Get the free L - Quarterly Expenditure Report. Lobbying Reporting Forms

Show details

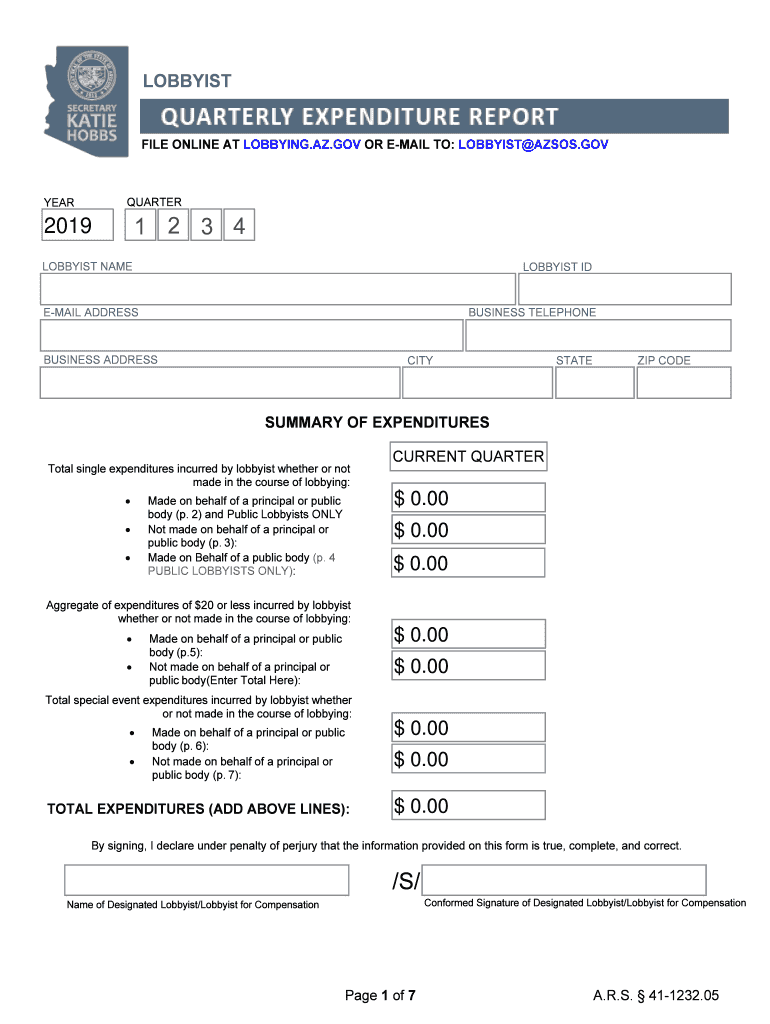

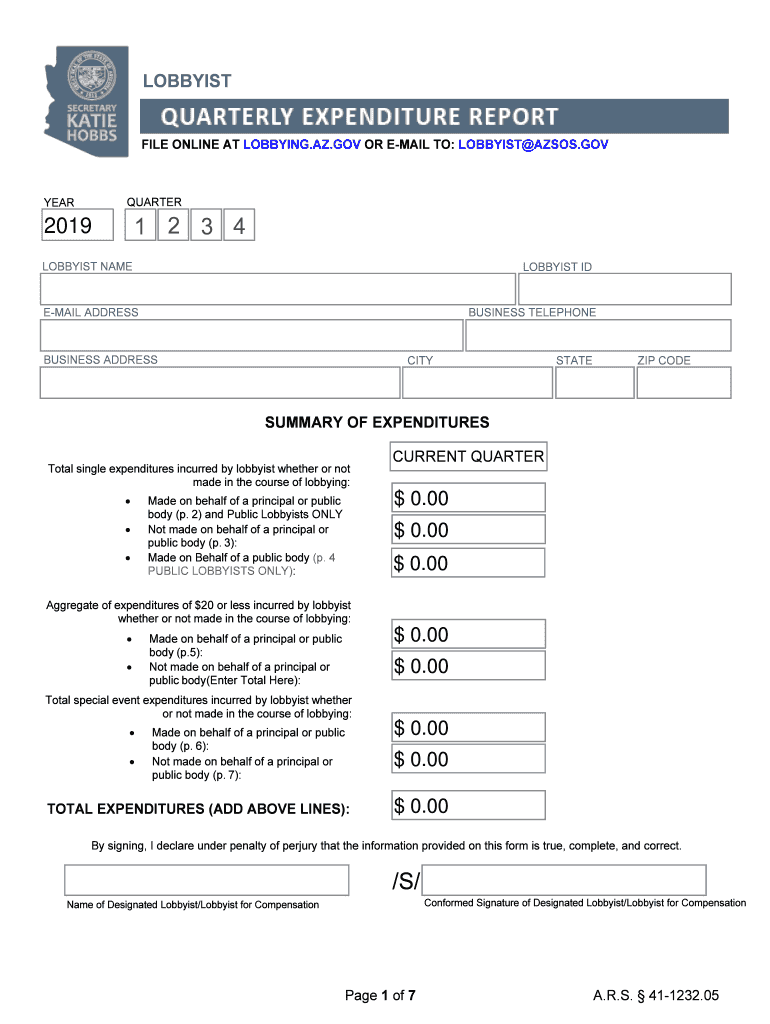

LOBBYIST FILE ONLINE AT LOBBYING.AZ.GOV OR EMAIL TO: LOBBYIST AZ SOS.GOVQUARTERYEAR1 2 3 42019 LOBBYIST NAMELOBBYIST BUSINESS TELEPHONEEMAIL ADDRESSBUSINESS ADDRESSCITYSTATEZIP CODESUMMARY OF EXPENDITURES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign l - quarterly expenditure

Edit your l - quarterly expenditure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l - quarterly expenditure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit l - quarterly expenditure online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit l - quarterly expenditure. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out l - quarterly expenditure

How to fill out l - quarterly expenditure

01

To fill out the L - quarterly expenditure form, follow these steps:

02

Gather all relevant financial documents, such as receipts, invoices, and bank statements, for the quarter you are reporting on.

03

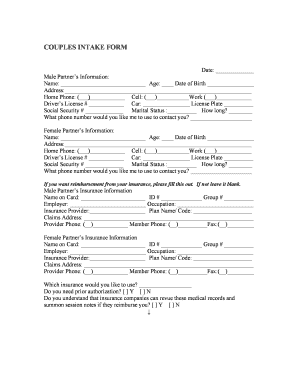

Start by entering your personal and business information in the designated fields on the form. This may include your name, business name, address, and contact details.

04

Proceed to the expenditure section of the form. Here, you will need to provide detailed information about each expense you incurred during the quarter.

05

Write down the date of each expense, along with a short description of what it was for.

06

Enter the total amount spent for each expense.

07

If applicable, differentiate between different expense categories such as office supplies, rent, employee wages, utility bills, etc.

08

Calculate the sum of all expenses for the quarter and write the total amount in the designated field.

09

Review the completed form for accuracy and ensure all required fields are filled in.

10

Save a copy of the filled-out form for your records before submitting it to the relevant entity responsible for collecting L - quarterly expenditure forms.

11

If necessary, seek assistance from a professional accountant or tax advisor to ensure accurate reporting of your expenditures.

12

Remember, it is crucial to be honest and transparent while filling out the L - quarterly expenditure form to comply with applicable regulations and avoid any potential penalties or legal issues.

Who needs l - quarterly expenditure?

01

The L - quarterly expenditure form is typically required by individuals or businesses who need to report their quarterly expenses to tax authorities or regulatory bodies.

02

This may include self-employed individuals, freelancers, small business owners, corporations, and other entities subject to tax or financial reporting obligations.

03

Complying with the requirement of filling out the L - quarterly expenditure form ensures transparency and accountability in financial reporting, enabling accurate assessment of tax liabilities or expense tracking for regulatory purposes.

04

It is advisable to consult local tax regulations or seek guidance from a professional accountant to determine whether you specifically need to submit the L - quarterly expenditure form and the applicable deadlines for submission.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find l - quarterly expenditure?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the l - quarterly expenditure in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute l - quarterly expenditure online?

pdfFiller has made it simple to fill out and eSign l - quarterly expenditure. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit l - quarterly expenditure on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign l - quarterly expenditure on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is l - quarterly expenditure?

L - Quarterly expenditure refers to the financial report that details the expenses incurred by a company or organization during a specific quarter.

Who is required to file l - quarterly expenditure?

Companies, organizations, or individuals who are required to report their financial activities to regulatory authorities or stakeholders are usually required to file L - Quarterly expenditure.

How to fill out l - quarterly expenditure?

L - Quarterly expenditure can be filled out by compiling all expenses incurred during a specific quarter and categorizing them based on different expense categories.

What is the purpose of l - quarterly expenditure?

The purpose of L - Quarterly expenditure is to provide a detailed breakdown of the expenses incurred by a company or organization during a specific quarter, helping stakeholders analyze the financial health of the entity.

What information must be reported on l - quarterly expenditure?

Information such as total expenses, breakdown of expenses by category, any significant changes in expenses compared to previous quarters, and explanatory notes for any unusual expenses must be reported on L - Quarterly expenditure.

Fill out your l - quarterly expenditure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

L - Quarterly Expenditure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.