Get the free 2020 05 164

Show details

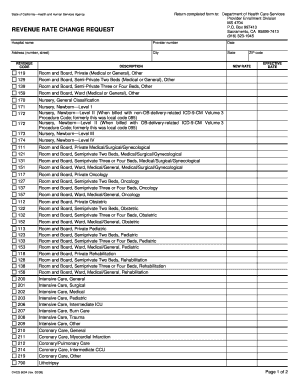

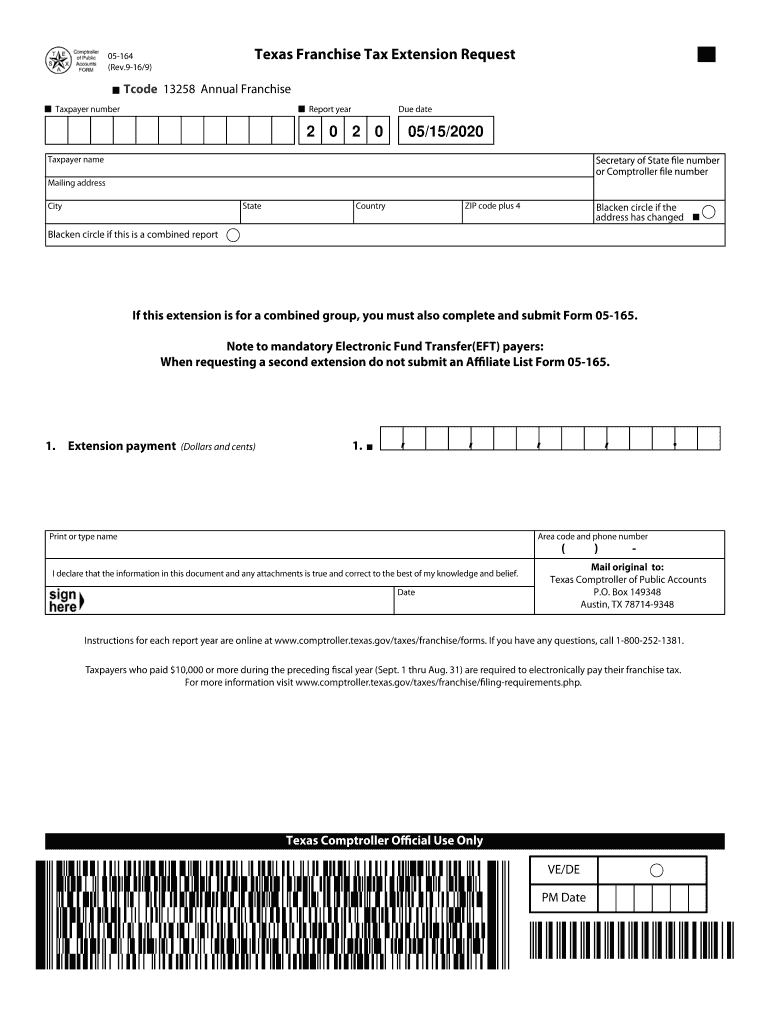

RESET FORM PRINT FORM Texas Franchise Tax Extension Request 05-164 Rev.9-16/9 FILING REQUIREMENTS Tcode 13258 Annual AnnualFranchise Taxpayer number Report year Due date 05/15/2018 Mailing address State City ZIP code plus 4 Country Blacken circle if the address has changed If this extension is for a combined group you must also complete and submit Form 05-165. Note to mandatory Electronic Fund Transfer EFT payers 1. Extension payment Dollars and cents Print or type name Area code and phone...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2020 05 164

Edit your 2020 05 164 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2020 05 164 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2020 05 164 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2020 05 164. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2020 05 164

How to fill out TX Comptroller 05-164

01

Download the TX Comptroller 05-164 form from the official website.

02

Fill out the identifying information in the top section, including your name, address, and Social Security number.

03

Indicate the type of claim you are filing by checking the appropriate box.

04

Fill out the relevant details related to your claim in the designated sections.

05

Calculate any amounts owed or refund due according to the instructions provided on the form.

06

Review the completed form for accuracy and sign it at the bottom.

07

Submit the form to the appropriate state agency either via mail or electronically as instructed.

Who needs TX Comptroller 05-164?

01

Individuals or businesses looking to claim a refund or credit related to Texas state taxes.

02

Taxpayers who made errors on their previous tax filings and need to correct them.

03

Those who have overpaid taxes and wish to get a refund.

Fill

form

: Try Risk Free

People Also Ask about

What is the no tax due report for 2020 in Texas?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

Which entity is not subject to Texas franchise tax?

Entities Not Subject to Franchise Tax sole proprietorships (except for single member LLCs); general partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships);

What is the Texas franchise tax threshold for 2020?

The no tax due threshold has been adjusted, as required by Texas Tax Code Section 171.006(b), and is now $1,180,000 for reports due on or after Jan. 1, 2020 and before Jan. 1, 2022.

How do I become exempt from franchise tax in Texas?

To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What is Form 05-164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

What is the threshold for Texas franchise tax?

Reports and Payments For franchise tax reports originally due…The no tax due threshold is…on or after Jan. 1, 2022, and before Jan. 1, 2024$1,230,000on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,0005 more rows

What is Texas Form 05-167?

Form 05-167 - Texas Franchise Tax Ownership Information Report — The Ownership Information Report (OIR) is to be filed for each taxable entity other than a legally formed corporation, limited liability company, limited partnership, professional association, or financial institution.

What is Texas Form 05 164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

Who is required to file Texas franchise tax report?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

What is the Texas franchise tax no tax due threshold?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,000,000Tax Rate (retail or wholesale)0.5%Tax Rate (other than retail or wholesale)1.0%Compensation Deduction Limit$320,0002 more rows

What is Texas Webfile number?

What is my Webfile number and where do I find it? Your Webfile number is your "access code" to Webfile issued by the Comptroller's office. It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666).

What is Texas Form 05-164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2020 05 164?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 2020 05 164 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in 2020 05 164 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2020 05 164 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit 2020 05 164 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 2020 05 164 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is TX Comptroller 05-164?

TX Comptroller 05-164 is a form used for reporting certain types of business activities and financial data to the Texas Comptroller of Public Accounts.

Who is required to file TX Comptroller 05-164?

Entities conducting certain business activities in Texas that meet specific thresholds or requirements are required to file TX Comptroller 05-164.

How to fill out TX Comptroller 05-164?

To fill out TX Comptroller 05-164, you will need to provide information related to your business activities, financial data, and any specific disclosures required by the form.

What is the purpose of TX Comptroller 05-164?

The purpose of TX Comptroller 05-164 is to collect data for tax assessment, compliance, and regulatory purposes within the state of Texas.

What information must be reported on TX Comptroller 05-164?

The information that must be reported on TX Comptroller 05-164 includes business identification, revenue details, expenses, and any specific tax-related information as specified in the form.

Fill out your 2020 05 164 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2020 05 164 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.