Get the free Home Loans Must Have: Mortgage Redemption Insurance

Show details

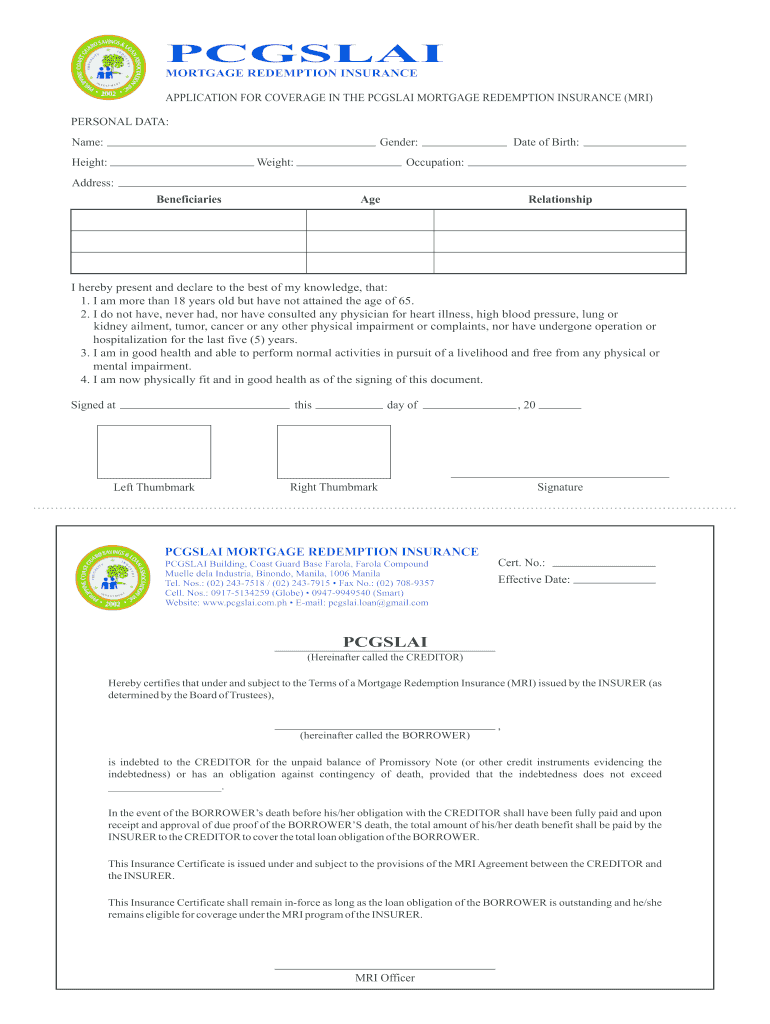

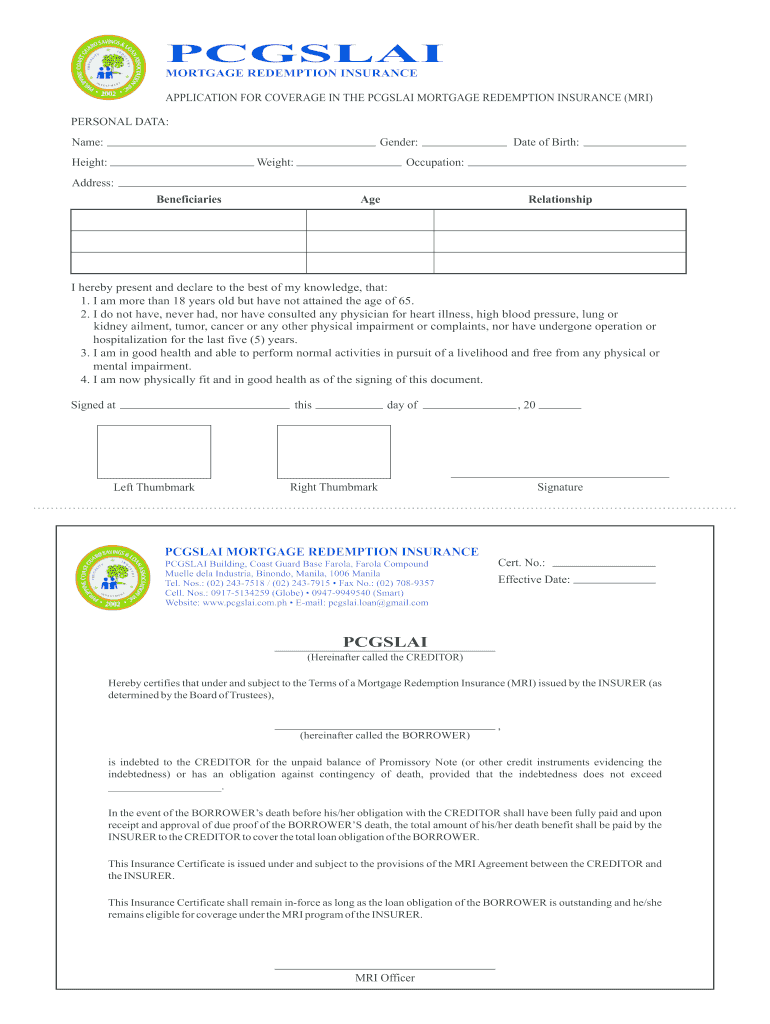

PCSI

MORTGAGE REDEMPTION INSURANCE

APPLICATION FOR COVERAGE IN THE PCSI MORTGAGE REDEMPTION INSURANCE (MRI)

PERSONAL DATA:

Gender:Name:

Height:Weight:Date of Birth:Occupation:Address:

AgeBeneficiariesRelationshipI

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home loans must have

Edit your home loans must have form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home loans must have form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home loans must have online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home loans must have. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home loans must have

How to fill out home loans must have

01

Start by gathering all the necessary documents such as income proof, employment details, and identification documents.

02

Research and compare different home loan options available in the market.

03

Determine your budget and assess your affordability taking into consideration factors like monthly income, expenses, and existing debts.

04

Approaching multiple lenders and getting pre-approved for a home loan can help you understand the loan amount you qualify for.

05

Once you have selected a lender, fill out the loan application form accurately with all the required details.

06

Provide the necessary supporting documents and ensure they are authentic and up to date.

07

Keep track of the loan processing progress and respond promptly to any queries or requests from the lender.

08

Review the loan offer carefully, including interest rates, repayment terms, and any additional fees or charges.

09

If satisfied with the loan offer, sign the loan agreement and complete any necessary paperwork.

10

Coordinate with relevant parties like real estate agents, lawyers, and sellers to ensure a smooth home buying process.

11

Regularly monitor your loan account and make timely repayments to maintain a good credit history.

12

Seek professional advice if you encounter any difficulties or have concerns regarding your home loan.

Who needs home loans must have?

01

Individuals who wish to purchase a home but cannot afford to pay the entire purchase price upfront.

02

First-time home buyers who require financial assistance to make their initial home purchase.

03

Homeowners who want to refinance their existing mortgages for better interest rates or loan terms.

04

People looking to invest in real estate and require funding for property purchases.

05

Those who want to build or renovate their homes and need the necessary funds for construction or renovation purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit home loans must have from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including home loans must have, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit home loans must have online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your home loans must have to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete home loans must have on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your home loans must have, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is home loans must have?

Home loans must have a clear understanding of the terms and conditions, interest rates, repayment schedule, and any potential fees or penalties.

Who is required to file home loans must have?

Home loans must be filed by individuals or families seeking financial assistance to purchase a home.

How to fill out home loans must have?

Home loans must be filled out with accurate and truthful information about the borrower's financial situation, employment status, and credit history.

What is the purpose of home loans must have?

The purpose of home loans is to provide individuals or families with the necessary funds to purchase a home that they would otherwise not be able to afford.

What information must be reported on home loans must have?

Home loans must include information such as the borrower's income, assets, liabilities, credit score, and employment history.

Fill out your home loans must have online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Loans Must Have is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.