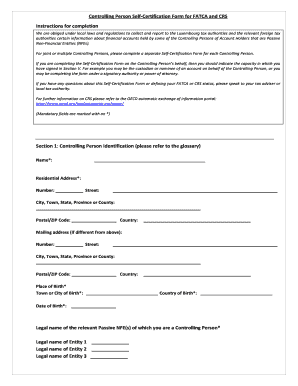

TX 06-168 2019-2026 free printable template

Show details

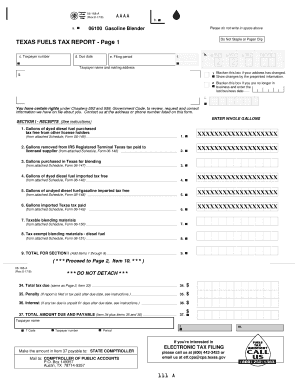

AB CD a. b AAAA 06-168-A Rev.4-19/9 b. 06168A0W041909 PRINT FORM 06100 Gasoline Supplier TEXAS FUELS TAX REPORT - Page 1 c. Taxpayer number d. Gallons of dyed diesel fuel purchased tax free from other license holders from attached Schedule Form 06-145 2. Gallons removed from IRS Registered Terminal Texas tax paid to licensed supplier from attached Schedule Form 06-146 XXXXXXXXXXXXXXXXXXX 5. Gallons of undyed diesel fuel/gasoline imported tax free 6. Gallons imported Texas tax paid 7. Taxable...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 06-168

Edit your TX 06-168 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 06-168 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX 06-168 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX 06-168. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 06-168 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 06-168

How to fill out TX 06-168

01

Obtain a copy of the TX 06-168 form from the Texas Comptroller's website or local office.

02

Fill in the taxpayer's name and identification number in the designated fields.

03

Provide the address where the business is located.

04

Indicate the type of business entity in the appropriate section.

05

Enter the details of any tax exemptions being claimed.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form either online or by mailing it to the appropriate office.

Who needs TX 06-168?

01

TX 06-168 is needed by businesses in Texas that are applying for certain tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Which state has the highest fuel tax?

As of 2023, Alaska has the lowest gas tax in the nation, with a rate of $0.09 per gallon. The state benefits from its abundant oil reserves and relies heavily on revenue generated from oil production rather than gas taxes. On the other end of the spectrum, Pennsylvania has the highest gas tax rate at $0.61 per gallon.

What form is Texas claim for refund of gasoline fuel taxes?

Gasoline and Diesel Fuel Refund Claims When requesting a refund directly from the Comptroller, claimants who are not licensed for motor fuels must submit Form 06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF).

Who is exempt from motor fuel tax in Texas?

Texas law provides a variety of exemptions from gasoline and diesel taxes. Federal agencies and Texas public school districts, or their bus contractors, are exempted.

Does Texas have a fuel tax license requirement?

All licensees have to complete the Texas Application for Fuels Tax License. You need to provide your business papers for sole proprietorship, partnership or corporation, and fill in the respective parts of the application for your type of business entity.

What is the state fuel tax in Texas?

Gas tax by state StateGasoline TaxUndyed Diesel TaxTexas$0.20 / gallon$0.20 / gallonUtah$0.364 / gallon$0.364 / gallonVermont$0.3237 / gallon$0.341 / gallonVirginia$0.28/ gallon$0.289 / gallon47 more rows

How much is the state fuel tax in Texas?

Texas has a state sales tax rate of 6.25 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my TX 06-168 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your TX 06-168 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit TX 06-168 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing TX 06-168.

How do I edit TX 06-168 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share TX 06-168 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is TX 06-168?

TX 06-168 is a tax form used in Texas for reporting specific tax information as required by state regulations.

Who is required to file TX 06-168?

Entities engaged in certain business activities that fall under the jurisdiction of the Texas Comptroller's office are required to file TX 06-168.

How to fill out TX 06-168?

To fill out TX 06-168, gather all required financial documents and information, then complete the form accurately, providing details as prompted in each section.

What is the purpose of TX 06-168?

The purpose of TX 06-168 is to collect necessary tax information from businesses to ensure compliance with state taxation laws.

What information must be reported on TX 06-168?

TX 06-168 requires reporting of various financial information, including gross receipts, deductions, and other relevant data related to business operations.

Fill out your TX 06-168 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 06-168 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.