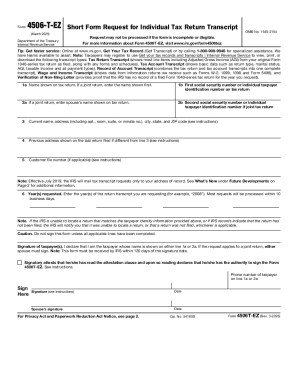

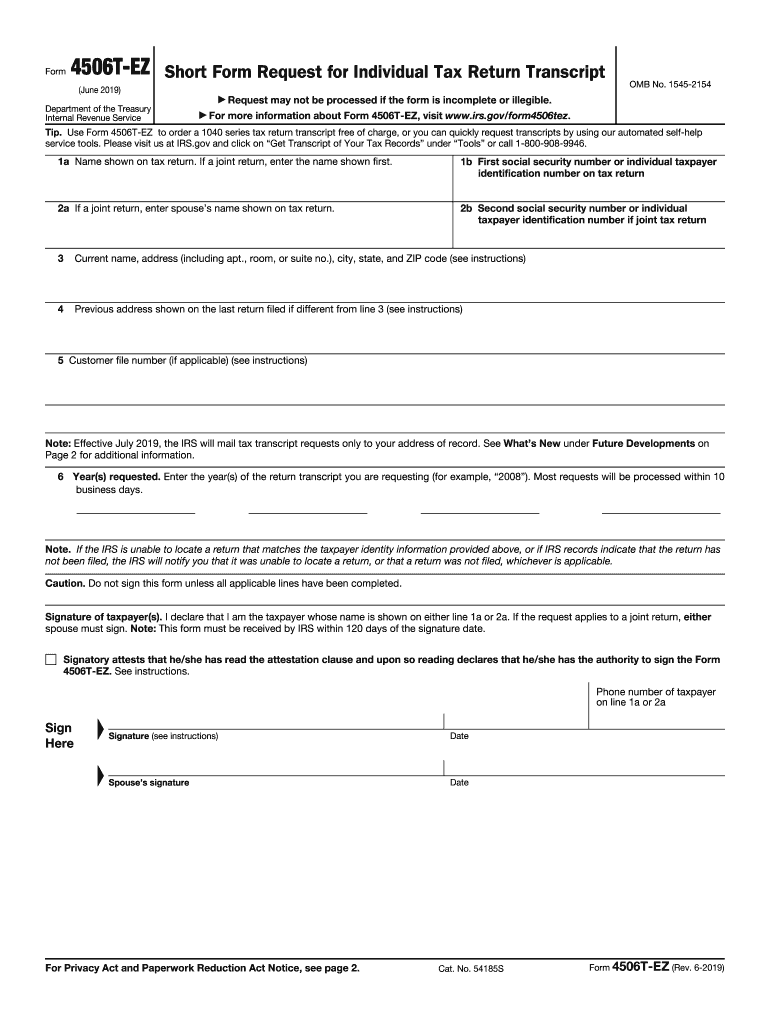

IRS 4506T-EZ 2019 free printable template

Instructions and Help about IRS 4506T-EZ

How to edit IRS 4506T-EZ

How to fill out IRS 4506T-EZ

About IRS 4506T-EZ 2019 previous version

What is IRS 4506T-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4506T-EZ

What should I do if I realize I've made a mistake on my IRS 4506T-EZ after submitting it?

If you discover an error after submitting the IRS 4506T-EZ, you can submit a corrected form to the same address where you submitted the original. Be sure to explain the corrections in a cover letter to assist with processing. It’s important to retain copies of both the original and corrected requests for your records.

How can I verify that my IRS 4506T-EZ has been received and processed by the IRS?

You can verify the status of your IRS 4506T-EZ by contacting the IRS directly or checking the IRS online tools available. Keep the confirmation details from any correspondence handy, and note that processing times may vary depending on the volume of requests the IRS is handling at the time.

What are the common mistakes to avoid when submitting the IRS 4506T-EZ?

Common mistakes include failing to sign the form, incorrect Social Security Numbers, or leaving out required information such as the tax period requested. Double-checking these details before submission can help prevent delays in processing your request.

What steps should be taken if I receive a notice from the IRS regarding my 4506T-EZ?

If you receive a notice from the IRS about your 4506T-EZ, review the notice carefully to understand the issue. Depending on the notice, you may need to provide additional documentation or correct any discrepancies. Always respond promptly to prevent further complications.

Are there any specific technical requirements to keep in mind when e-filing the IRS 4506T-EZ?

When e-filing the IRS 4506T-EZ, ensure compatibility with the e-filing software you are using, as well as your browser or mobile device. Regularly check for software updates and ensure your internet connection is stable to avoid submission issues.