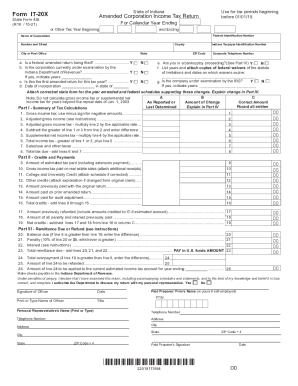

IN DoR IT-20X 2018 free printable template

Get, Create, Make and Sign 2018 it 20x

How to edit 2018 it 20x online

Uncompromising security for your PDF editing and eSignature needs

IN DoR IT-20X Form Versions

How to fill out 2018 it 20x

How to fill out IN DoR IT-20X

Who needs IN DoR IT-20X?

Instructions and Help about 2018 it 20x

Hello everybody my name is multiplier and welcome to five nights at Freddy's 2 10 20 mode otherwise known as golden Freddy mode I know it's been a while since I had played five nights at Freddy's 2, but I haven't had time to dedicate a full day to getting this done I've been practicing all morning, and I'm using oh it's FNaF strategy on YouTube because he's beaten, and he beat it about a month ago, so I've been practicing it, and I'm to the point where I think I can do it not being said there's going to be a lot of quiet moments because I need to concentrate because it's really, really hard, so also it's going to be weird because I haven't been talking since I've been doing it but the strategy all revolves around making sure this damn music box is Wow and that's all there is to it, so I'll see you on the other side everybody because it's going to take some concentration otherwise I'm going to die right away Paddington there's foxy only in the hole lol Balloon Boy hello chica I'm counting a bunch of numbers in my head I need to stay apprised of certain situations so that I know exactly how many counts to do because it's obscenely precise any error is too much yeah yeah yeah god I should not talk I can't think I can't hear I know the deal oh come on bullshit oh shit I hope that knew in that left man oh, oh hello three yep Wow Idol there yeah fucking fucker fuck there he's laughing at me that's alright this guy's I so hard when I can do it maybe this is bad I'm already getting behind already find our oh my god Bad News Bears all-around bad news bears there is a tiny gap where you cannot die from toy Bonnie in case you didn't know what was going on there Mon baba boy Phoebe boy was a son of a bitch this guy with the tour bond he doesn't want to play nice fuck why is he still there ah son of a bitch Bullock oi Balloon Boy whatever your name is go away kill me goddammit damn you Transit whoa, whoa well here whoa oh god-damn it with you ah my parents poopy poopy on my ass I was doing much better before I started talking I do want to say that right now fuck you too flashy again I was pushing the button I'm getting true dude I'm getting screwed I'm going to be screwed I'm fucking fuck the fuck in fact I'm fucked damn it god-damn it's such a tight window so small the small nor to her to baby starts just please stop rape god-damn it goes away I hear the thumping of the wrong thump hi are you doing here okay alright then I was weird okay gotcha baby hello Freddie Oh what the hell that's not supposed to happen piss balls house a good one too I was doing great seriously piece of shit Wow no house it only — I've been doing this for like ten minutes smells God — so obscene I got a not do that ah oh lucky Oh easy there buckaroo née Oh God oh boy all cheering burgh smacks I'm not okay I'm not okay I'm not okay I've made it to 4:00 a.m. like twice I made it to five my life sucks getting toy like a true again like a tiger I'm getting a little crazy I'm screwed I'm...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2018 it 20x in Chrome?

Can I edit 2018 it 20x on an iOS device?

How do I complete 2018 it 20x on an iOS device?

What is IN DoR IT-20X?

Who is required to file IN DoR IT-20X?

How to fill out IN DoR IT-20X?

What is the purpose of IN DoR IT-20X?

What information must be reported on IN DoR IT-20X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.