AZ DoR 140NR 2019 free printable template

Show details

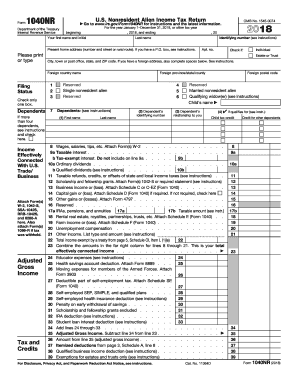

2 19Arizona Form140NRNonresident Personal Income Tax Booklets Booklet Contains: Form 140NR Nonresident Personal Income Tax Return must use Arizona Form 140NR? Schedule A(NR) Itemized DeductionFile

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

How to fill out AZ DoR 140NR

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

You can easily edit the AZ DoR 140NR Tax Form using pdfFiller. Start by uploading your form to the platform. Once uploaded, utilize the editing tools to make changes as necessary. After editing, ensure to save your updates before proceeding to fill it out or submit it.

How to fill out AZ DoR 140NR

To fill out the AZ DoR 140NR, follow these steps:

01

Download and open the form.

02

Fill in your personal information including your name, address, and Social Security number.

03

Complete the sections regarding your income and deductions as applicable.

04

Review the form for accuracy.

About AZ DoR 140NR 2019 previous version

What is AZ DoR 140NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140NR 2019 previous version

What is AZ DoR 140NR?

AZ DoR 140NR is the Arizona Department of Revenue form used by non-residents to report income earned within the state of Arizona. This form is essential for ensuring that the appropriate amount of state tax is assessed on income sourced from Arizona.

What is the purpose of this form?

The purpose of the AZ DoR 140NR Tax Form is to allow non-residents to accurately report their Arizona income to the state tax authorities. Completing this form is necessary for the calculation of state tax liabilities for individuals who do not reside in Arizona but earn income there.

Who needs the form?

Non-residents who earn income in Arizona must complete the AZ DoR 140NR. This includes individuals who may be working temporarily in the state, those with rental properties, or anyone receiving income from Arizona sources while maintaining residence in another state.

When am I exempt from filling out this form?

You are exempt from filling out the AZ DoR 140NR if your only income from Arizona is below the minimum threshold set by the Arizona Department of Revenue for non-residents. Additionally, if you are a full-time resident of another state and do not have any taxable Arizona income, you may also be exempt.

Components of the form

The AZ DoR 140NR consists of multiple sections including personal identification information, income details, and deductions. Each section requires specific information that helps determine the amount of tax owed. It is important to complete all relevant sections thoroughly to avoid processing delays.

Due date

The AZ DoR 140NR is generally due on the same day as the federal tax return for individuals. This usually falls on April 15 for most taxpayers unless it lands on a weekend or holiday, in which case the due date is extended. It is crucial to adhere to this timeline to avoid penalties.

What payments and purchases are reported?

The AZ DoR 140NR requires reporting of all income earned within Arizona. This includes wages, salaries, tips, and other compensations, as well as income from business operations, rental properties, and other sources. Non-residents must ensure that all sources of income are accurately reported to comply with state law.

How many copies of the form should I complete?

Typically, you will need to complete one copy of the AZ DoR 140NR for your records and one copy for submission to the Arizona Department of Revenue. Ensure that you retain a copy of your filed form for your personal records and future reference.

What are the penalties for not issuing the form?

If you fail to issue the AZ DoR 140NR or submit it late, you may incur penalties and interest charges based on the amount of tax owed. The Arizona Department of Revenue enforces these penalties to ensure compliance among taxpayers. Always aim to file on time to avoid unnecessary fees.

What information do you need when you file the form?

To file the AZ DoR 140NR, you will need personal identification details, your Social Security number, income statements such as W-2 forms from an employer, and any applicable deduction documentation. Having accurate and complete information available is crucial for a successful filing.

Is the form accompanied by other forms?

Typically, the AZ DoR 140NR is filed on its own; however, it may be necessary to include additional forms if you are claiming specific credits or deductions. Make sure to review the instructions provided with the form to understand any additional requirements.

Where do I send the form?

The completed AZ DoR 140NR should be submitted to the Arizona Department of Revenue. You can send it through standard mail or, if applicable, electronically through authorized platforms. Check the Arizona Department of Revenue website for specific mailing addresses based on your filing method.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am currently reviewing how much I would actually have to use the PC Filler to see whether I need to subscribe. Thank you.

Very easy to use. Enjoy using this program.

See what our users say