IRS 4506 2019 free printable template

Show details

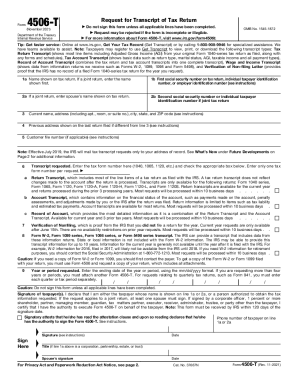

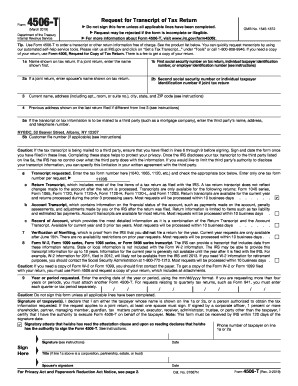

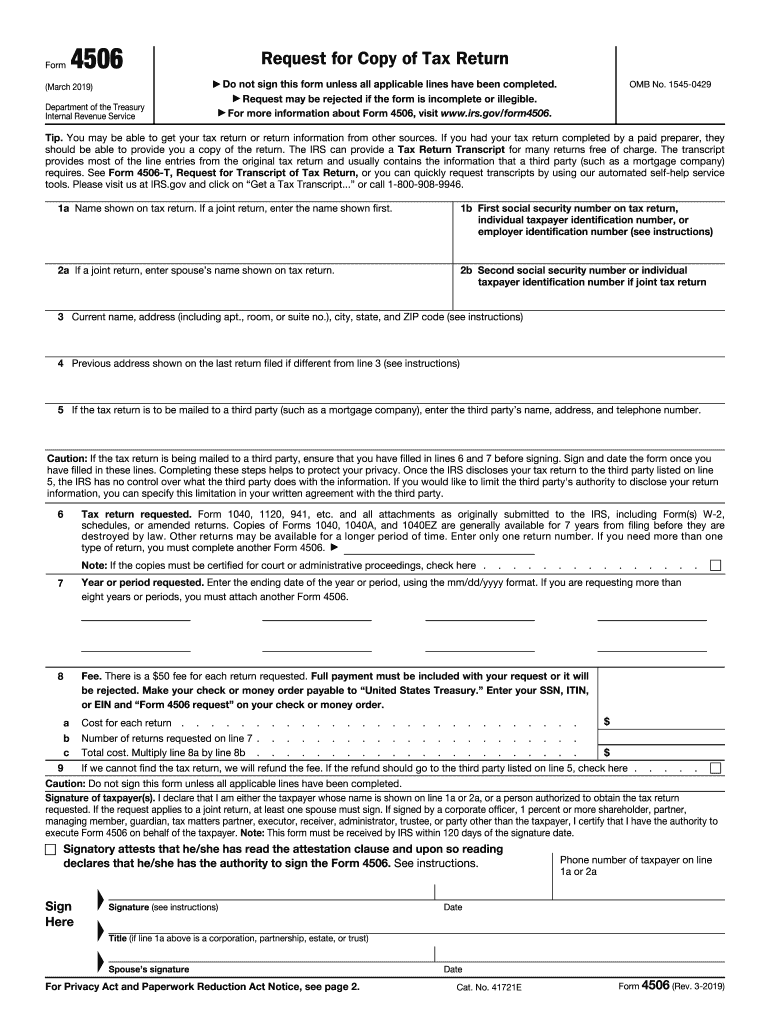

If you had your tax return completed by a paid preparer they should be able to provide you a copy of the return. The IRS can provide a Tax Return Transcript for many returns free of charge. Form Request for Copy of Tax Return Do July 2017 Department of the Treasury Internal Revenue Service not sign this form unless all applicable lines have been completed. may be rejected if the form is incomplete or illegible. We need this information to properly identify the return s and respond to your...request. If you request a copy of a tax return sections 6103 and 6109 require you to provide this information including your SSN or EIN to process your request. General Instructions lines have been completed. Purpose of form. Use Form 4506 to request a copy of your tax return. You can also designate on line 5 a third party to receive the tax return. How long will it take It may take up to 75 calendar days for us to process your request. Information about any recent developments affecting Form...4506 Form 4506-T and Form 4506T-EZ will be posted on that page. Cat. No. 41721E Form 4506 Rev. 7-2017 Page Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about Form 4506 and its instructions go to www.irs.gov/form4506. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. The IRS must receive Form 4506 within 120 days of the date signed by the taxpayer or it will be rejected. Ensure that all...applicable lines are completed before signing. The estimated average time is Learning about the law or the form 10 min. Preparing the form 16 min. and Copying assembling and sending the form to the IRS 20 min. If you have comments concerning the accuracy of these time estimates or suggestions for making Form 4506 simpler we would be happy to hear from you. You can write to Tax Forms and Publications Division 1111 Constitution Ave. NW IR-6526 Washington DC 20224. The transcript provides most of...the line entries from the original tax return and usually contains the information that a third party such as a mortgage company requires. Please visit us at IRS*gov and click on Get a Tax Transcript. or call 1-800-908-9946. 1a Name shown on tax return* If a joint return enter the name shown first. 1b First social security number on tax return individual taxpayer identification number or employer identification number see instructions 2a If a joint return enter spouse s name shown on tax return*...2b Second social security number or individual taxpayer identification number if joint tax return 3 Current name address including apt. room or suite no. city state and ZIP code see instructions 4 Previous address shown on the last return filed if different from line 3 see instructions 5 If the tax return is to be mailed to a third party such as a mortgage company enter the third party s name address and telephone number. Caution If the tax return is being mailed to a third party ensure that you...have filled in lines 6 and 7 before signing.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4506

How to edit IRS 4506

How to fill out IRS 4506

Instructions and Help about IRS 4506

How to edit IRS 4506

To edit the IRS 4506 form, you first need to access a fillable version of the form. Utilize tools like pdfFiller, which allow you to upload your completed document for any necessary modifications. Simply highlight the areas that need changes, make your edits, and save the document for submission.

How to fill out IRS 4506

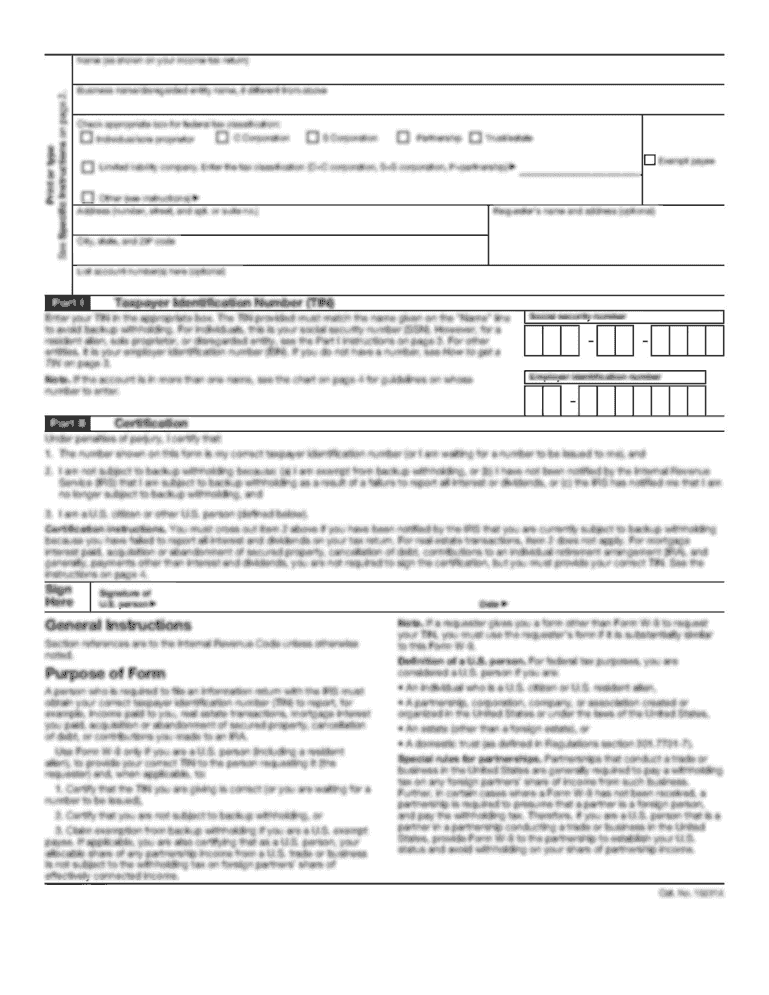

Filling out the IRS 4506 requires careful attention to detail. Start by entering your personal information in the designated fields, including your name, address, and Social Security number. Ensure clarity in all entries to avoid processing delays. Once completed, review all sections thoroughly before submission.

About IRS 4 previous version

What is IRS 4506?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4506?

IRS 4506 is a tax form that allows taxpayers to request a copy of their tax return or a transcript of their tax information directly from the IRS. This form is essential for individuals needing proof of income or tax history, particularly when applying for loans or government assistance.

What is the purpose of this form?

The purpose of the IRS 4506 form is to facilitate the retrieval of personal tax information. This may include obtaining a complete copy of past returns or a summary of income information for specific tax years. Having accurate records can significantly aid in various financial transactions, such as loan applications.

Who needs the form?

Taxpayers who need to verify their income or tax filing history may require the IRS 4506 form. It is commonly used by individuals applying for mortgages, student loans, or other financial assistance where proof of income is necessary. Additionally, tax professionals may use this form on behalf of their clients to secure necessary documents.

When am I exempt from filling out this form?

You may be exempt from filing the IRS 4506 if you have already secured your tax transcripts through alternative means, such as the IRS online portal. Additionally, if you are submitting documents directly to certain lenders who do not require formal proof of income from the IRS, this form may not be needed.

Components of the form

The IRS 4506 form contains several key components including taxpayer identification information, the specific tax years for which copies or transcripts are requested, and a signature block authorizing the release of information. Each section must be completed accurately to ensure that the IRS processes the request without delays.

What are the penalties for not issuing the form?

Failing to issue the IRS 4506 when required could result in delays in processing loans or benefits for which proof of income is mandated. In some cases, a lack of proper documentation may lead to disqualification from financial assistance or other programs that require compliance with income verification norms.

What information do you need when you file the form?

When filing the IRS 4506, you need your full name, current address, and the address where your tax return was filed. You will also require your Social Security number or Employer Identification Number, and the specific years for which you are requesting copies or transcripts of your returns.

Is the form accompanied by other forms?

The IRS 4506 does not generally need to be accompanied by other forms when submitted alone. However, if you are filing it for a specific purpose, such as in conjunction with a loan application, check if additional documentation is required by the lender.

Where do I send the form?

The completed IRS 4506 form should be sent to the address specified in the instructions on the form. The mailing address may vary depending on the state where the taxpayer resides or the purpose for which the form is filed. Ensure to check the latest guidelines to confirm the correct address.

See what our users say