TX Comptroller 50-141 2019 free printable template

Show details

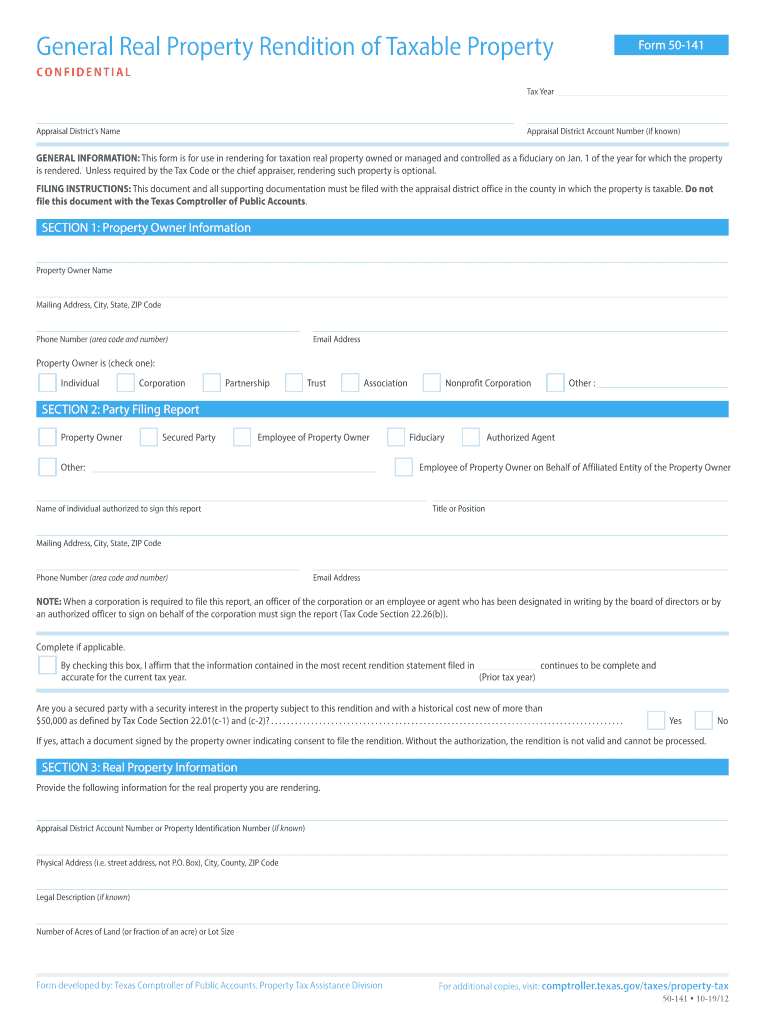

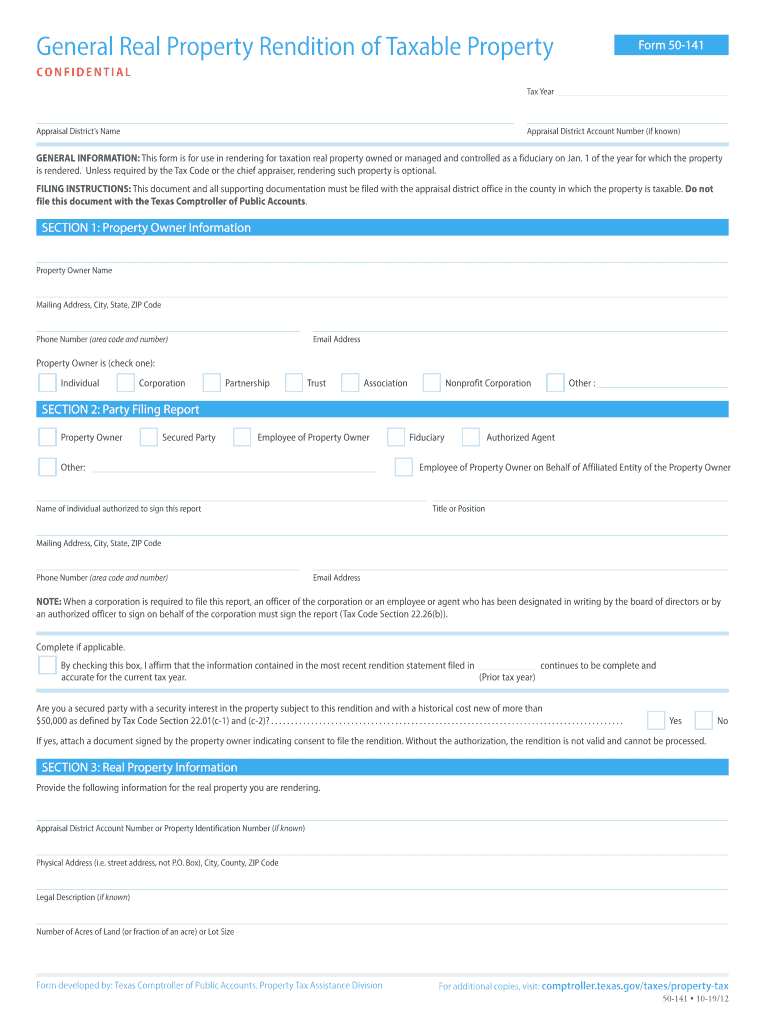

Form Texas Comptroller of Public Accounts 50-141 General Real Property Rendition of Taxable Property CONFIDENTIAL Phone area code and number Appraisal District s Name Address City State ZIP Code Are there one or more taxing units located in the county that exempt freeport property under Tax Code Section 11. 251. Yes No GENERAL INSTRUCTIONS This form is for use in rendering for taxation real property owned or managed and controlled as a fiduciary on Jan* 1 of the year for which the property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign real property rendition

Edit your real property rendition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property rendition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real property rendition online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit real property rendition. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-141 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out real property rendition

How to fill out TX Comptroller 50-141

01

Start by downloading the TX Comptroller 50-141 form from the Texas Comptroller's website.

02

Fill in the entity's name and address at the top of the form.

03

Provide the tax identification number of the entity.

04

Indicate the type of organization (e.g., nonprofit, government agency).

05

Complete the section regarding the purpose of the organization.

06

Fill out the information on the property owned, including descriptions and locations.

07

Sign and date the form in the designated areas.

08

Submit the completed form via mail or electronically, as instructed on the form.

Who needs TX Comptroller 50-141?

01

Nonprofit organizations seeking property tax exemptions in Texas.

02

Organizations that own property used for charitable or educational purposes.

03

Governmental entities that require recognition of their exempt status.

Fill

form

: Try Risk Free

People Also Ask about

What is a rendition penalty Texas?

A 10 percent to 50 percent penalty may be imposed if a rendition is filed late, incomplete or not at all. Property owners who need more time to file their renditions may file a written request with the chief appraiser on or before the rendition deadline to receive an automatic extension.

What is rendition requirements Texas law?

Under the rendition law, you must include. in your rendition either a good faith estimate of the market. value of your items or the historical cost and acquisition. date (discussed below) of the items, if the value of your. items are $20,000 or more.

How can I lower my property taxes in Texas?

The steps below will show you how to lower property taxes in Texas, so you can move forward with your appeal. File a notice of protest. Prepare information for hearing. Attend an informal hearing at the Appraisal District office. Attend an Appraisal Review Board hearing. Appeal through district court or arbitration.

What is Texas rendition?

A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. Property includes inventory and equipment used by a business. Owners do not have to render exempt property, such as church property or an agriculture producer's equipment used for farming.

What does rendition mean in real estate?

A rendition is a form that provides the appraisal district with the description, location, cost and acquisition dates for business personal property that you own. The appraisal district uses the information to help estimate the market value of your property for taxation purposes.

What is a business personal property tax rendition in Texas?

What is a rendition for Business Personal Property? A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. The District uses the information to help estimate the market value of your property for taxation purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my real property rendition directly from Gmail?

real property rendition and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit real property rendition from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your real property rendition into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit real property rendition on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing real property rendition.

What is TX Comptroller 50-141?

TX Comptroller 50-141 is a form used for reporting property tax exemptions for certain types of organizations in Texas.

Who is required to file TX Comptroller 50-141?

Organizations that are seeking property tax exemptions for specific purposes, such as charitable, religious, or educational activities, are required to file TX Comptroller 50-141.

How to fill out TX Comptroller 50-141?

To fill out TX Comptroller 50-141, organizations must provide their identification details, the type of exemption they are applying for, and any supporting information required to substantiate their eligibility.

What is the purpose of TX Comptroller 50-141?

The purpose of TX Comptroller 50-141 is to allow organizations to formally apply for and document their eligibility for property tax exemptions in Texas.

What information must be reported on TX Comptroller 50-141?

TX Comptroller 50-141 requires reporting information such as the organization's name, address, type of organization, the nature of the exemption requested, and supporting documentation to verify compliance with exemption criteria.

Fill out your real property rendition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Property Rendition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.