VT Domicile Statement 2019-2026 free printable template

Show details

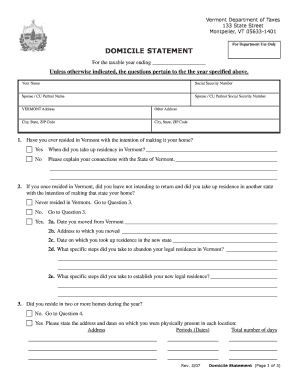

Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 For Department Use Only DOMICILE STATEMENT For the taxable year ending Unless otherwise indicated the questions pertain to the the year specified above. What specific steps did you take to abandon your legal residence in Vermont 3. Did you reside in two or more homes during the year Yes Please state the address and dates on which you were physically present in each location Address Periods Dates Total number of days Rev....

pdfFiller is not affiliated with any government organization

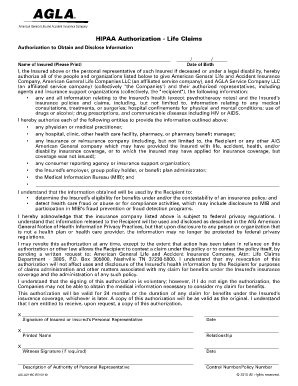

Get, Create, Make and Sign vermont domicile statement form

Edit your VT Domicile Statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT Domicile Statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VT Domicile Statement online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit VT Domicile Statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT Domicile Statement Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT Domicile Statement

How to fill out VT Domicile Statement

01

Obtain the VT Domicile Statement form from the Vermont Department of Taxes website or local office.

02

Begin filling out your personal information, including your name, address, and social security number.

03

Indicate the dates you established residency in Vermont.

04

Provide information on your prior residence, including the address and the dates you lived there.

05

List all of your sources of income and where they are generated.

06

Include information about your vehicle registration and driver's license status.

07

Answer questions regarding your voter registration status.

08

Review all information for accuracy and completeness.

09

Sign and date the form before submitting it according to the instructions provided.

Who needs VT Domicile Statement?

01

Any individual claiming Vermont residency for income tax purposes.

02

Students who are residents of Vermont attending school.

03

Individuals moving to Vermont and establishing a domicile for the first time.

04

People who wish to benefit from Vermont's residency-related tax advantages.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a homestead in Vermont?

In Vermont, all property is subject to education property tax to pay for the state's schools. For this purpose, property is categorized as either nonhomestead or homestead. A homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile.

How do I declare residency in VT?

Vermont Residency Utility bill (must list service address). Property tax bill with physical location. Lease or Landlord statement. Vermont EBT (Electronic Benefit Transfer) card or Vermont AIM (Advanced Information Management) identification card. Homeowners/Renters insurance (policy/proof of claim).

How long does it take to establish residency in VT?

ing to the Vermont website: A Resident is an individual that is domiciled in Vermont or maintains a permanent home, and is physically present in the state for 183 days or more.

Is Vermont a good state to homestead?

With affordable land and a climate that allows for a variety of fruits and vegetables to grow, Vermont could be a good choice to start farming or homesteading.

What is the difference between a residence and a domicile?

What's the Difference between Residency and Domicile? Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

How much is the Vermont Homestead Tax Credit?

The maximum credit for the 2022 and 2023 property tax bill is $5,600 for the education property tax portion and $2,400 for the municipal property tax portion.

How do I qualify for homestead exemption in Vermont?

Eligibility Your property qualifies as a homestead, and you have filed a Homestead Declaration for the current year's grand list. You were domiciled in Vermont for the full prior calendar year. You were not claimed as a dependent of another taxpayer. You have the property as your homestead as of April 1.

Who qualifies for the homestead exemption in VT?

The property must be declared as your homestead. You were domiciled in Vermont for the entire 2021 calendar year. You were not claimed as a dependent by another taxpayer for the 2021 tax year. You meet the household income criteria of $136,900 or less.

How do I prove residency in Vermont?

Vermont Residency Utility bill (must list service address). Property tax bill with physical location. Lease or Landlord statement. Vermont EBT (Electronic Benefit Transfer) card or Vermont AIM (Advanced Information Management) identification card. Homeowners/Renters insurance (policy/proof of claim).

How do I establish a domicile in Vermont?

You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.Resident Income exempted from state taxation by the laws of the United States. Full-time active duty pay from the armed services when the pay is earned outside of Vermont.

How long do I have to live in Vermont to get in-state tuition?

In-state tuition rates apply to students who have maintained legal residence in Vermont for at least one continuous year prior to enrollment.

Does Vermont have a property tax discount for seniors?

Vermont Property Tax Breaks for Retirees For 2022, senior homeowners with 2021 household income of $136,900 or less may qualify for a property tax credit of up to $8,000. To satisfy the household income requirement, homeowners age 65 and older don't have to include interest and dividend income greater than $10,000.

How does IRS determine domicile?

You will be presumed to be a California resident for any taxable year in which you spend more than nine months in this state. Although you may have connections with another state, if your stay in California is for other than a temporary or transitory purpose, you are a California resident.

How long does it take to establish residency in Vermont?

In-State Status Classification Regulations In addition to establishing domicile, an in-state status applicant must reside in Vermont continuously for one full year prior to the semester for which in-state status is sought.

What counts as proof of residency Vermont?

Valid Vermont driver's license with the CVSD town address. Current utility bill in your name. Valid Vermont identification card with the CVSD town address. Valid automobile insurance card with the address showing.

How much is Vermont homestead exemption?

In Vermont, the maximum value of exempt property is $125,000. The legal value of the property is the amount appearing on the last completed county assessment roll at the county treasurer's office.

How long do you need to live in Vermont to become a resident?

Who Is A Resident Of Vermont? You qualify as a Vermont resident for that part of the taxable year during which: You are domiciled in Vermont, or. You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send VT Domicile Statement for eSignature?

When you're ready to share your VT Domicile Statement, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit VT Domicile Statement straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing VT Domicile Statement right away.

How do I fill out VT Domicile Statement on an Android device?

Use the pdfFiller app for Android to finish your VT Domicile Statement. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is VT Domicile Statement?

The VT Domicile Statement is a document used to declare an individual's legal residence in Vermont for tax purposes.

Who is required to file VT Domicile Statement?

Individuals who claim Vermont residency for tax purposes or who need to establish their domicile in Vermont must file the VT Domicile Statement.

How to fill out VT Domicile Statement?

To fill out the VT Domicile Statement, individuals must provide personal information such as name, address, and duration of residence, along with any supporting documentation required.

What is the purpose of VT Domicile Statement?

The purpose of the VT Domicile Statement is to determine an individual's residency status for tax assessment and compliance in Vermont.

What information must be reported on VT Domicile Statement?

The VT Domicile Statement requires reporting personal identification details, current and previous addresses, and duration of residency, along with any additional supporting information.

Fill out your VT Domicile Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT Domicile Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.