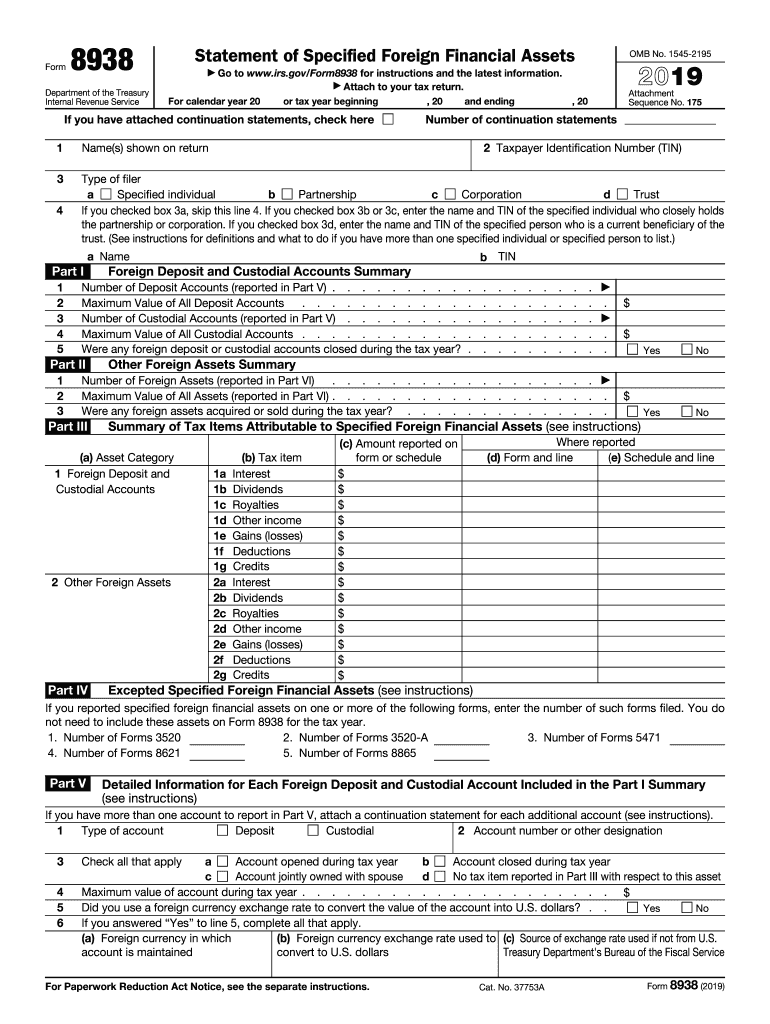

Who Needs IRS Form 8938?

Everyone who holds financial assets outside the United States or is somehow connected with foreign entities is required to fill out Form 8938. An important requirement for filing the form is that the value of all foreign assets should exceed the particular threshold.

What is IRS Form 8938 for?

Form 8938 is used to report all the foreign financial assets a taxpayer holds somewhere abroad. However, foreign financial assets are a collective notion. The IRS differentiates some types of such assets. They are as follows:

- The accounts held in financial institution outside the UAS

- Foreign stocks and bonds

- Interest in a foreign organization or corporation

- Any financial documentation

Is IRS form 8938 accompanied by other forms?

Initially form 8938 was designed as a part of FATWA short for Foreign Account Tax Compliance Act. According to the regulations an individual fills out Form 8938 and attaches it to their annual return which may be one of the following: Form 1040, Form 1040NR, Form 1041, etc.

When is IRS Form 8938 Due?

The form should be sent to the IRS only when it is attached to the annual return or amended return by April 18th, 2017.

How do I Fill out IRS Form 8938?

The form is rather complicated with four parts that need to be completed. Prior to filling out the four parts of the form, an individual should complete the fields with their identification information and define which type of filer they are.

Each part of the form accounts for a particular type of foreign asset such as: financial accounts, stocks, bonds, etc.

Where do I send IRS form 8938?

The form together with the annual income return is sent to the IRS.