KS DoR KS-1216 2019 free printable template

Show details

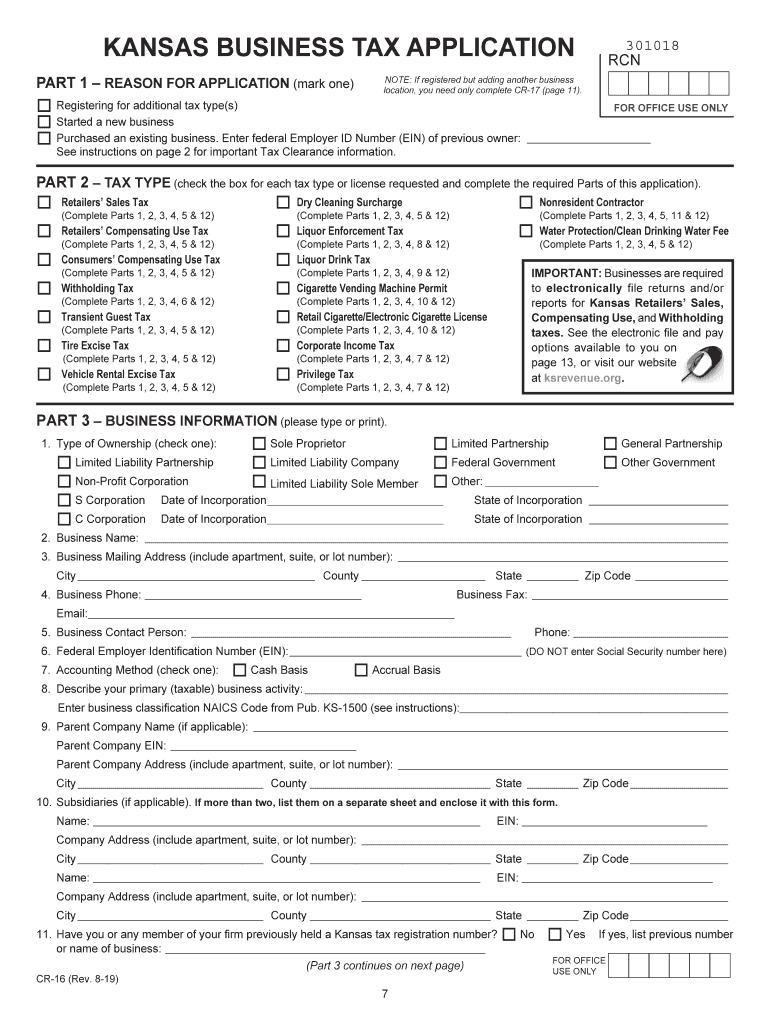

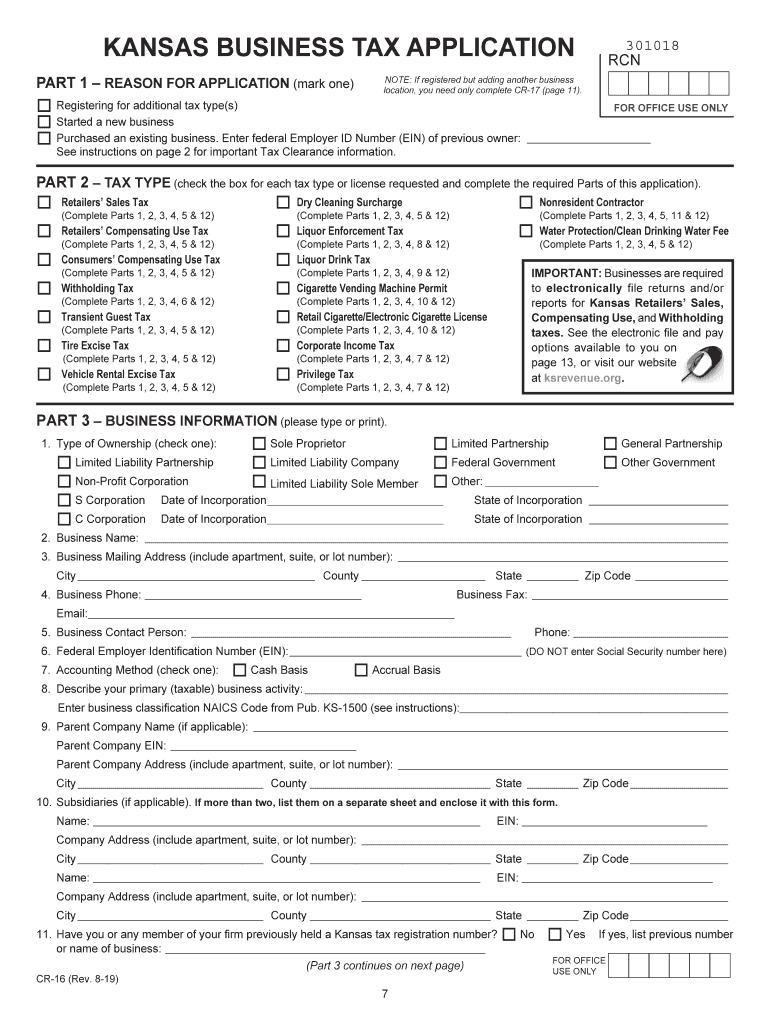

Ksrevenue. org Pub KS-1216 Rev. 9-18 TABLE OF CONTENTS GETTING STARTED. Choosing a Business Structure Record Keeping Certificate of Tax Clearance Accounting Methods AFTER YOU APPLY. 12 Your Certificate of Registration Filing Tax Returns Reporting Business Changes COMPLETING THE BUSINESS TAX APPLICATION.. 3 When and How to Apply General Instructions Specific Line Instructions Required Bonds and Fees BUSINESS TAX APPLICATION FORM CR-16. If more space is needed attach additional pages....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR KS-1216

Edit your KS DoR KS-1216 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR KS-1216 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS DoR KS-1216 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS DoR KS-1216. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR KS-1216 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR KS-1216

How to fill out KS DoR KS-1216

01

Obtain a copy of the KS DoR KS-1216 form from the official website or local office.

02

Fill in the personal information section, including your name, address, and contact details.

03

Provide the relevant details regarding the property or transaction being reported.

04

If applicable, include any identification numbers such as tax ID or social security number.

05

Review the instructions on the form carefully to ensure all required fields are completed.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate office indicated in the instructions.

Who needs KS DoR KS-1216?

01

Individuals or businesses engaging in property transactions in Kansas.

02

Property owners who need to report changes in ownership.

03

Anyone requiring to document significant financial transactions related to real estate.

Instructions and Help about KS DoR KS-1216

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a business license in Kansas?

How Much Does a Business License Cost in Kansas? There is no cost to register your business in Kansas or to obtain a sales tax license.

How much is a seller's permit in Kansas?

How much does it cost to apply for a sales tax permit in Kansas? There is no fee for the sales tax permit in Kansas. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business.

Do I need to attach federal tax return to state tax return?

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.

Does Missouri require a copy of the federal tax return with the state return?

You must allocate your Missouri source income on Form MO-NRI and complete Form MO-1040. You must include a copy of your federal return with your state return.

How do I get a KS sales tax number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

Do I need to send a copy of my federal return with my Kansas state return?

If your Form K-40 shows an address other than Kansas, you must enclose a copy of your federal return (1040EZ, 1040A or 1040 and applicable Schedules A through F) with your Kansas return. Income tax information disclosed to KDOR, either on returns or through department investigation, is held in strict confidence by law.

What is my Kansas withholding account number?

Kansas Withholding Account Number You can find your Withholding Account Number on any previous Form KW-5, or on any notices you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (785) 368-8222.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find KS DoR KS-1216?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the KS DoR KS-1216 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the KS DoR KS-1216 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your KS DoR KS-1216 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit KS DoR KS-1216 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like KS DoR KS-1216. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is KS DoR KS-1216?

KS DoR KS-1216 is a form used for reporting certain financial information to the Kansas Department of Revenue.

Who is required to file KS DoR KS-1216?

Individuals and entities that meet specific criteria for financial reporting in Kansas are required to file KS DoR KS-1216.

How to fill out KS DoR KS-1216?

To fill out KS DoR KS-1216, follow the instructions provided with the form, ensuring all required fields are completed accurately.

What is the purpose of KS DoR KS-1216?

The purpose of KS DoR KS-1216 is to provide the Kansas Department of Revenue with necessary financial information for tax assessment and compliance.

What information must be reported on KS DoR KS-1216?

The information that must be reported on KS DoR KS-1216 includes income, expenses, and other relevant financial data as required by the form's guidelines.

Fill out your KS DoR KS-1216 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR KS-1216 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.