necessary financial documents for the audited period, including income statements, balance sheets, and cash flow statements.

02

Review the audit requirements and guidelines provided by the relevant regulatory agency or accounting standards board. Familiarize yourself with the specific reporting format and disclosure requirements for the audited period.

03

Ensure that all financial records are accurate, complete, and categorized correctly. Reconcile any discrepancies or errors before proceeding with the audit.

04

Prepare the audited financial statements based on the chosen reporting format. This typically includes an income statement, balance sheet, cash flow statement, and notes to the financial statements.

05

Clearly present all relevant financial information, such as revenues, expenses, assets, liabilities, and equity. Use appropriate headings, labels, and formulas to ensure clarity and ease of understanding.

06

Include detailed explanatory notes that provide additional context and clarification to the audited financial statements. These notes should explain significant accounting policies, estimates, and judgments made during the audit process.

07

Perform a thorough review of the audited financial statements to ensure accuracy, compliance with regulations, and adherence to the chosen reporting format. Make any necessary adjustments or corrections before finalizing the report.

08

Obtain the necessary approvals and signatures from authorized personnel, such as company executives or board members, to validate the audited financial statements.

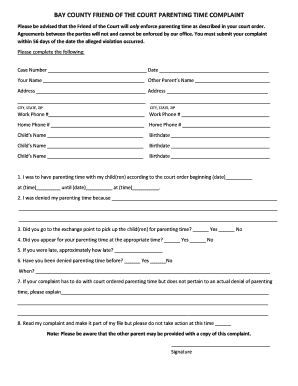

Who needs 4 audited 92011 22012:

01

Companies or organizations required by regulatory authorities to undergo an annual audit of their financial statements.

02

Investors who are evaluating the financial health and performance of a company before making investment decisions.

03

Lenders or creditors who need assurance of a company's financial stability and repayment ability before approving credit facilities or loans.

04

Government agencies or regulatory bodies that oversee financial reporting and compliance.

05

Potential buyers or acquirers of a company who want to assess its financial position and risks before making a purchase or investment.

06

Stakeholders, including shareholders, employees, and customers, who rely on accurate and transparent financial information to make informed decisions and assess the company's overall performance.

In summary, filling out 4 audited 92011 22012 involves gathering financial records, following audit requirements, preparing accurate financial statements, and providing necessary explanations. The need for audited financial statements arises from regulatory, investment, lending, and informational purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 4 audited 92011 22012?

4 audited 92011 22012 refers to the financial statements that have been examined and verified by a professional auditor for the years 2020 and 2021.

Who is required to file 4 audited 92011 22012?

Businesses and organizations that meet certain financial criteria are typically required to file 4 audited 92011 22012 to ensure transparency and accuracy of financial reporting.

How to fill out 4 audited 92011 22012?

To fill out 4 audited 92011 22012, one would need to compile financial information, have it audited by a professional auditor, and submit the completed report to the relevant authorities.

What is the purpose of 4 audited 92011 22012?

The purpose of 4 audited 92011 22012 is to provide stakeholders with reliable and accurate financial information about the organization's performance and financial position during the specified years.

What information must be reported on 4 audited 92011 22012?

Typically, 4 audited 92011 22012 requires information such as balance sheets, income statements, cash flow statements, notes to the financial statements, and auditor's report.

How do I modify my 4 audited 92011 22012 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 4 audited 92011 22012 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify 4 audited 92011 22012 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 4 audited 92011 22012 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit 4 audited 92011 22012 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 4 audited 92011 22012.

Fill out your 4 audited 92011 22012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

4 Audited 92011 22012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.