Get the free TAXSAVING STRATEGIES:

Show details

CONFIDENTIALITY

AGREEMENTS AND

TAXPAYING STRATEGIES:

HOW CONFIDENT ARE YOU?

(WITH FORMS)

Victoria Blackly

The Internal Revenue Service continues to cast a wide net to deter improper and

illegal tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxsaving strategies

Edit your taxsaving strategies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxsaving strategies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxsaving strategies online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxsaving strategies. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxsaving strategies

How to fill out tax saving strategies?

01

Start by assessing your financial situation and identifying your goals. Determine how much you want to save on taxes and what specific strategies you can implement.

02

Research and understand the different tax saving strategies available. This may include tax deductions, tax credits, and tax-deferred investment options.

03

Consult with a professional tax advisor or accountant to get personalized advice and guidance based on your specific financial circumstances and goals.

04

Take advantage of tax deductions and credits that you qualify for. This may include deductions for home office expenses, educational expenses, medical expenses, and more. Make sure to keep all necessary documentation and receipts to support your claims.

05

Maximize your contributions to tax-advantaged retirement accounts such as 401(k)s or IRAs. This can help reduce your taxable income and potentially grow your savings for the future.

06

Consider investing in tax-efficient investment options such as index funds or municipal bonds that may offer tax advantages.

07

Look for opportunities to consolidate or streamline your finances to minimize tax liabilities. For example, you may benefit from combining multiple retirement accounts or restructuring your investments.

08

Stay updated on changes in tax laws and regulations to ensure you are taking advantage of any new opportunities or potential benefits.

09

Regularly review and evaluate your tax saving strategies to ensure they align with your financial goals and take advantage of any new opportunities that arise.

Who needs tax saving strategies?

01

Individuals who want to reduce their tax liabilities and increase their savings or investment opportunities.

02

Small business owners or self-employed individuals who want to maximize deductions and credits available to them.

03

High-income earners who are looking for legal and strategic ways to minimize their tax burdens.

04

Individuals or families with complex financial situations, such as multiple sources of income, investments, or properties.

05

People planning for retirement who want to optimize their savings and potentially lower their taxable income.

06

Anyone wanting to take control of their financial situation and make the most of their hard-earned money by implementing smart tax-saving strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find taxsaving strategies?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific taxsaving strategies and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit taxsaving strategies on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing taxsaving strategies.

How do I fill out the taxsaving strategies form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign taxsaving strategies. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your taxsaving strategies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxsaving Strategies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

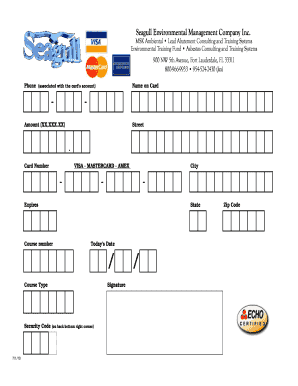

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.