PA REV-1123 2018 free printable template

Show details

FILL IN FORM USING ALL CAPS. DO NOT USE DASHES () OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

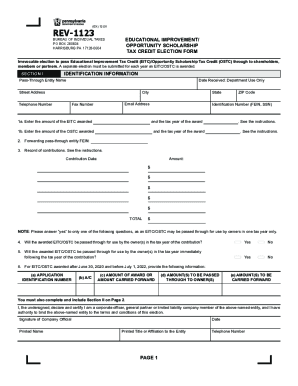

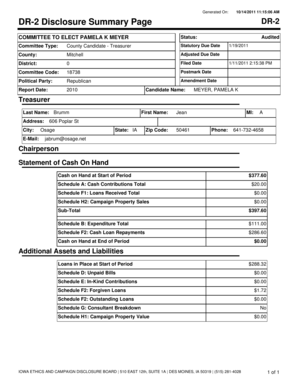

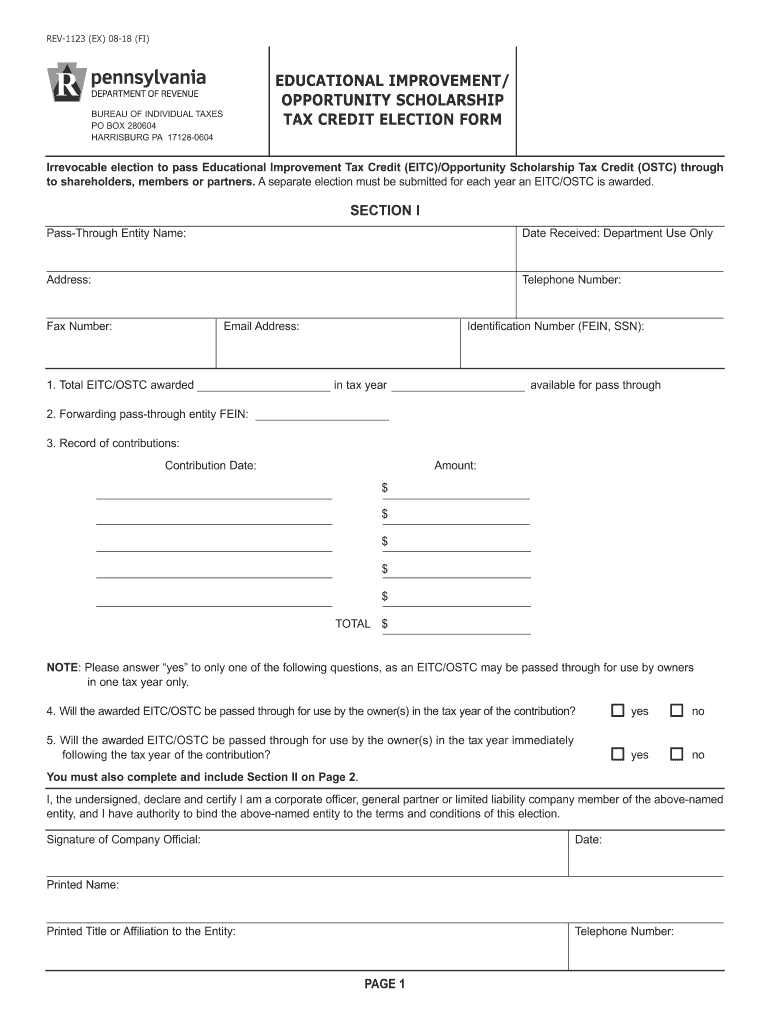

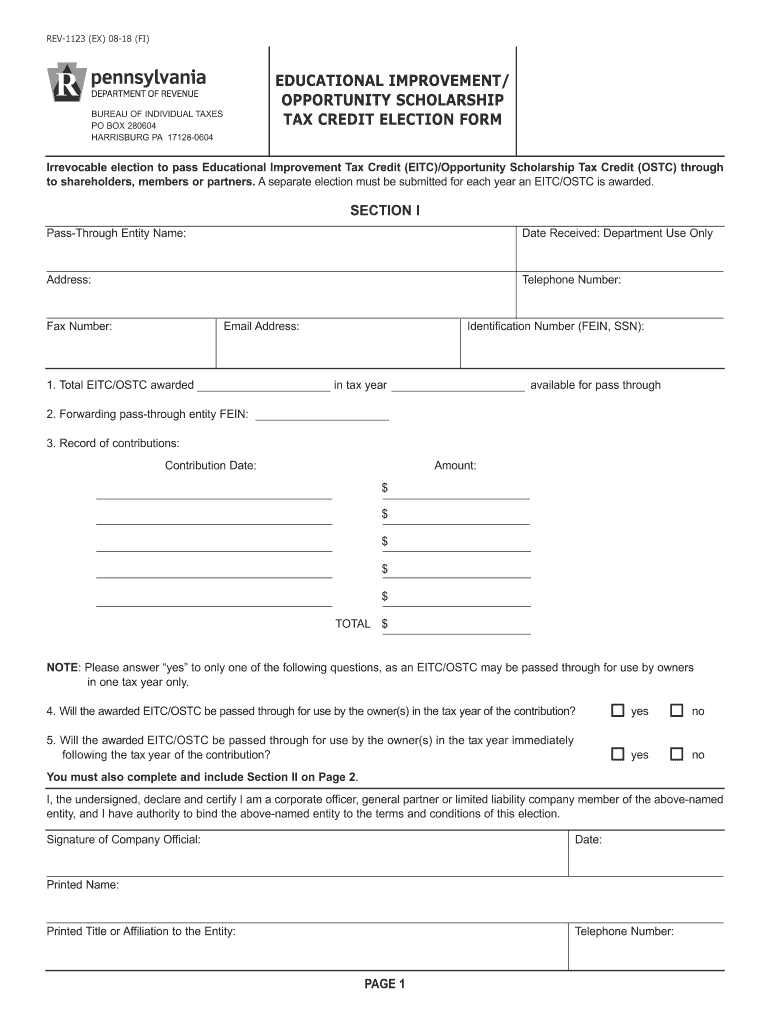

REV1123 (EX) 0818 (FI)EDUCATIONAL IMPROVEMENT/

OPPORTUNITY SCHOLARSHIP

TAX

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-1123

Edit your PA REV-1123 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1123 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA REV-1123 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA REV-1123. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1123 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1123

How to fill out PA REV-1123

01

Download the PA REV-1123 form from the official website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the relevant account information in the designated sections.

04

Indicate the reason for filing the form in the appropriate box.

05

Complete any additional sections as required for your specific situation.

06

Review all the information entered to ensure accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form by mail or online as instructed.

Who needs PA REV-1123?

01

Individuals or businesses seeking an extension for filing taxes.

02

Taxpayers who need to correct prior submission errors.

03

Parties looking to claim exemptions or adjustments related to their tax accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is a special purpose entity in PA EITC?

What is a Special Purpose Entity (SPE) as it pertains to Pennsylvania education tax credits? A Special Purpose Entity is a new class of pass-through partnerships that exists solely for the purpose of obtaining Education Improvement Credits (EITC/OSTC).

What is rev 1123?

Printable 2022 Pennsylvania Form REV-1123 (Educational Improvement/Opportunity Scholarship Tax Credit)

How do I know if I qualify for earned income credit?

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

What is the federal earned income tax credit?

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low and moderate incomes. It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes.

What is the maximum number of dependents that may be claimed for the earned income credit?

The maximum number of dependents you can claim for earned income credit purposes is three. You must also meet other requirements related to your adjusted gross income (AGI) to qualify for the EIC. If you're married filing separately, you can't claim the EIC. Was this topic helpful?

How does federal earned income credit work?

Credit Grows With Earnings, Then Phases Out at Higher Income Levels. Working households qualify for an EITC based on their earnings. Beginning with the first dollar of earnings, a low-income household's EITC increases (or “phases in”) as their earnings increase, until the credit reaches its maximum amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA REV-1123 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including PA REV-1123, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit PA REV-1123 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your PA REV-1123 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit PA REV-1123 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as PA REV-1123. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is PA REV-1123?

PA REV-1123 is a form used in Pennsylvania for reporting certain tax information or claiming specific tax benefits.

Who is required to file PA REV-1123?

Individuals and businesses that qualify for specific tax credits or exemptions as specified by the Pennsylvania Department of Revenue are required to file PA REV-1123.

How to fill out PA REV-1123?

To fill out PA REV-1123, gather necessary documentation, provide all required personal and financial details accurately, and follow the instructions provided on the form.

What is the purpose of PA REV-1123?

The purpose of PA REV-1123 is to allow taxpayers in Pennsylvania to claim eligible tax credits or report tax-related information to the state.

What information must be reported on PA REV-1123?

Necessary information includes taxpayer identification details, specific tax credits being claimed, financial data, and other related information as directed by the form instructions.

Fill out your PA REV-1123 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1123 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.