PA REV-1123 2015 free printable template

Show details

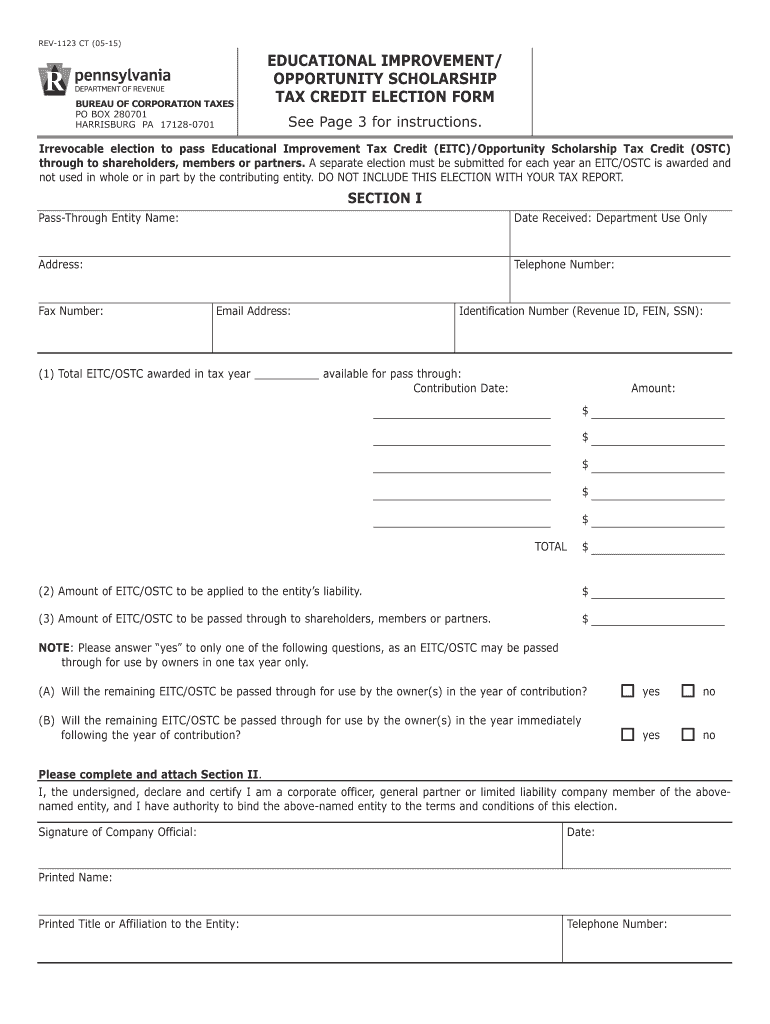

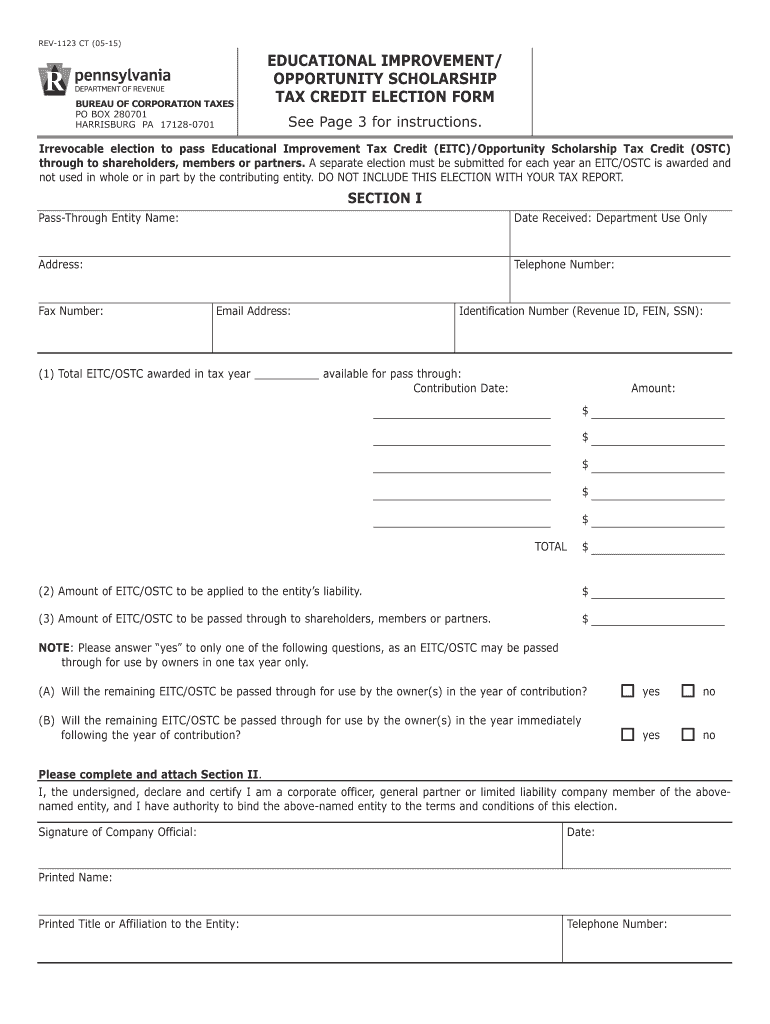

REV-1123 CT (05-15) BUReAU oF CoRPoRAtIoN tAXeS PO BOx 280701 hARRISBuRg PA 17128-0701 eDUCAtIoNAL IMPRoVeMeNt/ oPPoRtUNItY SCHoLARSHIP tAX CReDIt eLeCtIoN FoRM See Page 3 for instructions. GO TO

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-1123

Edit your PA REV-1123 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1123 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1123 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1123

How to fill out PA REV-1123

01

Obtain a copy of the PA REV-1123 form from the Pennsylvania Department of Revenue website.

02

Fill out the taxpayer information section, including name, address, and Social Security number or EIN.

03

Provide details about the specific tax year you are referencing.

04

Indicate the type of tax for which you are filing by marking the appropriate checkbox.

05

Complete the calculation sections by inputting the necessary financial figures as instructed.

06

Attach any required supporting documentation, such as tax returns or payment records.

07

Review the form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the completed PA REV-1123 form by mailing it to the address provided in the instructions.

Who needs PA REV-1123?

01

Individuals or businesses seeking a refund of overpaid taxes in Pennsylvania.

02

Taxpayers who need to adjust their tax liabilities or request corrections from the Pennsylvania Department of Revenue.

03

Those who are filing for a tax year that has been previously assessed.

Fill

form

: Try Risk Free

People Also Ask about

What is a special purpose entity in PA EITC?

What is a Special Purpose Entity (SPE) as it pertains to Pennsylvania education tax credits? A Special Purpose Entity is a new class of pass-through partnerships that exists solely for the purpose of obtaining Education Improvement Credits (EITC/OSTC).

What is rev 1123?

Printable 2022 Pennsylvania Form REV-1123 (Educational Improvement/Opportunity Scholarship Tax Credit)

How do I know if I qualify for earned income credit?

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

What is the federal earned income tax credit?

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low and moderate incomes. It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes.

What is the maximum number of dependents that may be claimed for the earned income credit?

The maximum number of dependents you can claim for earned income credit purposes is three. You must also meet other requirements related to your adjusted gross income (AGI) to qualify for the EIC. If you're married filing separately, you can't claim the EIC. Was this topic helpful?

How does federal earned income credit work?

Credit Grows With Earnings, Then Phases Out at Higher Income Levels. Working households qualify for an EITC based on their earnings. Beginning with the first dollar of earnings, a low-income household's EITC increases (or “phases in”) as their earnings increase, until the credit reaches its maximum amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PA REV-1123?

PA REV-1123 is a form used in Pennsylvania for reporting specific tax-related information to the Pennsylvania Department of Revenue.

Who is required to file PA REV-1123?

Entities or individuals mandated by Pennsylvania tax laws to report certain financial data or activities are required to file PA REV-1123.

How to fill out PA REV-1123?

To fill out PA REV-1123, one should provide accurate financial data as per the instructions provided on the form, ensuring all required fields are completed correctly.

What is the purpose of PA REV-1123?

The purpose of PA REV-1123 is to collect information necessary for the administration and enforcement of Pennsylvania tax laws.

What information must be reported on PA REV-1123?

The information reported on PA REV-1123 typically includes details about income, deductions, credits, and any other relevant financial information as required by the form's guidelines.

Fill out your PA REV-1123 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1123 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.