CA DE 2522 2010-2025 free printable template

Show details

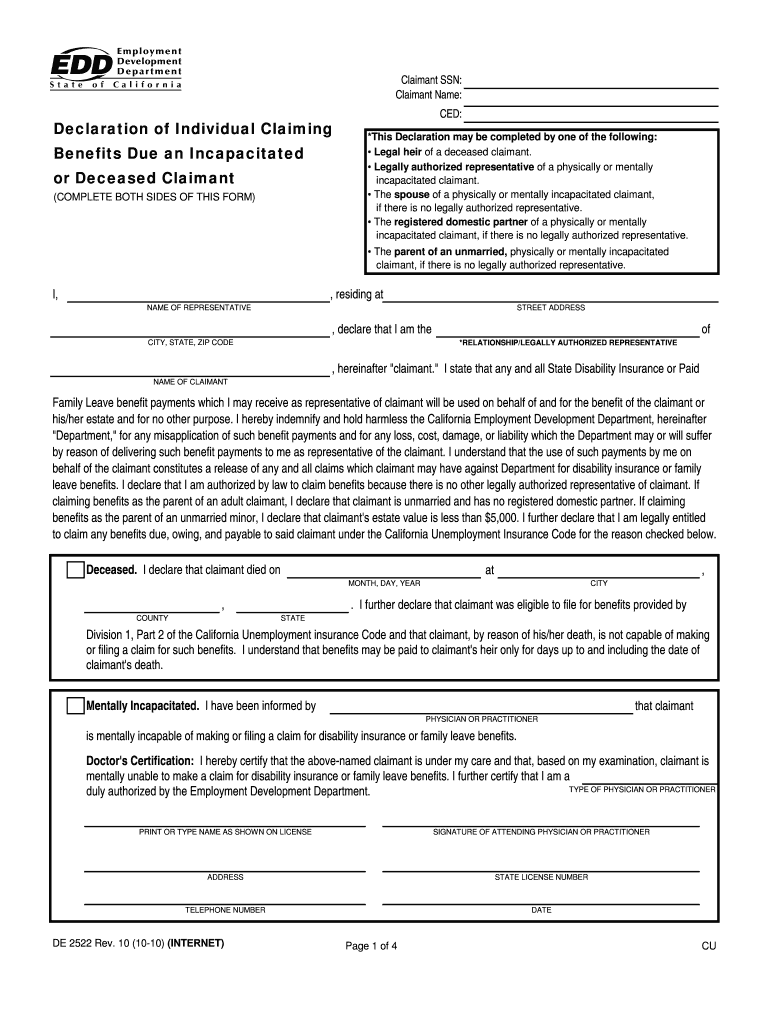

Claimant SSN: Claimant Name:Declaration of Individual Claiming Benefits Due an Incapacitated or Deceased Claimant (COMPLETE BOTH SIDES OF THIS FORM)CED: *This Declaration may be completed by one of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign de 2522 form

Edit your edd benefits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california individual deceased form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca edd benefits online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit de 2522 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca edd due form

How to fill out CA DE 2522

01

Obtain the CA DE 2522 form from the California Employment Development Department (EDD) website or your local EDD office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide the details of your disability, including the nature of your disability and the date it began.

04

Indicate the last date you worked before your disability began.

05

Complete any additional sections required for your specific situation, such as medical information.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate EDD office, either by mail or online, as instructed.

Who needs CA DE 2522?

01

Individuals who are applying for State Disability Insurance (SDI) benefits in California.

02

Employees who are unable to work due to a non-work-related illness, injury, or pregnancy.

03

Self-employed individuals who wish to claim SDI benefits under specific eligibility criteria.

Fill

edd claiming benefits

: Try Risk Free

People Also Ask about de2522

What tax form do I file for a deceased person?

Form 1310 is a tax form that is filed with the IRS to request a tax refund for a deceased individual. This form is typically filed by a surviving spouse, another beneficiary, or the executor of the deceased's estate.

How do I notify the DMV of death in CA?

You will need to do the following: Submit the decedent's California DL/ID card to DMV (even if it is expired). Include an original or certified copy of the decedent's death certificate. Submit a written statement listing the: Decedent's full name. Decedent's DL/ID card number.

How do you transfer ownership of a car from a deceased person in California?

Transferring a vehicle title within probate Just as you would with other probate assets, you will be required by the court to formally transfer automobiles to the person designated in the deceased's Will. California's DMV (Department of Motor Vehicles) does not have a form for transferring a vehicle within probate.

How long do you have to transfer property after death in California?

At least 40 days have passed since the death of the decedent, as shown by the attached certified copy of the decedent's death certificate.

How to transfer a car title when owner is deceased in California?

Transferring a vehicle title within probate Just as you would with other probate assets, you will be required by the court to formally transfer automobiles to the person designated in the deceased's Will. California's DMV (Department of Motor Vehicles) does not have a form for transferring a vehicle within probate.

Does California have a form 1310?

Use this screen to complete the California version of Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, when the California return shows a tax refund. Information is automatically used from data input in federal Screen 1310.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ca due?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific edd de 2522 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in edd benefits form without leaving Chrome?

california deceased form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the de 2522 deceased in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your ca benefits deceased and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is CA DE 2522?

CA DE 2522 is a form used to report employee wages and withholdings for California's Employment Development Department (EDD).

Who is required to file CA DE 2522?

Employers who withhold California state income tax from their employees' wages are required to file CA DE 2522.

How to fill out CA DE 2522?

To fill out CA DE 2522, gather the required employee information, report wages, and the amounts withheld for state income tax, then submit the form to the EDD.

What is the purpose of CA DE 2522?

The purpose of CA DE 2522 is to ensure that state income tax withholdings are properly reported and remitted to the California Employment Development Department.

What information must be reported on CA DE 2522?

The information that must be reported on CA DE 2522 includes the employer's identification information, employee wages subject to withholding, and amounts withheld for state income tax.

Fill out your california edd benefits form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Deceased is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.